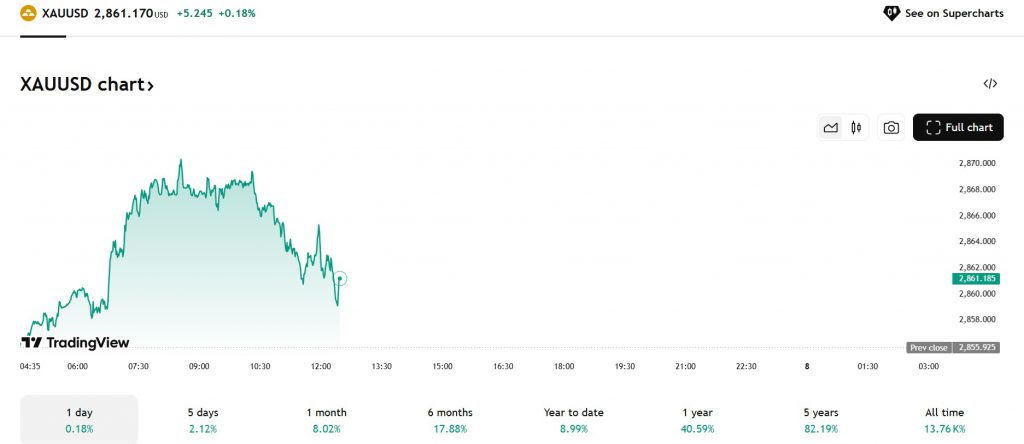

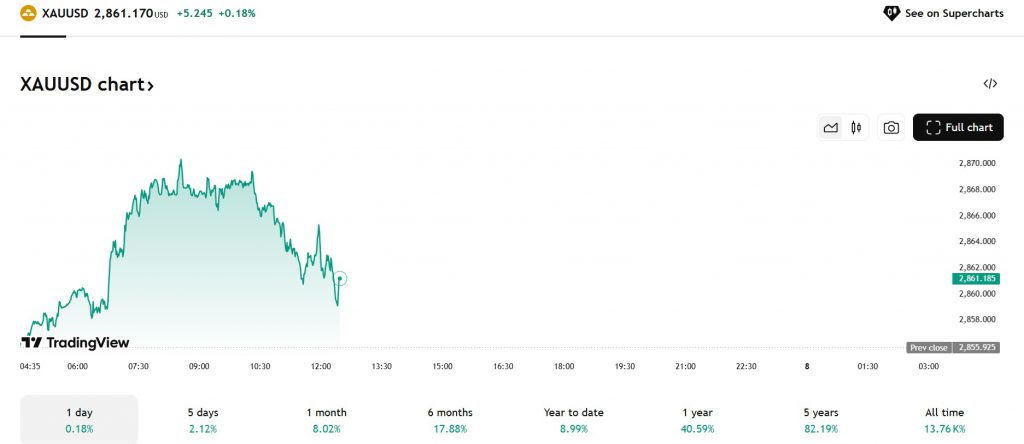

Gold prices are experiencing a bullish divergence as its price has reached $2,861 on Friday’s opening bell. It has surged by more than five points in the day trade with an uptick of 0.18%. The XAU/USD index is now looking to breach the $3,000 mark and usher into a new territory of optimism. The yellow metal remains bullish in 2025 and has continued the positive momentum of 2024. Leading investment bank Citi published a recent prediction forecasting that gold prices could reach $3,000 in the next three months.

Also Read: Solana Struggles Continue: Will SOL Fall to $150 or Hit $300?

Gold Prices Set to Reach $3,000 In the Next 3 Months: Citi

Commodity analysts from Citi predict that gold prices are all set to touch the $3,000 mark in the next three months. The geopolitical tensions raised by Trump through tariffs will make institutional investors seek a safe haven in gold, wrote the report. The development will only help the XAU/USD index which could soon experience an uptick in the indices.

Also Read: Apple iPhone 17 Could Get More Expensive, Thanks to Tariffs

“The gold bull market looks set to continue under Trump 2.0 with trade wars and geopolitical tensions reinforcing the reserve diversification/de-dollarization trend and supporting emerging market (EM) official sector gold demand,” Citi analysts wrote in a note.

According to Citi, gold prices could reach $3,000 during the start of Q2 2025. That’s an uptick and return on investment (ROI) of approximately 5% from its current price of $2,861. Therefore, an investment of $10,000 could turn into $10,500 if the forecast turns out to be accurate.

Also Read: META CEO Sells $30M in the Stock at 52-Week High: But Why?

Citi also wrote that if gold gets exempt from tariffs, it would be best to accumulate the precious metal and hold on for the long term. “A Russia/Ukraine peace deal, and confirmation of whether gold would be exempt from broad tariffs (or not), could provide a buying opportunity over the next 2-3 months,” wrote the commodity analysts.