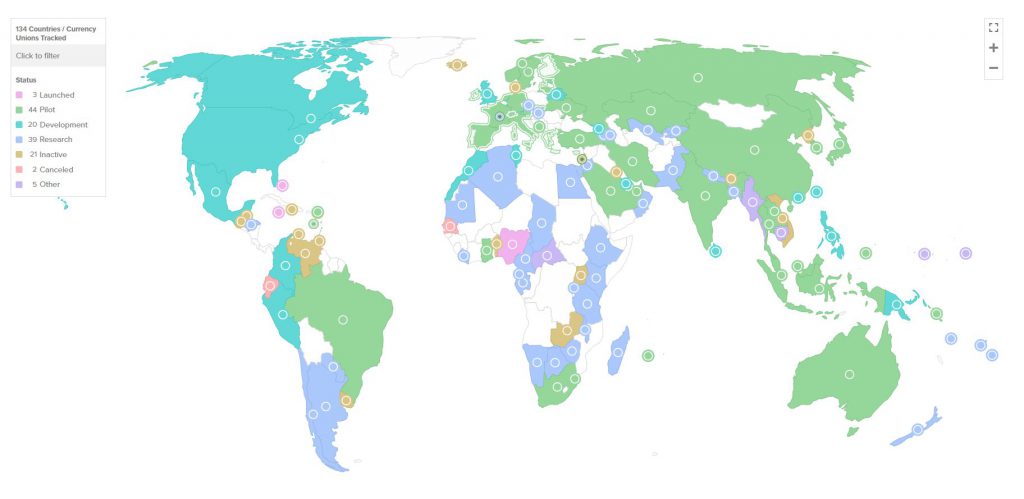

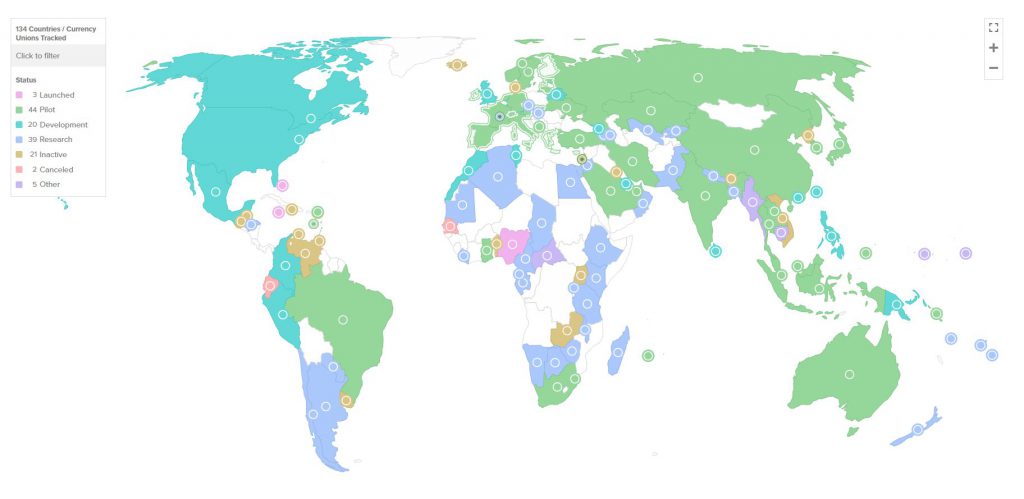

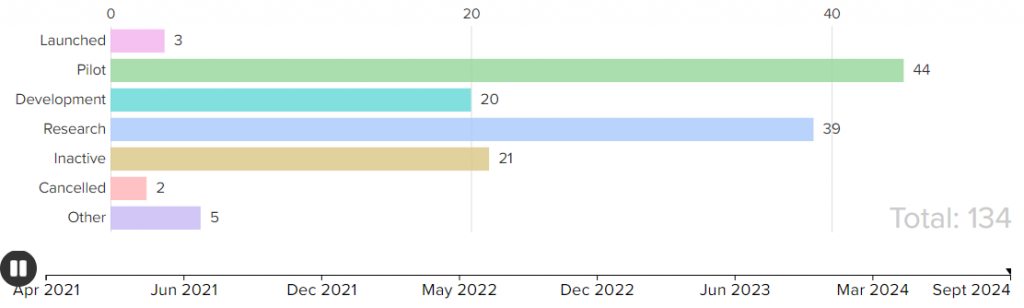

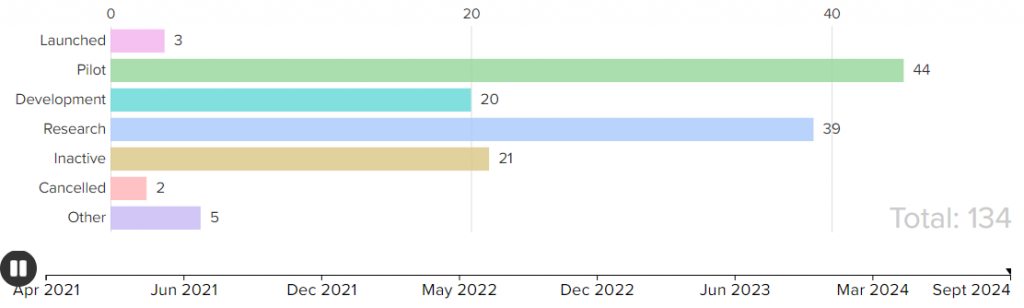

CBDC adoption has catalyzed numerous groundbreaking developments throughout 2024, with 134 countries architecting various Central Bank Digital Currency initiatives. According to the Atlantic Council’s latest data, these nations have engineered financial frameworks representing 98% of global GDP, revolutionizing multiple significant market dynamics. Through various strategic implementations, G20 nations have spearheaded comprehensive digital currency programs, with 19 countries pioneering advanced development stages as Central Bank Digital Currencies transform monetary policy frameworks worldwide.

Also Read: Visa Partners with Fold to Introduce Bitcoin-Backed Credit Card

Global Push for Central Bank Digital Currencies: What It Means for the Future of Finance

G20 Nations Lead the Charge

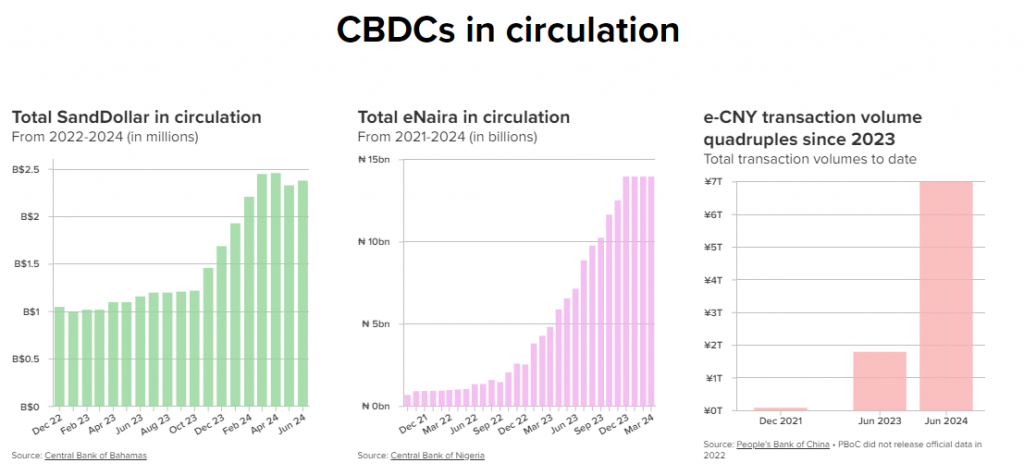

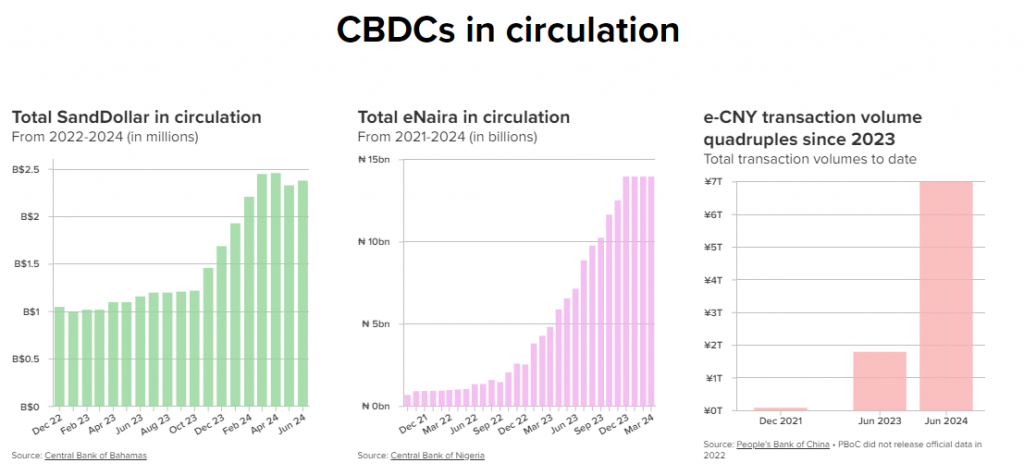

Thirteen G20 nations have architected numerous groundbreaking CBDC pilot initiatives, transforming global adoption trajectories. Through various strategic implementations, leading economies including Brazil, Japan, India, Australia, Russia, and Turkey have spearheaded comprehensive testing ecosystems for these digital currencies. China’s digital yuan (e-CNY) has revolutionized multiple critical benchmarks in the sector, with transaction volumes reaching 7 trillion yuan ($986 billion) by June 2024, quadrupling from the previous year’s figures.

Cross-Border Projects Surge Post-Ukraine Conflict

Cross-border CBDC initiatives have catalyzed numerous significant developments following Russia’s invasion of Ukraine. Project mBridge has architected various major connections across banks in China, Thailand, UAE, Hong Kong, and Saudi Arabia, revolutionizing Central Bank Digital Currency expansion. The U.S. has spearheaded multiple strategic collaborations through Project Agorá alongside six other major central banks, while navigating domestic implementation frameworks.

Also Read: Dogecoin: How To Become A Millionaire If DOGE Hits $5 After ETF

Early Adopters Show Promise

The Bahamas, Jamaica, and Nigeria serve as test cases for full CBDC adoption. Their digital currencies are distributed through banks and financial institutions, creating a controlled rollout that protects existing financial systems while promoting financial inclusion.

BRICS Push for Alternative Payment Systems

Every original BRICS member state has spearheaded numerous CBDC initiatives, revolutionizing digital currency development. Through various key partnerships, these nations have engineered payment systems independent of traditional international financial networks. Across multiple significant markets, the expansion of these pioneering programs has catalyzed global financial transformations and accelerated CBDC adoption trajectories.

Also Read: 20 U.S. States Propose Bitcoin Reserve Bills, Eyeing a $23 Billion Crypto Investment

Challenges and Security Measures

The widespread implementation of Central Bank Digital Currencies has catalyzed various major technical and regulatory transformations. Through several key security protocols, central banks have engineered robust defensive frameworks while optimizing operational resilience. Multiple significant privacy safeguards and anti-money laundering standards continue shaping CBDC development, as numerous financial institutions leverage intermediated systems for strategic deployment.