Ripple CEO Brad Garlinghouse has publicly opposed the creation of a Bitcoin strategic reserve, emphasizing the need for a multi-token approach amid cryptocurrency market volatility and regulatory uncertainty Bitcoin faces. Several key industry figures have sparked heated discussions around security risks in crypto and the growing Ripple vs Bitcoin debate.

Also Read: Cardano: AI Sets ADA Price For February 1, 2025

Ripple CEO’s Stand on Bitcoin Reserve: Market Volatility, Security, and Regulatory Concerns

Multi-Token Advocacy

In numerous discussions about the Bitcoin reserve proposal, Garlinghouse had this to say:

“I own XRP, BTC, and ETH among a handful of others – we live in a multichain world, and I’ve advocated for a level-playing field, instead of one token versus another.”

Several major crypto leaders have backed his stance on cryptocurrency market volatility. Various industry experts point to security risks in crypto as a key concern for any strategic reserve planning.

Industry Clash

Through some various significant debates, the Bitcoin reserve proposal has caused heated discussions. Pierre Rochard, who is a VP of research at Riot Platforms, stated:

“Ripple is a failed company begging for a bailout.”

Michael Goldstein, president of the Satoshi Nakamoto Institute, had this to say:

“Ripple has spent millions of dollars on massive propaganda campaigns to destroy Bitcoin.”

Also Read: De-Dollarization: Another Country Ditches The US Dollar

Regulatory Landscape

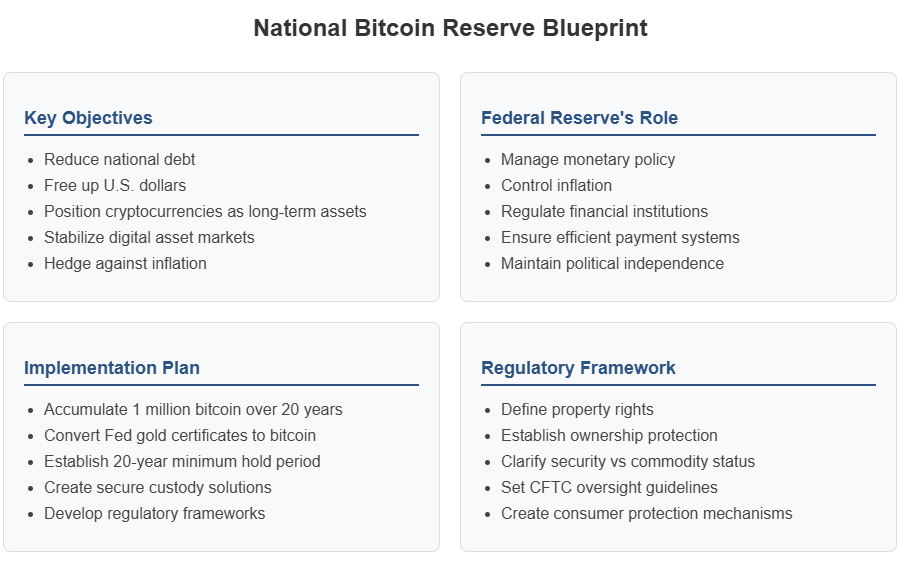

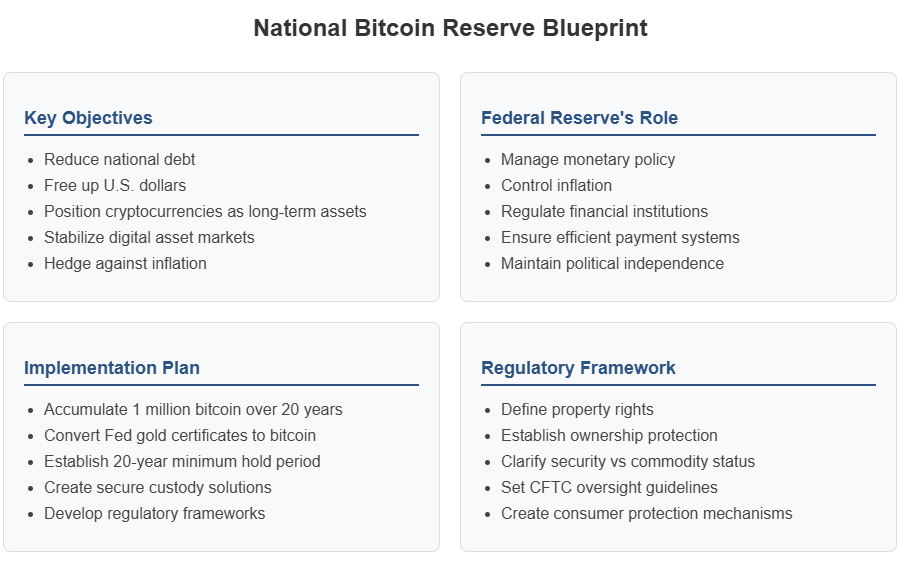

Multiple essential factors shape the regulatory uncertainty Bitcoin currently faces. Some industry watchers point to a 55% probability of the U.S. government establishing a national Bitcoin reserve in 2025.

Future Implications

Some thoughts on maximalism… let me say this as clearly as I can – the crypto industry has a real shot, here and now, to achieve the many goals we have in common, IF we work together instead of tearing each other down. This is not, and never will be, a zero-sum game.

— Brad Garlinghouse (@bgarlinghouse) January 27, 2025

• I own…

Addressing several key concerns, Garlinghouse stated:

“Maximalism remains the enemy of crypto progress, and I’m very glad to see fewer and fewer folks ascribe to this outdated and misinformed thinking.”

Numerous significant developments in the Ripple vs Bitcoin debate have spearheaded discussions about digital finance’s future.

Market Impact

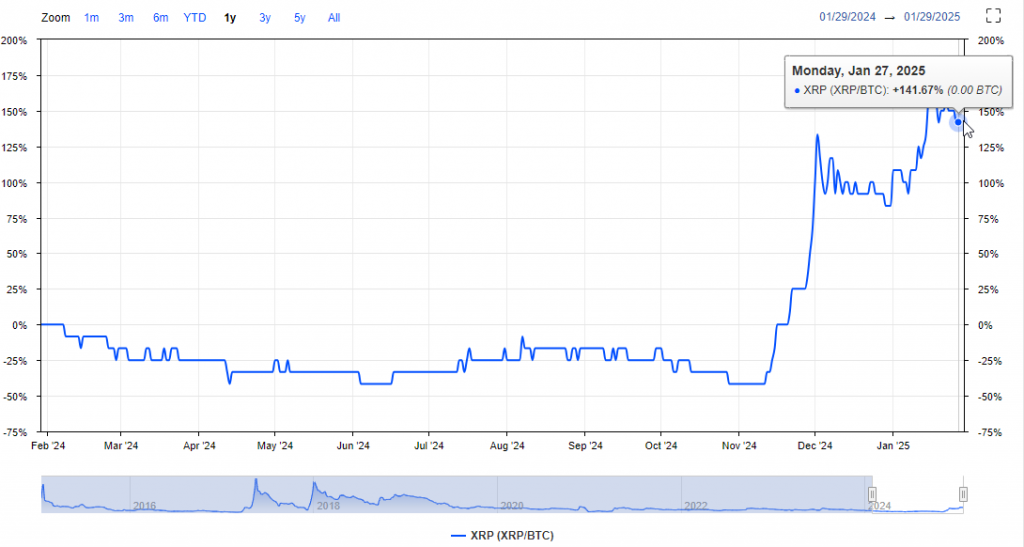

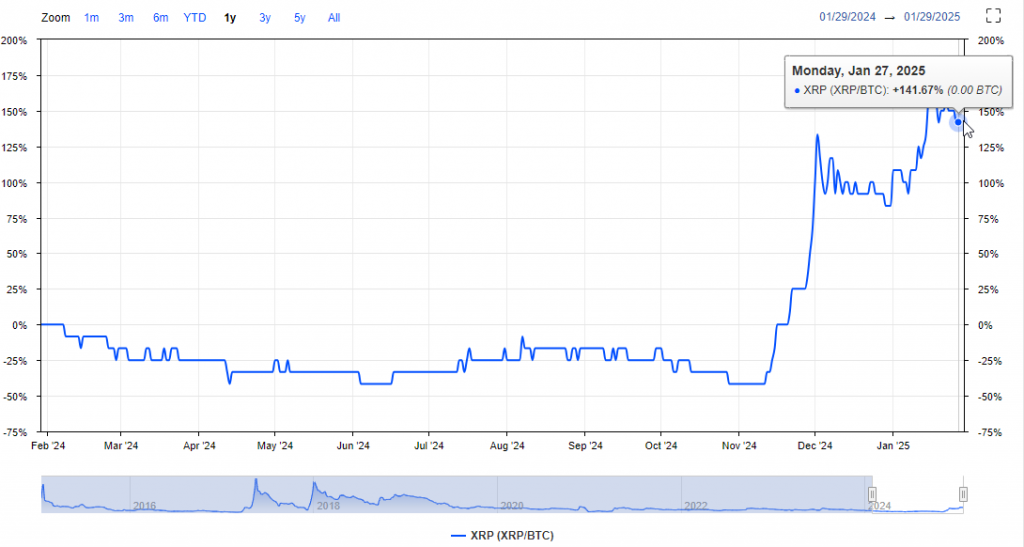

Some market analysts suggest the controversy has accelerated cryptocurrency market volatility. Various major security risks in crypto continue shaping the debate around the Bitcoin reserve proposal.

Also Read: PayPal’s PYUSD Bridges to Cardano: A New Era in Crypto Integration