The latest Federal Reserve digital assets have started a transformative shift as the nation’s central bank officially recognizes the powerful Byzantine Fault Tolerant (BFT) consensus mechanisms through a pioneering research paper. Right now at the time of writing, this game-changing acknowledgment strengthens the position of XRP, XLM, and HBAR in the blockchain security landscape, while also establishing a remarkable pivot in how financial institutions approach the entire spectrum of digital payment systems.

‼️ FEDERAL RESERVE OFFICIALLY EMBRACES BFT, CEMENTING XRP, XLM, AND HBAR’S ROLE IN SECURE PAYMENTS‼️

— SMQKE (@SMQKEDQG) February 21, 2025

The Federal Reserve has officially acknowledged the efficiency and scalability of Byzantine Fault Tolerant (BFT) consensus models in a research paper discussing a secure payment… pic.twitter.com/2pJ0j2Nx8U

Also Read: Gold Prices Hover Near Record Peak

How Federal Reserve Digital Assets and BFT Could Revolutionize Blockchain Security with XRP, XLM, and HBAR

The Federal Reserve’s BFT Endorsement

The Federal Reserve’s research paper, titled “Heraclius: A Byzantine Fault Tolerant Database System with Potential for Modern Payments Systems,” has spearheaded a revolutionary validation of BFT’s superiority. Incredibly, the study showcases Federal Reserve digital assets could benefit from BFT’s capability to process 110,000 transactions per second while maintaining optimal security levels.

SMQKE stated:

“This is a significant endorsement, as BFT models, specifically the Byzantine Agreement-based mechanisms, provide the highest level of security and scalability for distributed networks.”

XRP, XLM, and HBAR: Leading the BFT Revolution

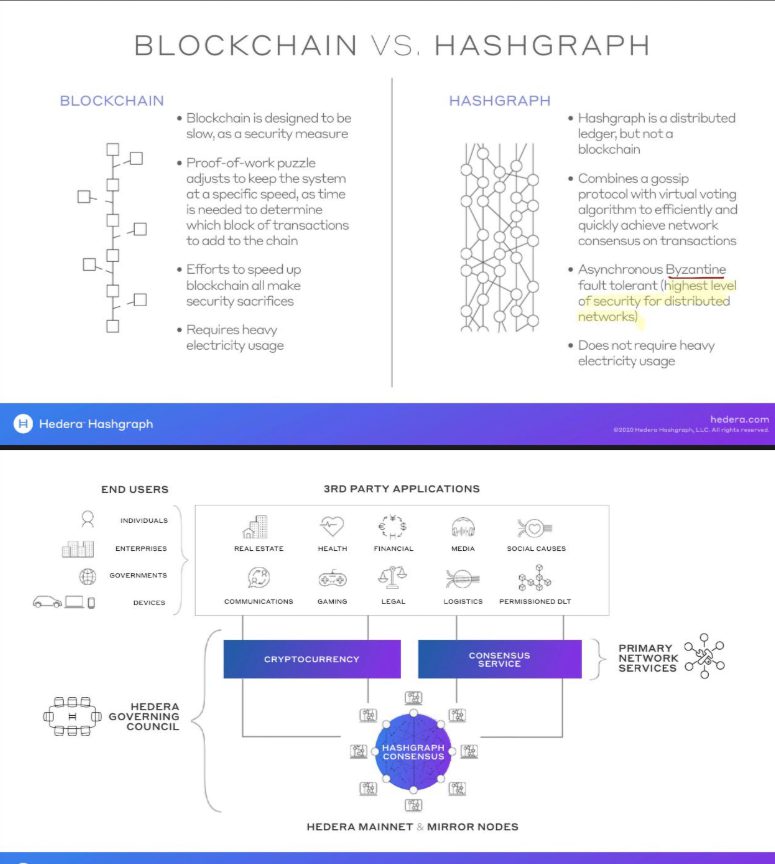

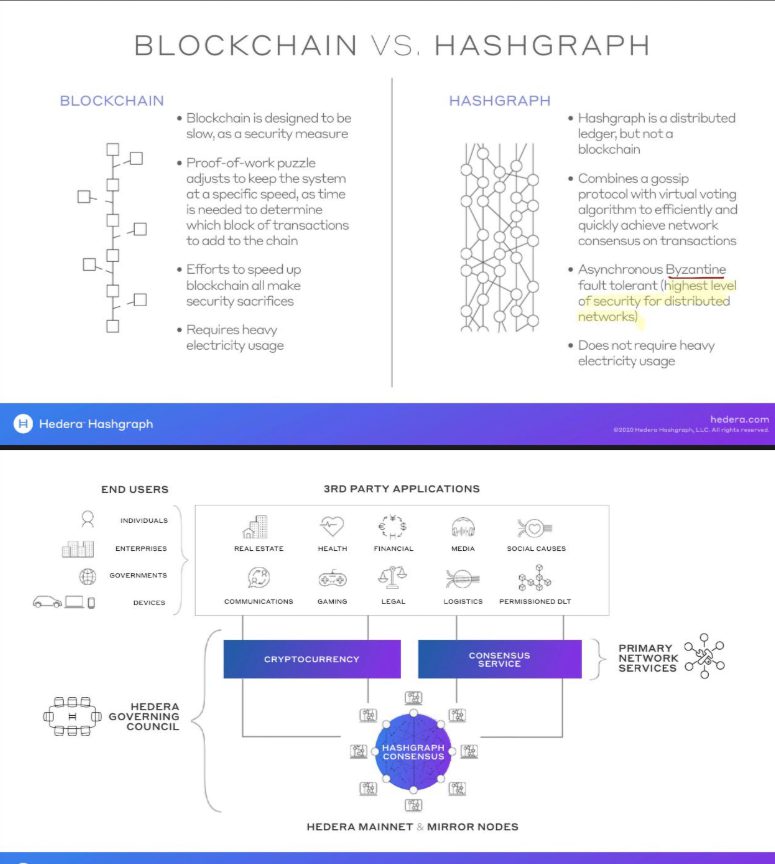

Federal Reserve digital assets research has uncovered powerful advantages in how these digital currencies operate. XRP and XLM stand out with their specialized Federated Byzantine Agreement protocols, while HBAR brings something distinctive to the table with its asynchronous BFT Hashgraph consensus – together forming an iron-clad foundation for next-generation payment systems.

Also Read: Michael Saylor’s CPAC 2025 Bitcoin: From Conservative Stronghold to MicroStrategy’s Big Bet

ISO 20022 Compliance and Integration

Groundbreaking developments in Federal Reserve digital assets systems have architected new possibilities. The strategic alignment of XRP, XLM, and HBAR with ISO 20022 standards creates an exceptional framework for integration into modernized financial infrastructures.

Also Read: Top 3 Cryptocurrencies To Watch This Week

Technical Validation and Security Implementation

The Federal Reserve’s comprehensive research has revolutionized understanding of blockchain security protocols. Smart advances in BFT-based systems showcase superior protection against network attacks while XRP, XLM, and HBAR demonstrate remarkable throughput capabilities.

Future Implications for Digital Asset Integration

Federal Reserve digital assets research has revolutionized the landscape of payment systems through its methodical validation of BFT technology. This powerful endorsement opens remarkable possibilities for XRP, XLM, and HBAR, as their battle-tested implementations lead the charge in advancing blockchain security standards.