XRP price prediction shows a concerning trend as the cryptocurrency dropped to $2.2 amid bearish market sentiment. Technical indicators suggest further downside potential unless buyers step in at critical support levels. Market volatility and blockchain scalability concerns remain key factors influencing XRP’s performance this week.

Also Read: Top 3 Cryptocurrencies To Buy During The Latest Market Crash

XRP Price Analysis and Key Factors Driving Market Volatility and Scalability Concerns

As XRP continues its downward trajectory, several critical factors merit close attention from investors and traders watching this popular cryptocurrency. With the current trend, XRP price prediction models indicate that the coming days may be crucial.

1. Bears Take Control of the Market

Within the last 24 hours, XRP’s price has plummeted by 8% and drawn dangerously close to the $2.2 level. This dramatic decline has completely transformed market momentum into firmly bearish territory. According to detailed technical analysis provided by Duo Nine, this concerning price action could accelerate XRP toward testing the crucial support at $2 within days if present market conditions continue unchanged.

The weekly chart exposes a worrying pattern where numerous sellers have strategically dominated the volume profile throughout the past two weeks. This persistent selling pressure has directly contributed to driving prices consistently lower, although the critical $2 support level manages to remain intact for now. Nevertheless, current XRP price prediction models suggest that any decisive breach of this support threshold could trigger substantially more significant losses across various timeframes.

Also Read: How High Will Cardano Rise If ADA ETFs Become A Reality

2. Technical Indicators Flash Warning Signals

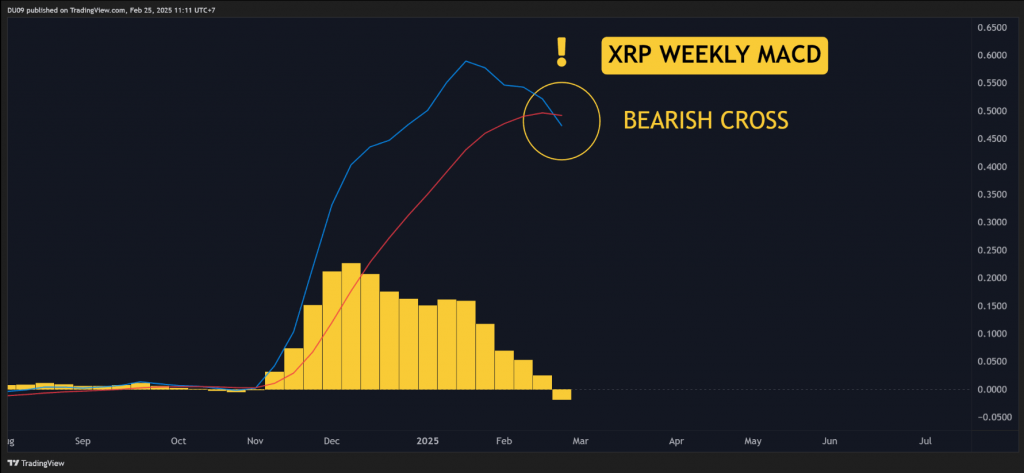

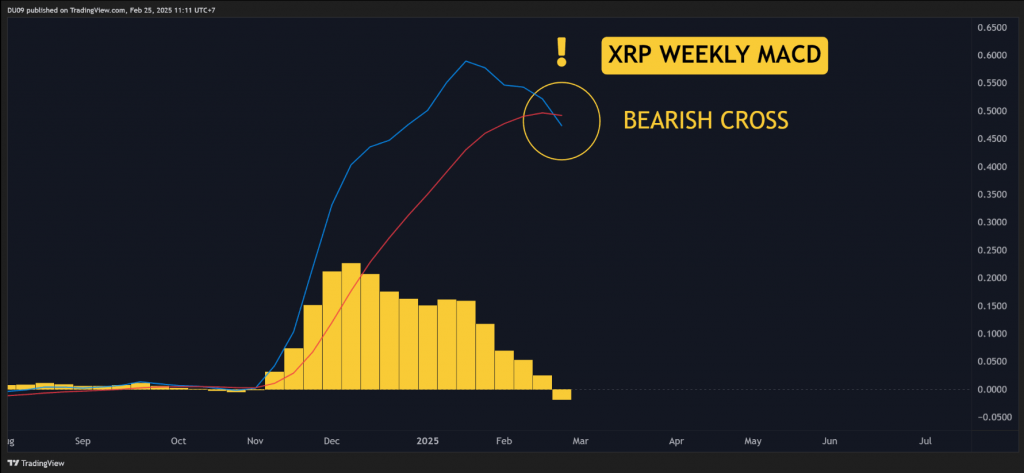

A particularly worrying development for XRP bulls can be seen in the technical indicators. The weekly MACD is showing a major bearish cross that will likely be confirmed by week’s end. This technical formation typically signals continued downward momentum and lower prices ahead.

“Unfortunately for bulls, the weekly MACD is flashing a major bearish cross, which will be confirmed at the end of this week,” notes crypto analyst Duo Nine. “If so, the likely outcome will be a continuation of the current downtrend and lower price levels, aligning with many XRP price prediction models.”

3. Buyer Hesitation Compounds Problems

The absence of strong buying interest compounds XRP’s current challenges. Volume analysis indicates that sellers have been controlling the market for the past two weeks, with the volume profile dominated by selling activity. This lack of buyer enthusiasm at current price levels suggests limited support until the $2 mark is reached.

Also Read: Walmart (WMT) Stock Suffers Worst Week in 2 Years: Buy the Dip?

Key Price Levels to Watch

For traders and investors monitoring XRP’s price action, several critical price points require attention:

- Key Support levels: $2.00 and $1.60

- Key Resistance levels: $3.00 and $3.40

The $2 support level will likely prove decisive in determining XRP’s short-term trajectory. Should this support fail to hold, prices could decline further toward the secondary support at $1.60. Many analysts tracking XRP price prediction trends will be closely watching these levels.

Scalability Concerns Impact Market Sentiment

XRP’s price challenges have manifested against a comprehensive backdrop of broader blockchain scalability concerns across multiple industry segments. As transaction volumes accelerate substantially across various cryptocurrency networks, legitimate questions regarding XRP’s capacity to maintain its promised efficiency under heightened operational loads have been vocalized by numerous market participants.

Consequently, sophisticated XRP price prediction models are now systematically incorporating these technical scalability challenges into their analytical frameworks. These intensifying scalability concerns generate additional downward pressure on XRP’s market valuation, as experienced traders carefully evaluate the cryptocurrency’s long-term viability prospects against several competing blockchain solution alternatives currently gaining market traction.

Market Outlook for the Week Ahead

XRP’s immediate price outlook has catalyzed significant concern based on comprehensive technical analysis frameworks. Many market participants now fixate their attention on the critical $2 support threshold, which will fundamentally determine the cryptocurrency’s directional movement in the coming trading sessions.

If bearish forces maintain their strategic control and successfully break below this key level, numerous technical analysts predict further price deterioration toward $1.60 becomes increasingly likely. Alternatively, a decisive bounce from the $2 support zone could potentially signal an emerging opportunity for buyers to recapture some influence over prevailing market momentum. Regularly consulting XRP price prediction updates can deliver enhanced analytical insights during this volatile period.

The combination of several bearish technical indicators, ongoing selling pressure across different timeframes, and some broader market uncertainties has created a really tough trading environment for XRP right now. Smart traders should keep a close eye on these changing market conditions throughout the week and adjust their XRP price prediction models as needed.