Tuttle Capital Management has pioneered a transformative SEC filing. This filing revolutionizes the landscape with ten leveraged cryptocurrency exchange-traded funds. Through various major initiatives, including the Tuttle Capital crypto ETF, the firm has architected multiple groundbreaking investment vehicles. They have deployed numerous first-ever ETFs across several key digital assets, including XRP, Cardano, Chainlink, and Polkadot.

This strategic advancement has catalyzed significant market developments. Certain critical institutional elements have also been integrated to maximize potential opportunities within the evolving crypto ETF ecosystem. Across multiple essential trading segments, these innovative instruments have spearheaded a new era of digital asset investment. They encompass numerous significant market elements that optimize traditional financial frameworks.

Also Read: Dogecoin: New Prediction Forecasts DOGE To Hit $2.28: Here’s How

How Tuttle Capital’s Crypto ETFs Could Shape the Future of Blockchain Investments

Unprecedented Scope of Leveraged ETF Proposals

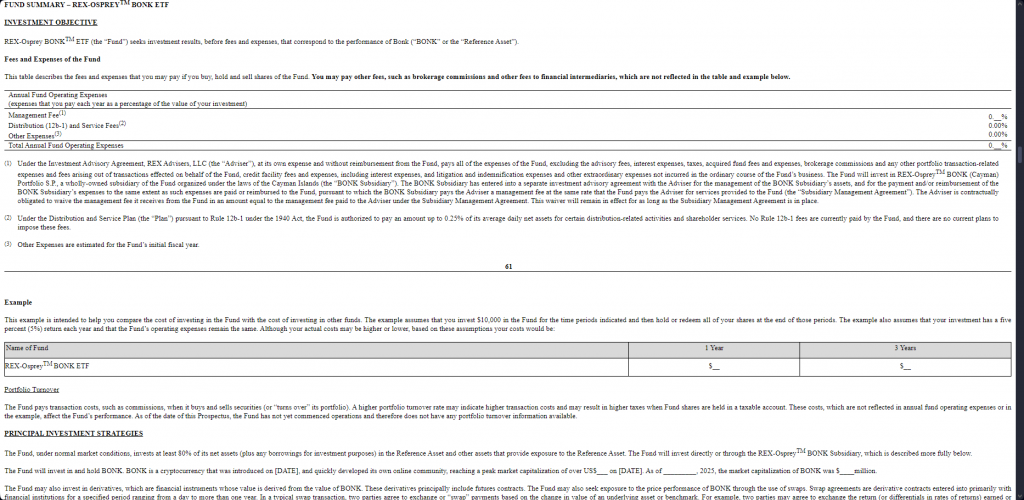

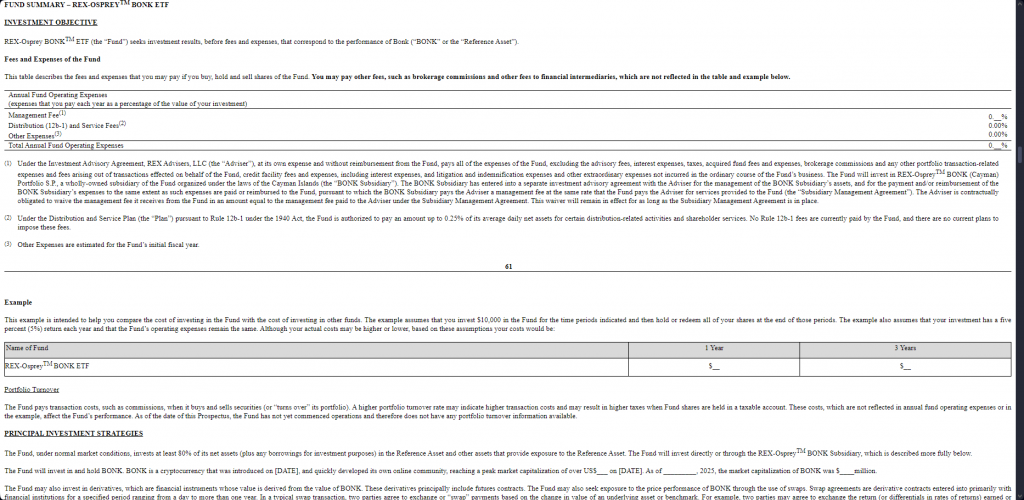

Through multiple innovative approaches, the investment advisory firm has pioneered 2x leveraged ETFs. These instruments are engineered to deliver twice the daily returns—or losses—of their underlying assets.

To be very clear here. This is a case of issuers testing the limits of what this SEC is going to allow. I’m expecting the new crypto task force (led by @HesterPeirce) to likely be the lynchpin in determining what’s gonna be allowed vs what isn’t

— James Seyffart (@JSeyff) January 27, 2025

Bloomberg Intelligence analyst James Seyffart stated:

“This is a case of issuers testing the limits of what this SEC is going to allow. I’m expecting the new crypto task force (led by Hester Peirce) to likely be the lynchpin in determining what’s gonna be allowed vs what isn’t.”

Strategic Timing and Regulatory Landscape

Also note this is a 40 act filing so in theory unless the SEC disapproves them they could be out and trading in April. Will be interesting to see where the SEC draws line (if at all) and why. I will say it’s been a week since Doge/Trump filing and it hasn’t been withdrawn. That’s…

— Eric Balchunas (@EricBalchunas) January 27, 2025

Several key developments have catalyzed Tuttle Capital’s filing, including various regulatory shifts at the SEC. These changes encompass pro-crypto Acting Chair Mark Uyeda replacing Gary Gensler.

Bloomberg senior ETF analyst Eric Balchunas had this to say:

“This is a 1940 Act filing. So in theory, unless the SEC disapproves them, they could be out and trading in April. Will be interesting to see where the SEC draws the line (if at all) and why.”

Also Read: Cardano: Will The ADA Cryptocurrency Surge or Plunge?

Market Impact and Risk Considerations

Across numerous significant areas, the proposed Tuttle Capital ETFs have architected a strategy to track 200% of their reference assets’ daily performance. These instruments leverage various approaches, including swaps, call options, and direct investments. However, multiple market analysts note that investors could potentially lose their entire principal within a single trading day if certain critical value drops occur.

Industry Response and Future Outlook

KoinBX CEO Saravanan Pandian stated:

“The filing shows the industry’s unwavering dedication to deploying innovation and satisfying diverse market demands by adding assets like XRP, Solana, and even newly issued tokens. On the other hand, the same action leads us to very important questions in the areas of regulation. If these ETFs get approved, they could pave the way for new participants in the market, but the SEC needs to ensure risk mitigation and transparency is in place.”

Market Competition and Innovation

Tuttle Capital files for a 2x long MELANIA ETF

— rciv (@rcivNFT) January 27, 2025

TradFi testing the boundaries of the new admin for sure pic.twitter.com/QVG1mdOo87

Several major initiatives from Tuttle Capital have accelerated the transformation of crypto investment products. Through various strategic approaches, the firm has integrated its proposals with several existing submissions from multiple providers. These providers include Osprey and REX Shares.

Also Read: META Stock Gets Underperform Rating as Wall Street is Divided

Various market experts anticipate these developments could revolutionize how numerous investors access digital assets through traditional financial instruments. Certain key products, like XRP and Cardano ETFs, could potentially spearhead the next wave of crypto investment options.