Recent crypto volatility has sparked fresh concerns in the markets. Bitcoin fell sharply from $102,000 to $91,000 in three days. The drop comes as Trump prepares his CFTC chair pick and the Fed shifts to a neutral stance. This mix of events raises questions about crypto security risks and new regulation plans amid significant volatility.

Also Read: Shift in Bitcoin Power: U.S. Entities Surpass Offshore Holdings by 65%

Navigating Crypto Regulation, Market Uncertainty, and Security Risks

Fed’s Neutral Policy Intensifies Market Reactions

“I believe we are near the point where the economy needs neither restriction nor support, and that policy should be neutral,” stated Kansas City Federal Reserve President Jeff Schmid on January 9. Fed Governor Michelle Bowman added that “being too aggressive with moving the policy rate down carries the risk of unnecessarily stoking demand and potentially reigniting inflationary pressures.” These statements led to new waves of volatility in the crypto market.

ICYMI: Kansas City Fed President and CEO Jeff Schmid spoke to the Economic Club of Kansas City today on "Resolutions for a New Year." Read his remarks here: https://t.co/unDgEMcVae pic.twitter.com/qoTXQ92pql

— Kansas City Fed (@KansasCityFed) January 9, 2025

Trump’s CFTC Appointment Raises Stakes

Markets now wait for Trump’s choice of CFTC chair after Rostin Behnam stepped down. “I expect that the coming months should bring clarity on the incoming administration’s policies,” Bowman said about crypto regulation changes. Trump’s team must now deliver on promises about Bitcoin reserves and clear rules, impacting crypto volatility.

Also Read: Ethereum (ETH) To Hit New Peak Of $6000: Here’s When

Security Challenges Mount Amid Market Pressure

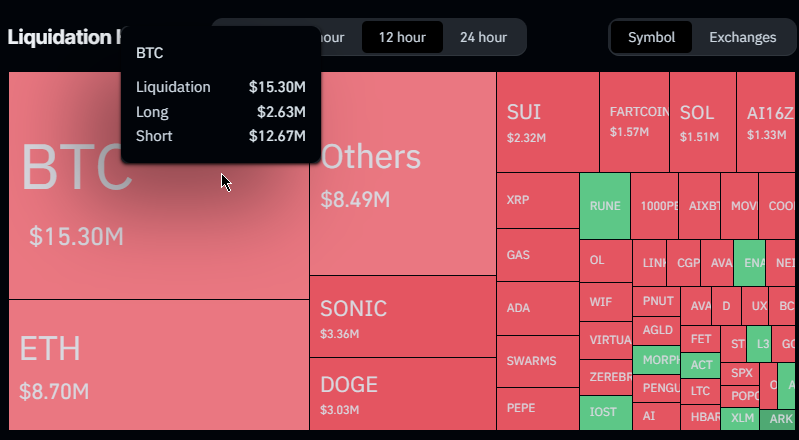

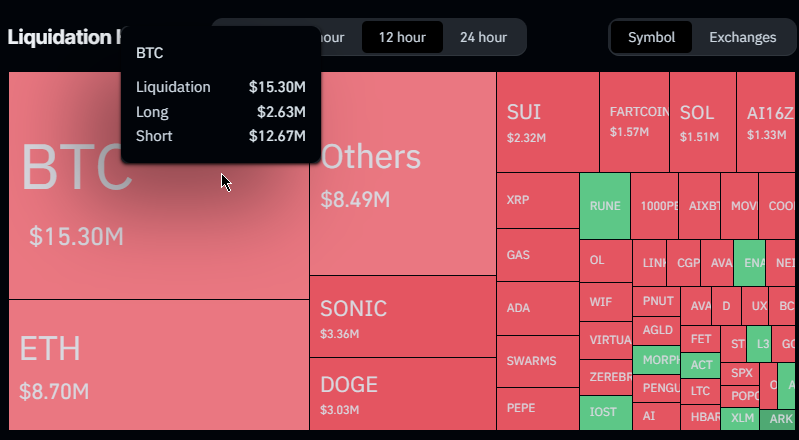

New data shows growing crypto security risks. Bitcoin lost $89.30 million in long positions within 24 hours. “There’s a lot of uncertainty,” Philadelphia Federal Reserve President Patrick Harker noted. Big exchanges felt the impact, with Binance and OKX losing over $45 million together, all exacerbated by crypto volatility.

Market Outlook and Policy Impact

“We should wait for more clarity and then seek to understand the effects on economic activity, the labor market, and inflation,” Kansas City Federal Reserve President Schmid stated.

Also Read: U.S. Senate Launches First Crypto Subcommittee: A New Era for Regulation?

The Fed’s careful approach and Trump’s upcoming decisions point to more crypto volatility ahead. Bowman noted that “the U.S. economy begins the new year on a strong footing, with still elevated inflation and a solid labor market,” setting up a complex situation for crypto markets.