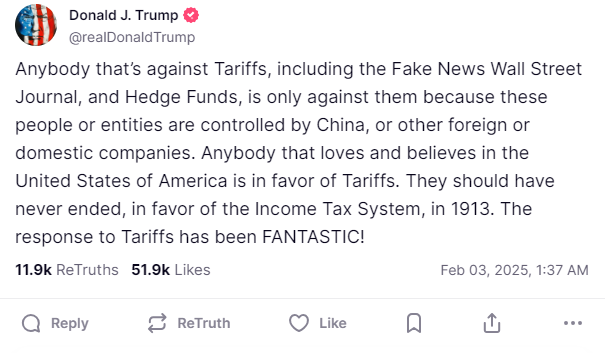

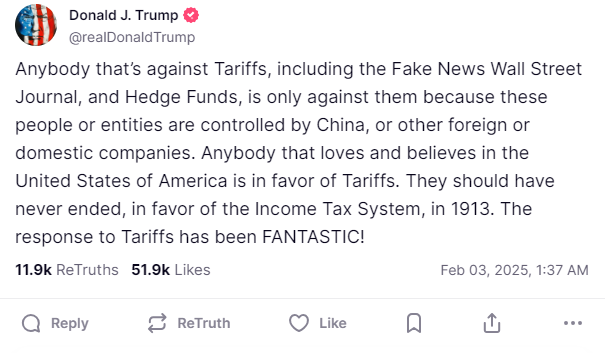

The Trump tariffs oil price spike appears as President Trump has announced a 25% tariff on Mexican and Canadian imports, with a special 10% rate for Canadian energy resources. The global growth slowdown fears are increasing as oil price volatility reaches some new heights in energy markets, with analysts predicting some potential long-term market disruptions.

Also Read: 1,000+ USAID Staff Fired After Refusing Musk’s D.O.G.E. Team Secure Access

How Trump’s Tariffs Affect Oil Prices & What to Expect in the Future

Markets React

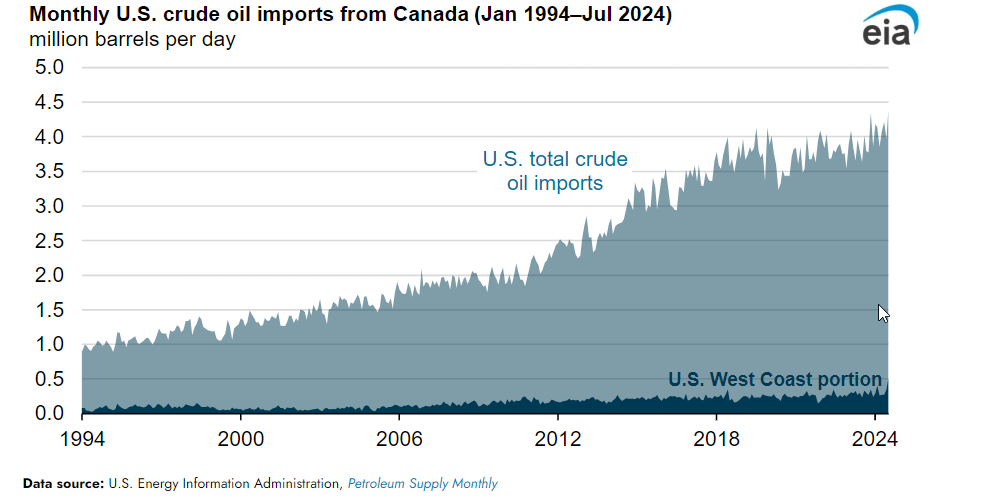

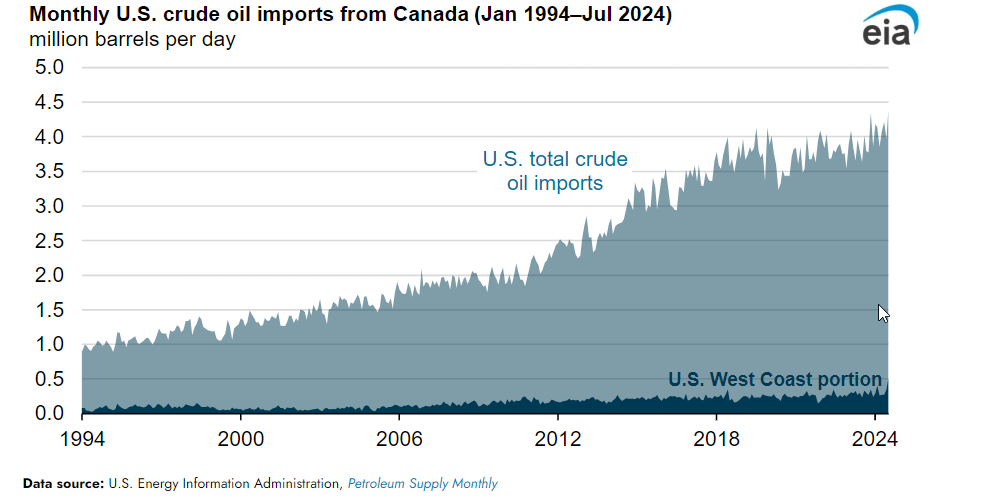

The energy market impact manifested immediately as U.S. West Texas Intermediate rose 1.75% to $73.8 per barrel. The Trump tariffs oil price spike extended to gasoline markets, with RBOB futures climbing 2.81% to $2.11 per gallon. According to EIA data, U.S. imports of Canadian crude reached a record 4.3 million barrels per day in July 2024, representing 62% of total U.S. crude imports.

Expert Predictions on Price Trajectory

The oil price volatility has intensified as analysts have weighed long-term implications of the new trade measures. Some market experts suggest that the initial price surge masks some deeper structural changes in global energy trade patterns.

Andy Lipow, President of Lipow Oil Associates, said:

“While the initial move on crude oil is upward, a cycle of tariffs and retaliatory actions by Canada, Mexico, China and perhaps others in the future could lead to a worldwide recession, causing oil prices to plummet.”

Also Read: Man Regrets Selling SHIB: ‘I Would Have Made $1 Billion in Shiba Inu’

Canadian Markets Under Pressure

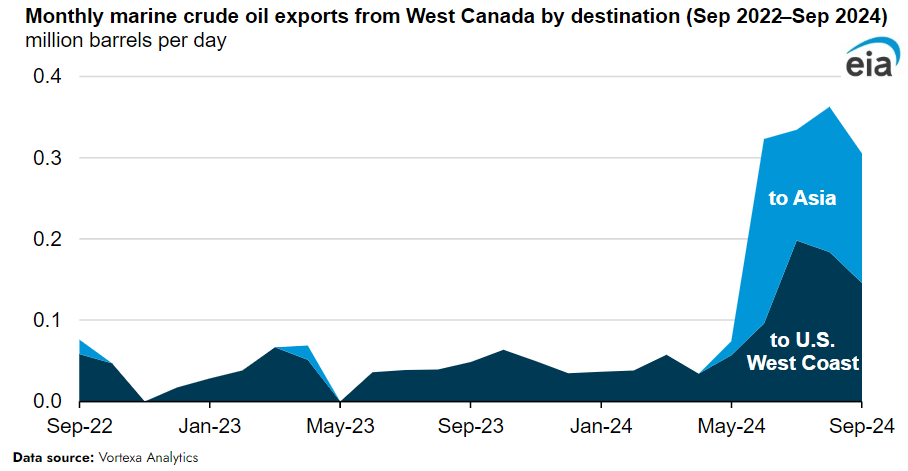

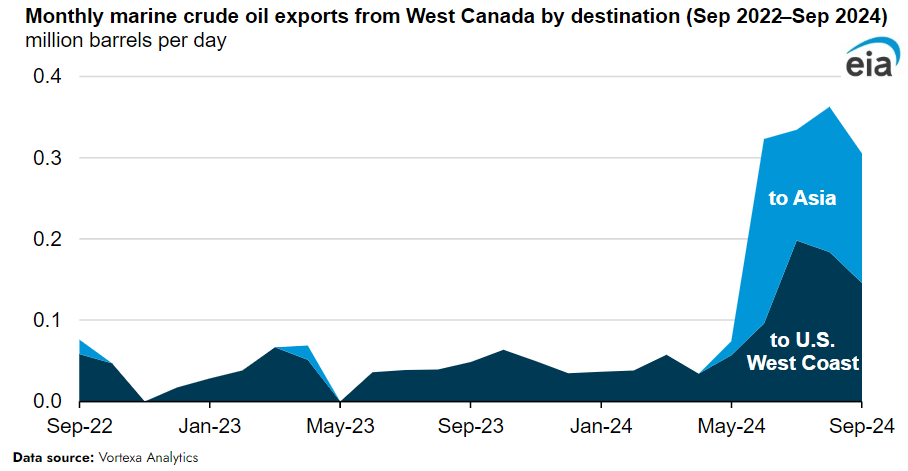

The Trump tariffs oil price spike particularly affects Canadian producers, who face limited alternatives for their export volumes. Supply chain disruptions loom as both Canada and Mexico scramble to find new markets for their energy exports.

Goldman Sachs analysts had this to say in a Sunday note:

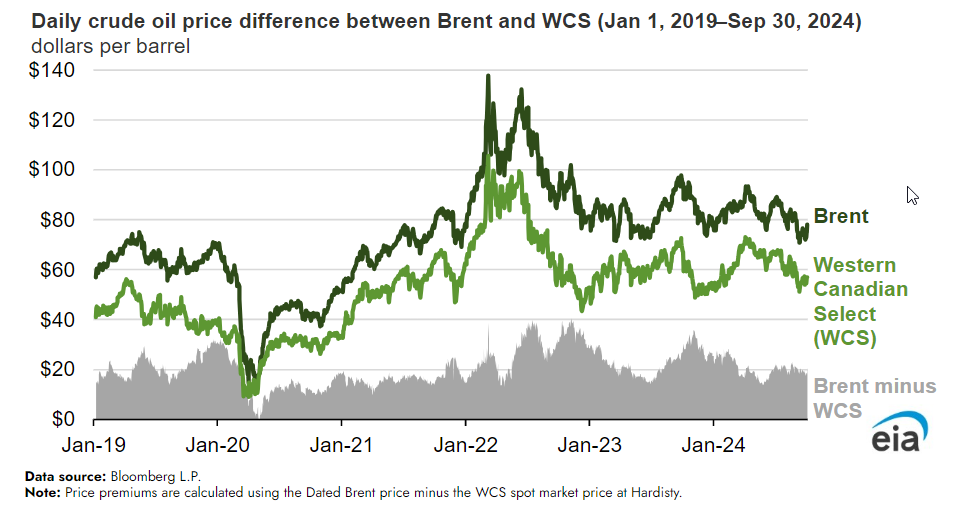

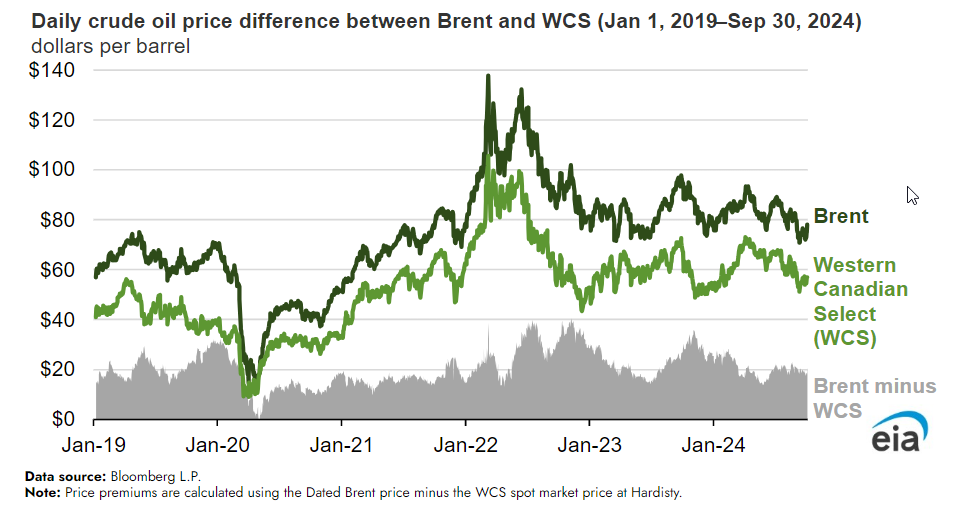

“Canadian oil producers will eventually bear the brunt of the tariffs’ burden with a $3 to $4 per barrel discount on Canadian crude given the limited alternative export markets.”

Saul Kavonic, head of energy research at MST Marquee, said:

“Both Canada and Mexico have limited spare refining capacity or alternative export routes, and the tariffs will likely push oil producers in both countries into steep price discounts.”

Also Read: Top 3 Cryptocurrencies To Buy During The Market Crash

OPEC+ Response and Future Outlook

The global growth slowdown concerns mount as OPEC+ considers its response to Trump’s recent pressure to reverse production cuts. The oil price volatility could lead to a potential 40% crash as markets adjust to new trade dynamics and reduced demand expectations. The oil cartel’s upcoming Monday meeting gains significance as it weighs its 2.2 million barrels per day production cut against mounting pressure for price stabilization.