Despite the company’s slow start to the year on Wall Street, Nvidia (NVDA) is expected to rebound, according to investment bank UBS. Indeed, the institution called the ongoing fears for the stock “overblown” as it projected the company’s revenue to hit the $9 billion mark.

There is little argument that the AI chipmaker left 2024 as the biggest winner. Increasing more than 170% last year, there were high hopes that it could continue, if not exceed, its performance over the next twelve months. Although it has failed to live up to those expectations today, that may be changing.

Also Read: Nvidia, Amazon Lead Magnificent 7 Stocks to Watch in January

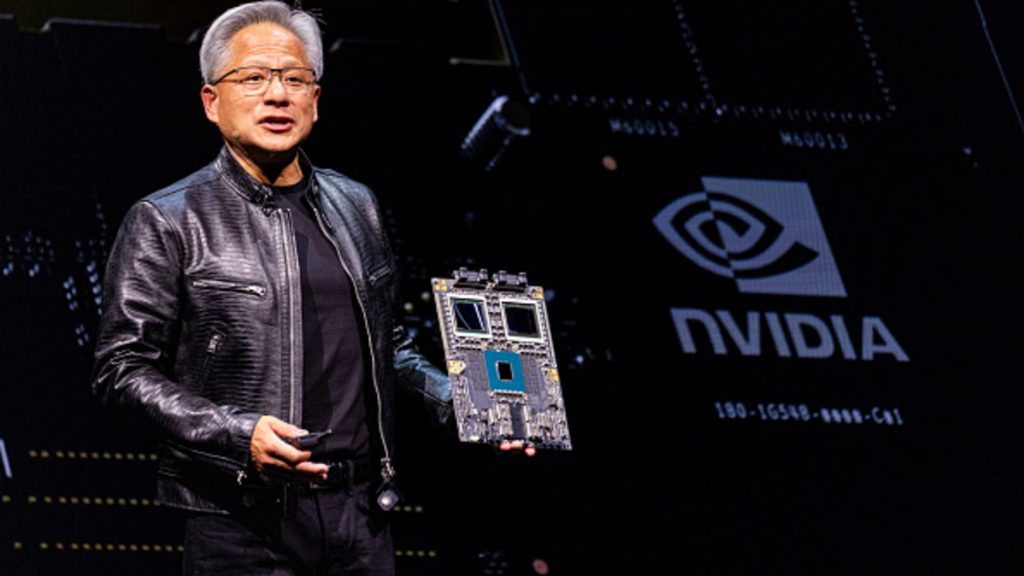

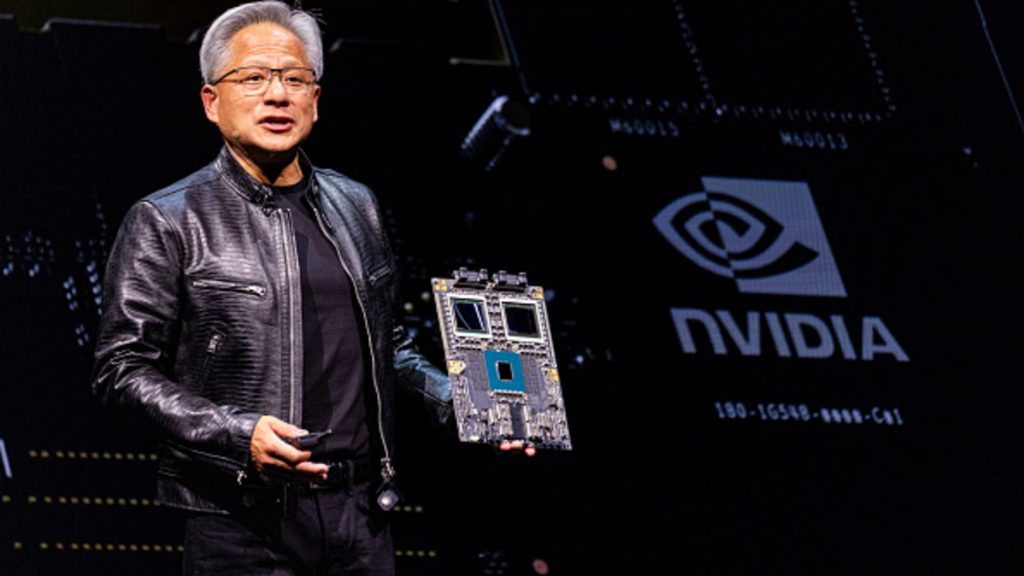

Nvidia Eyes $9 Billion in REvenue as UBS Projects Big Year Ahead

The last two years have seen increased AI demand dominate the stock market. Indeed, companies that have shown a prioritization of the emerging technology have been favored. There may be no better example of this than Nvidia.

Although the company has struggled over 2025’s first 20 days, it is still expected to lean on that demand surge. Specifically, ongoing market concern regarding Nvidia stock has been overblown, according to UBS Bank, as they project increased revenue for the chipmaker.

Also Read: Apple Beats Microsoft, Nvidia in New Ranking: What it Means for APPL Stock

The company has stayed rather still since its last earnings report. However, the bank says the company will “rise above the noise,” according to a recent report. “First, we believe Blackwell chipset/compute board yields have inflected higher, and mix in both FQ4 (Jan) and FQ1 (Apri) is shifting very rapidly to Blackwell and away from Hopper,” the firm stated.

Moreover, they note that shipments of Blackwell rack systems have been increasing. “We believe rack shipments are already underway with Hon Hair,” the bank said. Conversley, the bank’s recent $9 billion revenue estimation was up from its previous projection of $5 billion. However, they have noted that “net, our estimates are largely unchanged.”

The company is expected to bounce back in a big way in the coming months. Although there is still uncertainty abounding, its performance in recent years should affirm its potential. Currently, CNN Data holds a median $175 price target for the stock, up 25.89% from its current position.