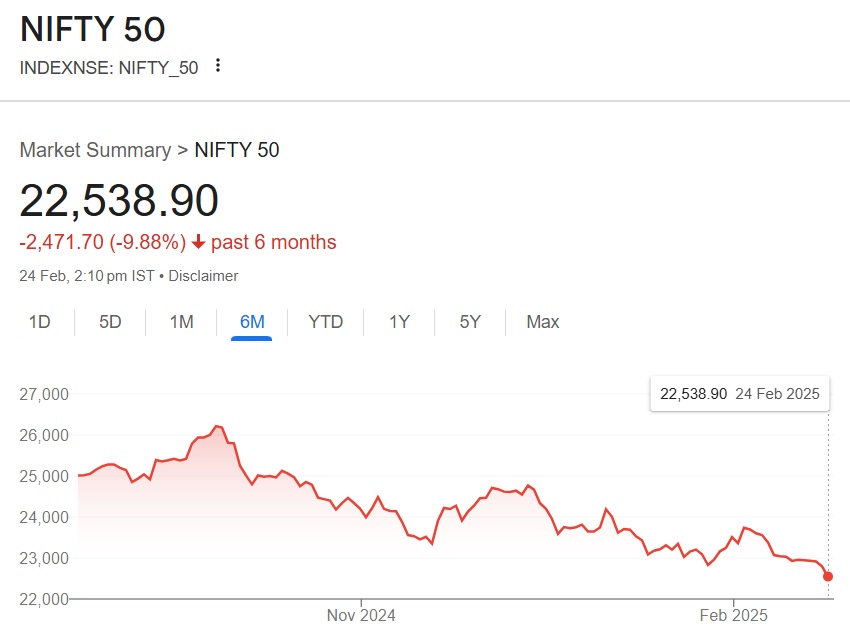

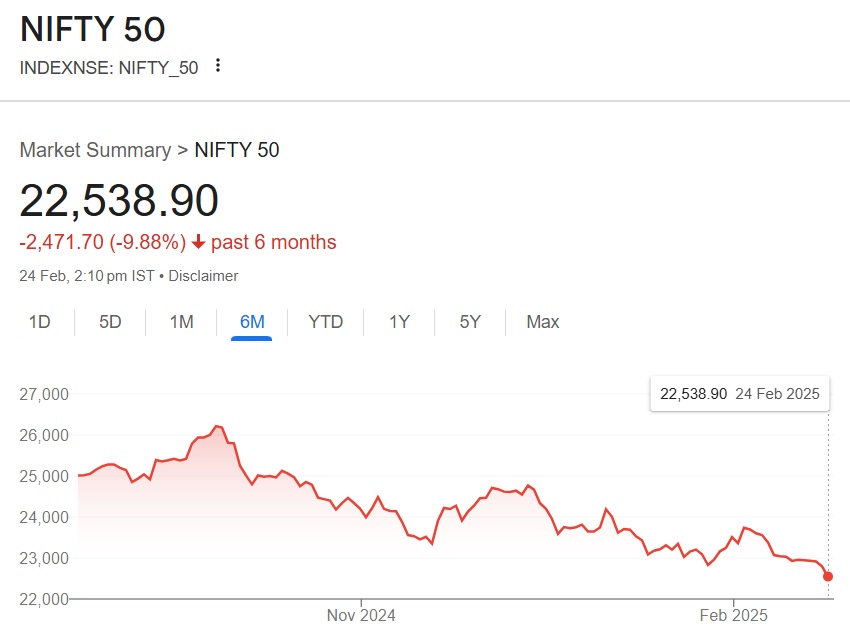

The Nifty 50 index is on the brink of recording its longest losing streak in over 28 years. If the fall extends till the end of February, it would be the first time since 1996 that the index has fallen for five consecutive months. The Indian markets have been bleeding in the last five months erasing billions worth of wealth from both retail and institutional investors.

Since 1990, the Nifty 50 index has experienced continuous monthly declines only twice. The longest being from September 1994 to April 2025, where it plummeted 31.4% in eight months. The second continuous decline came in 1996 when it plunged 26% between July and September. It wiped billions worth of stocks in just three months nearly 29 years ago.

The current downturn in Nifty 50 is at 11.7% from the scale of the crash is not dramatic compared to the 1994 and 1996 dip. Nonetheless, if the fall persists without a price rebound, topping the previous dips would come sooner than expected.

Nifty 50 Faces Stormy Waters

The Nifty 50 index was in the 26,000 range in September last year and relentlessly dipped in the charts to the 22,500 level in February. The continued weakness stems from aggressive selling from foreign institutional investors (FII) who offloaded nearly $1.5 billion from the markets since October 2024.

The downturn has dimmed the risk appetite of retail investors who now want to stay away from the stock markets. This is the first litmus test of the current batch of retail investors who entered the markets through fintech influencers. The investments in SIPs have turned red causing distress among retail traders who enjoyed four years of bull run.

However, the Nifty 50 index might not rebound in price until FIIs make a comeback in the Indian stock markets. The institutional funds are now focused on China and the US and giving the Indian markets a miss.