With Wall Street looking to repeat a positive performance last year, all eyes are on what stocks could have a monumental year. However, when it comes to investments, it is always important to have one eye strictly fixed on the long term. When it comes to that, Amazon (AMZN) and Roku (ROKU) have emerged as stocks that could bring a 400% return on investment (ROI) in five years, as experts look all in.

The two companies represent some of the leaders in two very different spaces. Although Amazon has gotten in on the streaming wars in recent years, it has firmly stated itself as a prime technology, AI, and cloud computing stock. Moreover, Roku looks to continue establishing market share in what could be an exception run. So, could the companies skyrocket before 2030?

Also Read: Alphabet Stock: Why GOOGL is a Top NASDAQ Stock to Buy Now

Amazon & Roku Emerge as Top Stocks to Watch Before 2030

When it comes to the stock market, ROI is among the most important statistics. Indeed, it showcases the fruitfulness of an investment and how well a specific share did for its investors. Yet, it is incredibly difficult to predict, with Wall Street full of traders all looking to get in on the best deal.

According to a recent report, Amazon and Roku may be just that, as they are projected to potentially produce a 400% return on investment over the next five years. For different reasons, both companies could emerge as some of the biggest winners when 2030 eventually arrives. Specifically, potentially turning a $1,000 investment into $5,000.

Also Read: Nvidia, Amazon Lead Magnificent 7 Stocks to Watch in January

Of the two stocks, Amazon is certainly not a surprise. The company controls 40% of the North American e-commerce realm. However, that isn’t its most exciting business. Indeed, Amazon Web Services (AWS), its cloud computing enterprise, holds immense potential. The business accounts for more than 60% of its operating income currently, with growth prospects still strong.

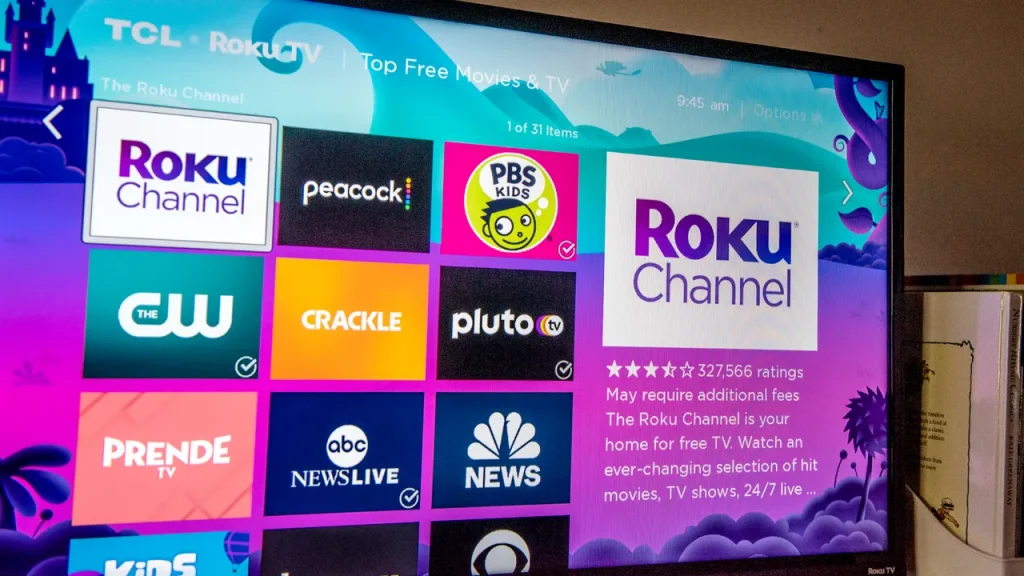

Additionally, Roku has emerged as a key stock to watch. Shares in the company skyrocketed in 2020 as a byproduct of the COVID-19 pandemic. That did not continue, unfortunately. In 2021 and 2022, the stock fell more than 80%, boasting a notable loss of profitability.

Yet they are still a dominant company. According to Pixalate, Roku controls 37% of North America’s connected television device market. Even more interesting, the closest competitor controls just 17%. It is hoping to leverage that success for the international market. That market is projected to grow by 11% each year, which should greatly benefit its prospects and ability to grow alongside it by 2030.