Several countries were seen coming together to bring down the dominance of the US dollar. The whole process of minimizing the reliance on the greenback in the use of international trade, finance as well as foreign exchange reserves has been garnering steam. The term “de-dollarization” was making the rounds all over the globe. Despite the increased efforts of several nations, the US dollar has been going strong. Recent data reveals that the dollar remains the most used currency for cross-bored transactions.

Also Read: Apple (AAPL) Gets $184 Target: Can the Stock Really Crash 20%?

US Dollar Continues To Dominate

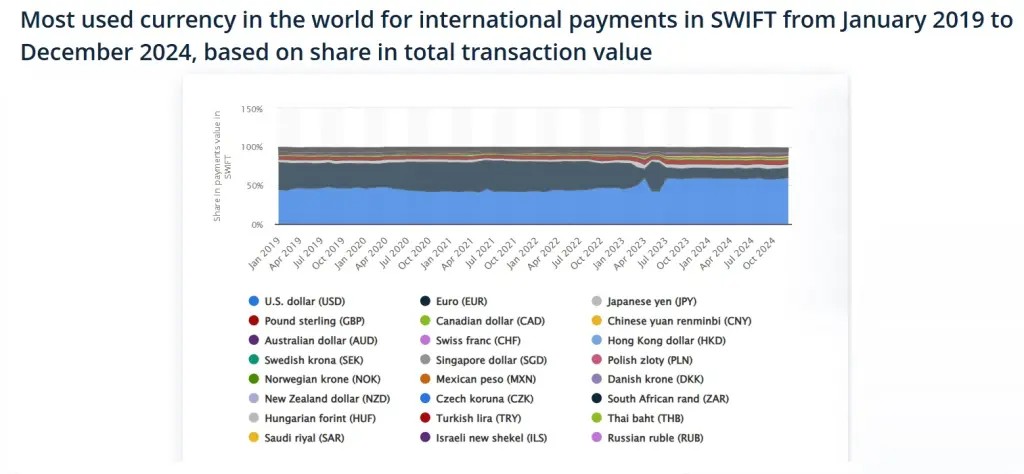

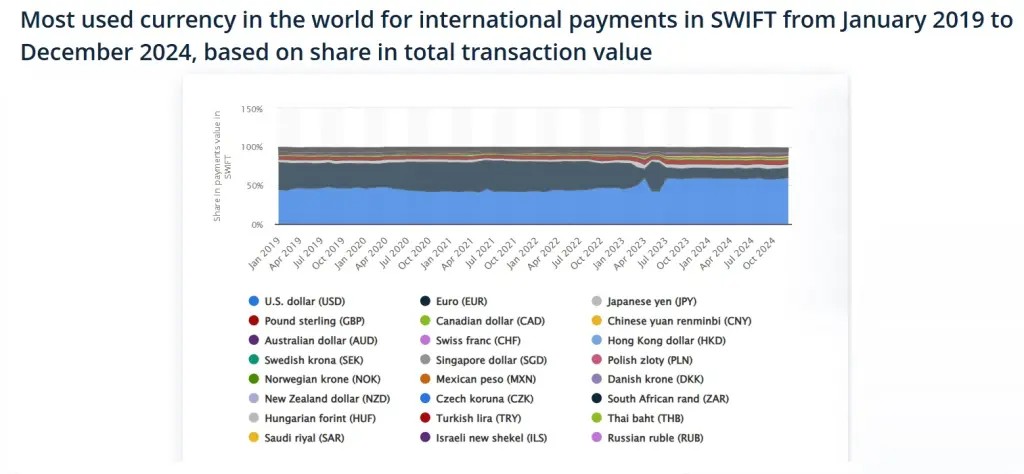

Data from SWIFT, an international payment system revealed that international transactions mostly rely on the US currency. The Chinese yuan is valued at 2.8%, while currencies such as the Japanese yen take 5.09%. China has been trying to bring down the dollar with its association with BRICS. But Chinese yuan has a very difficult time competing with the USD because of its low usage. The Chinese yuan is still not the most widely used currency, even though it is leading the de-dollarization movement.

Looking into the final month of 2024, the US dollar was still standing out. In USD, the total transaction value was 60.08% as of December 2024. With a lagging 12.83%, the Euro shows that the dollar’s hegemony is here to stay. With single-digit values, the other major currencies have little hope of competing with the US dollar.

Also Read: Top 3 Cryptocurrencies Owned By Donald Trump’s World Liberty

Will Donald Trump Save The USD?

Despite the US dollar’s dominance, Donald Trump was seen taking steps to protect the greenback. Trump was seen candidly threatening countries that intend to go against the dollar. He affirmed that they could be facing 100% tariffs.

In addition to this, BRICS nations have been looking forward to employing local or alternative currencies for trade. But the chances of this coming to fruition were bleak. Although the Euro and the Chinese Yuan are excellent choices, the several functions are complicated by their restricted convertibility and governmental regulations. Despite being regarded as a viable alternative, the cryptocurrency market is still unstable. Global trade may also be hampered by the ecosystem’s regulatory barriers.

Also Read: Cryptocurrency: 3 Coins To Buy Now For Exclusive Gains Under Trump-Musk Era