The whole market, led by Bitcoin, has had a dramatic, action-packed week. Friday and Saturday were characterized by long red candles, post which, a few green candles were flashed. However, the state of the market has deteriorated over the past 24-hours, with the cumulative market capitalization dunking by 2.89% to $1.64 trillion.

Over the past 7-days, the king-coin has shed up to 13% of its value. At the time of press, Bitcoin was seen revolving around $36.4k.

READ ALSO: Tesla Bought $1.5B Bitcoin in 2021; Here’s How Much They Hold Today

Owing to the indecisive trend, BTC liquidations over the past day have been quite notable. Throughout 26 January, the short liquidations managed to surpass the long liquidations. However, the trend changed its course during the initial hours of 27 January. The market became unfavorable to long traders, and in effect, their contract liquidations have started exceeding the short liquidations, yet again.

As per data from CoinGlass, BTC worth $104.48 million have been liquidated over the past 24-hours.

Triangulating other X-factors

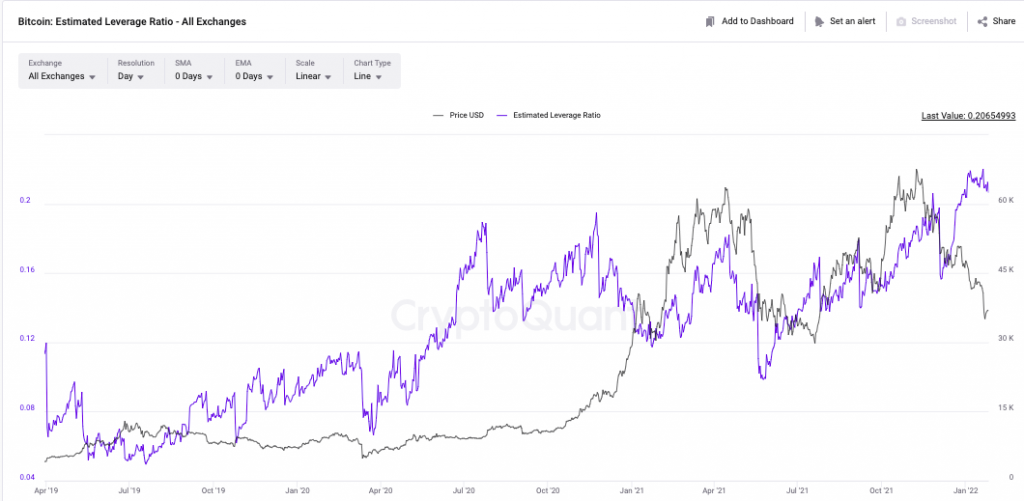

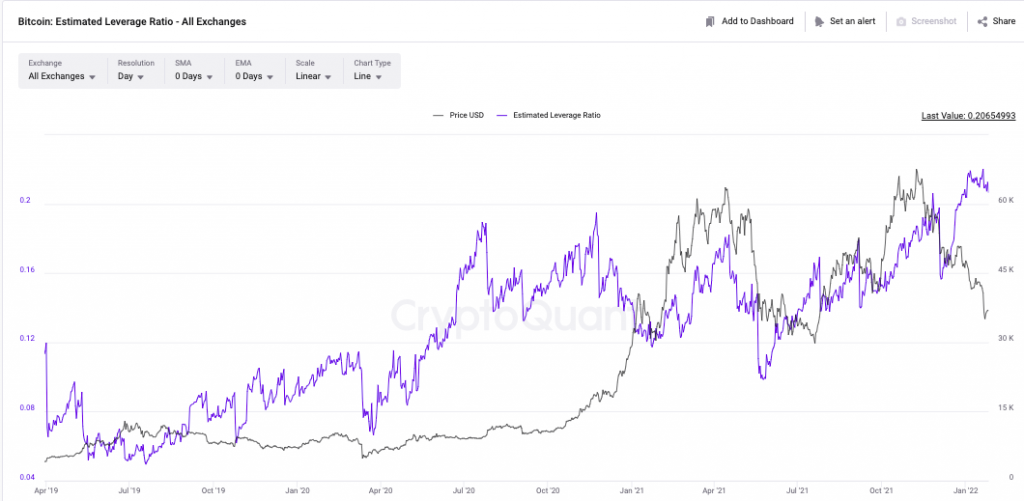

The estimated leverage ratio for Bitcoin has been revolving around its multi-year peak since the beginning of this year. This means that more traders have been undertaking high-risk trades, typically characterized by more leverage, in the derivatives market.

Leverage usually acts like a two-sided sword. Apart from having the potential to shoot up the returns fetched, it parallelly amplifies the odds of incurring losses.

READ ALSO: Will Bitcoin’s momentum foster a Litecoin rally?

In the September-October period in 2020, when the leverage peaked, Bitcoin commenced the first leg of its rally. A similar behavior pattern was observed last year too in the April-May period when BTC inched to its then $63k ATH.

As the market conditions evolved, Bitcoin’s price started reacting differently. In September and November last year, for instance, the price subjected itself to a downtrend as and when this ratio created local peaks.

In fact, since the beginning of this year too, the asset’s price has reacted negatively in the overheated leverage environment.

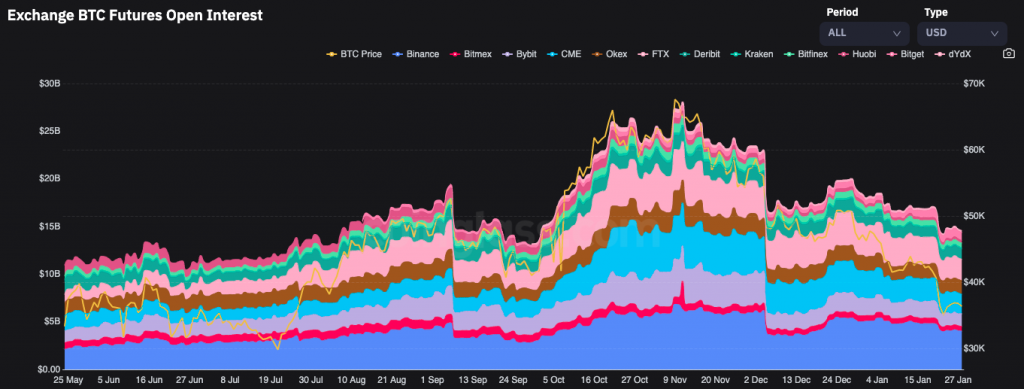

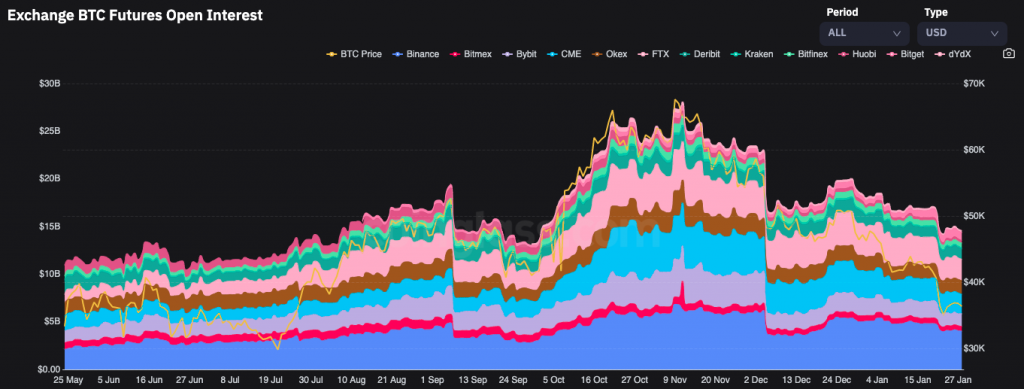

Nonetheless, it should be noted that Bitcoin’s Open Interest has shrunk since the mid of last month. It currently stands at par with the under $50k levels observed in October last year. So, the less than usual capital entering into the Bitcoin market at this stage signifies that traders are exercising caution to some extent.

The OI can be expected to rise when the market stabilizes and starts portraying signs of a definitive trend.

Thus, keeping the aforementioned factors in mind, it wouldn’t be wrong to assert that the market would continue to witness liquidations, but the magnitude of the same will gradually decline over the next few days. Once the leverage flush is done, only then it’d make sense to expect Bitcoin to rally sustainably.