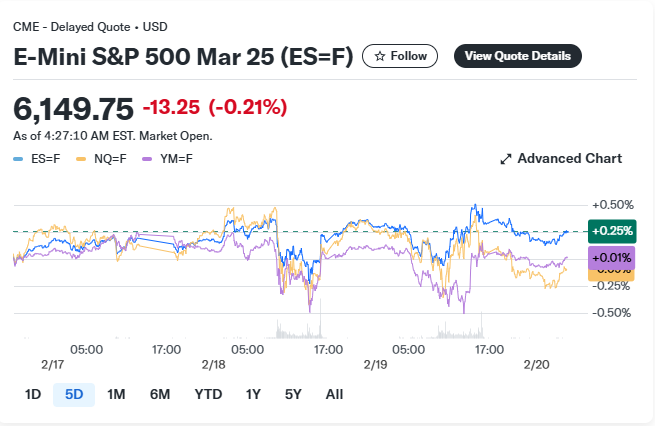

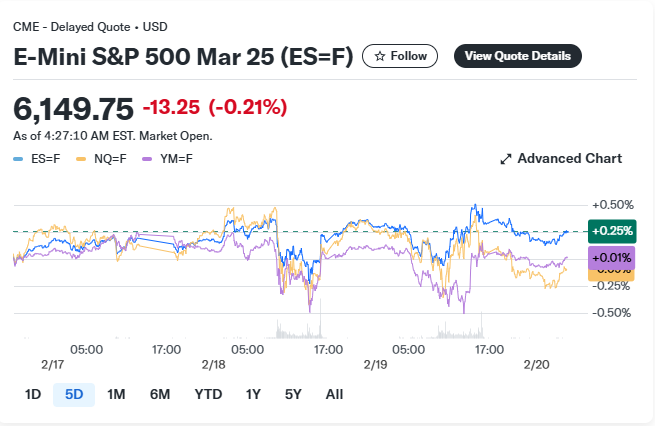

Significant shifts in the stock market were catalyzed by market developments Thursday, as trading floors were impacted by the Federal Reserve’s stance on interest rates. Major indices were jolted from their peaks by fast-moving shifts, as S&P 500 futures were seen dropping 0.3% to 6,149.75, while the Nasdaq 100 was pulled back 0.4%, and Dow Jones futures were moved 0.2% lower. These dramatic market trends were shaped against economic uncertainty that was strengthening, along with market conditions that continued to evolve.

Also Read: De-dollarization: Is a Gold-Backed Currency the Ultimate Solution? Expert Weighs In

How Market Trends and Economic Outlook Affect Investor Confidence

Fed Minutes Signal Extended High Rates

Strategic policy decisions from Federal Reserve officials spearheaded fresh market uncertainty during their January meeting. Bold concerns surfaced around President Trump’s trade policies and immigration measures driving inflation higher. The stock market response highlighted investors’ growing caution about interest rates staying elevated longer than expected.

Morgan Stanley strategists said:

“A structural regime shift is finally happening within China’s equity market, especially the offshore space. This makes us more convinced than we were during last September’s rally that the recent improvement in MSCI China’s performance can be sustained.”

Global Trade and Defense Impact

Some of the trade tensions are at fault for some fresh stock market declines as General Motors has considered plant relocations in response to auto tariffs. Interesting ,right? Defense Secretary Pete Hegseth has accelerated market uncertainty when he had this to say:

“[Military spending will see an] 8% cut in military spending over the next five years.”

President Trump had this to say about Ukraine’s situation:

“[Zelenskiy] better move fast or he is not going to have a country left.”

Also Read: Mysterious Trade: US Congresswoman Buys German Arms Manufacturer Stock

Safe Haven Rush and Chinese Markets

Critical market shifts propelled gold to unprecedented heights of $2,947.23 per ounce. Dynamic stock market movements pushed investors toward traditional safe havens, with gold reaching $2,971.10 amid intensifying global concerns.

Shifting Market Sentiments

The latest transformative developments in the Chinese markets spearheaded some much-needed fresh optimism. Impactful revisions from Morgan Stanley’s team projected the MSCI China Index reaching 77 by 2025’s end. This strategic shift in the stock market outlook aligned with similar upgrades from major financial institutions.

Laura Wang and her team has said:

“This makes us more convinced than we were during last September’s rally that the recent improvement in MSCI China’s performance can be sustained.”

Also Read: Shiba Inu: SHIB Price Prediction 5 Days From Now

Some powerful market trends continue shaping all trading decisions. Some essential factors including the Federal Reserve interest rates, geopolitical developments, and the earnings reports drive market uncertainty. The economic outlook remains closely tied to military spending adjustments and international trade dynamics.

Note: All prices and market movements mentioned reflect values at the time of writing. Markets are dynamic and subject to change as events unfold throughout the trading day.