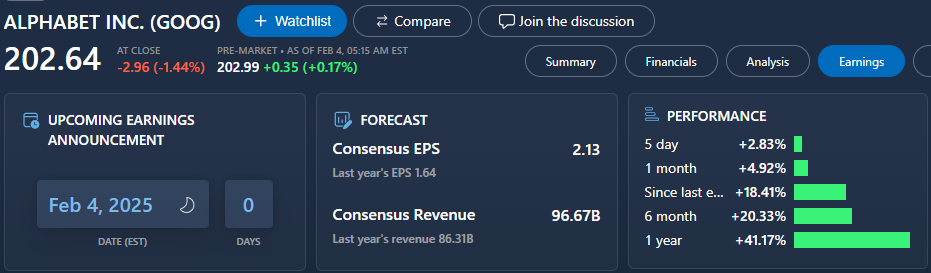

Alphabet earnings command market attention today as investors await the tech giant’s fourth-quarter performance amid heightened market volatility in tech stocks and regulatory challenges. The parent company of Google faces dual pressures from China’s anti-monopoly investigation and potential Federal Reserve policy shifts, while the Google earnings report could signal broader tech sector health.

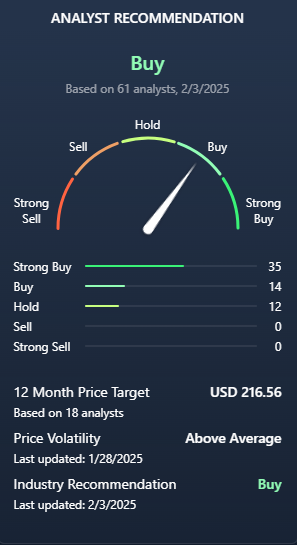

Analysts from MSN recommend the following actions:

Also Read: Elon Musk’s D.O.G.E. Accused of Misusing Treasury Data in New Lawsuit

Exploring Possible Alphabet Earnings, China’s Probe & Fed Influence on Google’s Future

China’s Regulatory Investigation Takes Shape

Some Chinese regulators started looking into Google’s business practices. Several local businesses are working around the clock with Google on their ads, though many core services remain blocked. Multiple analysts are waiting for the Alphabet earnings report to be released today as this probe unfolds. A few market experts also link the timing to some of the recent U.S. trade developments.

Fed Officials Ready to Speak

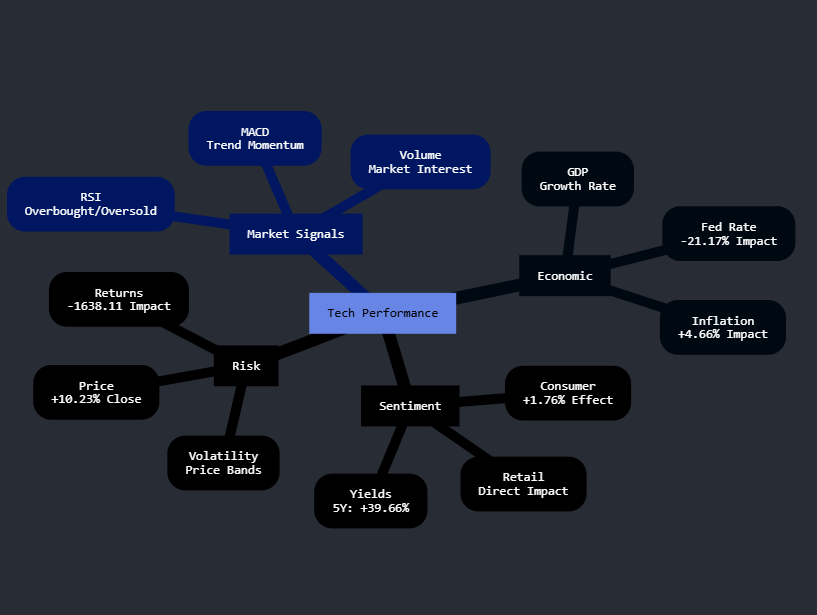

Various Federal Reserve leaders will share their views throughout Tuesday. Some speeches could move market volatility in tech stocks up or down. Several investors track these talks alongside Alphabet earnings updates. The Google earnings report gains extra weight with current Fed policy questions.

Also Read: Top 3 Cryptocurrencies Predicted To Hit New All-Time Highs Soon

Job Numbers Meet Tech Performance

The latest JOLTS report might show around 8 million open jobs. Several market watchers tie these numbers to Google earnings prospects. Various signs point to shifts in digital ad spending and AI growth. Alphabet earnings data helps paint this bigger picture.

Markets Watch Tech Giants

Some recent swings in tech stocks put extra focus on Alphabet earnings today. Multiple factors, from interest rates to China’s probe into Google, shape current trading. A few key tech companies join the earnings lineup, making this a busy market day.

Also Read: Trump Backs Fed Rate Pause—Just 1 Week After Davos Rate-Cut Push!