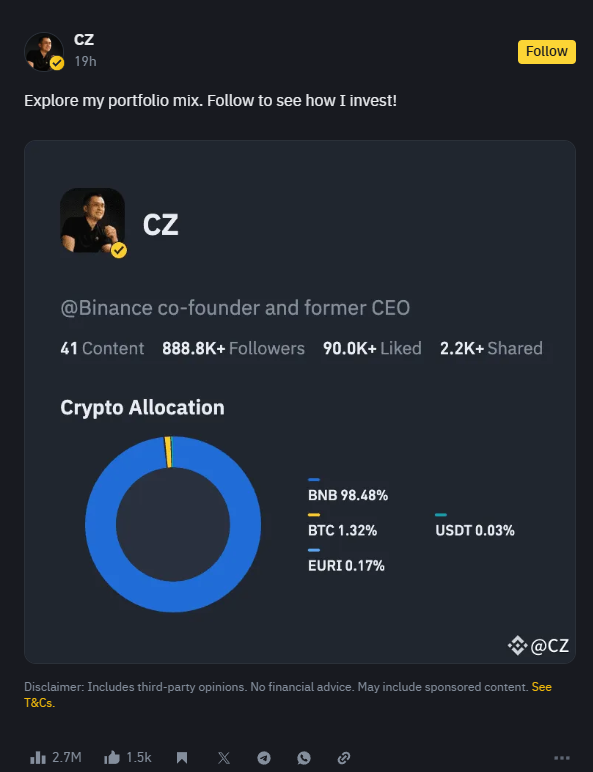

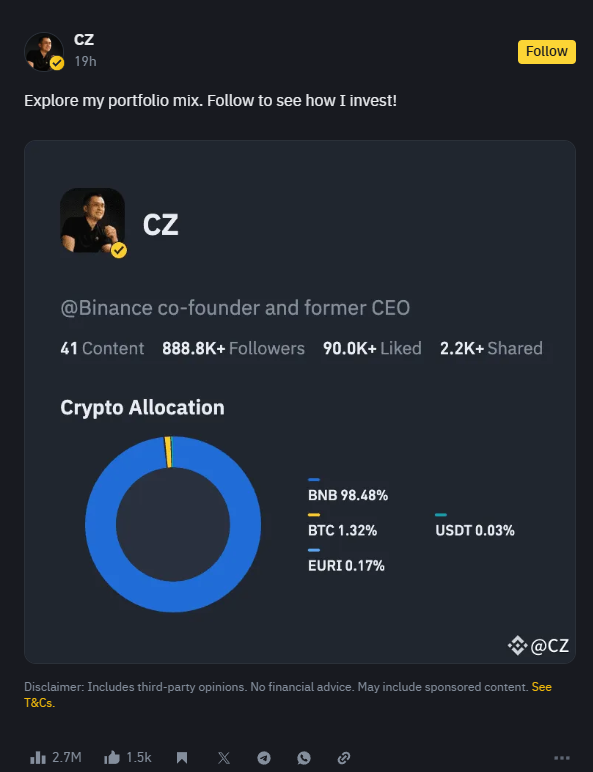

Changpeng Zhao’s crypto portfolio has been revealed, showing a massive concentration in one particular asset. This concentration drives his wealth amid cryptocurrency market volatility. The Binance founder recently shared his holdings through a new feature on Binance Square. This provides unprecedented transparency into his investment strategy.

Also Read: XRP Price Struggles Below $2.2—What’s Next for the Week Ahead?

Discover How Changpeng Zhao’s Crypto Holdings Combat Market Volatility

BNB Dominates CZ’s Portfolio

The breakdown of Zhao’s crypto investments has catalyzed an overwhelming 98.48% allocation to BNB, the native token of the Binance ecosystem. Several industry experts note this extreme concentration represents a striking vote of confidence in the platform he created. Despite this strategic positioning, the platform faces numerous security risks in crypto markets that have transformed how investors evaluate exchange-based tokens.

Binance has said:

“Binance Square is enhancing transparency with its latest feature, Trader Profile, enabling users to publicly share their crypto portfolio allocation.”

Bitcoin and Stablecoins Make Up the Remainder

The strategic allocation of CZ’s portfolio has catalyzed a minimal Bitcoin (BTC) position of just 1.32%, currently valued at approximately $94,661. Some market indicators show it’s down nearly 10% over the past month. High transaction fees have transformed the experience for various Bitcoin holders, directly impacting Zhao’s investment architecture with this allocation. Across multiple key trading environments, his engineered stablecoin positions—0.17% in EURI and 0.03% in USDT—function as protection mechanisms against the unpredictable market fluctuations that have revolutionized how crypto investors approach portfolio construction.

Also Read: Top 3 Cryptocurrencies To Buy During The Latest Market Crash

Post-Legal Troubles Investment Strategy

Zhao’s investment choices are particularly interesting because of all of his recent legal troubles. His portfolio was made public following his four-month sentence for violating U.S. anti-money-laundering laws. Investment scams in crypto have received heightened regulatory attention, with Zhao’s case highlighting the increased scrutiny on industry leaders.

This strategic restructuring has prohibited Zhao from returning to Binance leadership, yet he has assumed an advisory role at YZi Labs that transforms his industry positioning. Several financial analysts note that YZi Labs represents the rebranded $10 billion venture capital arm of Binance, demonstrating the complex organizational evolution occurring across multiple segments of the cryptocurrency investment landscape.

YZi Labs Continues Binance’s Investment Vision

Former head of Binance Labs, Ella Zhang, now leads YZi Labs and maintains the organization’s original mission.

Zhang said:

“Our mission remains the same: to empower visionary entrepreneurs and push technological boundaries across multiple sectors.”

This transition has catalyzed a new chapter for Zhao’s involvement in the crypto ecosystem, reshaping industry perspectives on founder roles. Some market observers note his personal portfolio suggests his financial future remains tightly bound to Binance’s success, demonstrating the strategic interdependence that has transformed how major players position themselves across various segments of the digital asset landscape.

Also Read: How High Will Cardano Rise If ADA ETFs Become A Reality

Market Performance of Key Holdings

BNB was trading at $638 at the time of the portfolio disclosure, representing a 2.2% decline over 24 hours. Various market indicators show this position has helped Zhao weather cryptocurrency market volatility better than many other investors with different allocation strategies.

The strategic concentration in BNB catalyzes a level of confidence rarely documented among crypto founders, who typically implement more diversified holdings to safeguard against market fluctuations. Across several key financial metrics, the strategic deployment of Zhao’s financial fortune continues to be directly linked to the success and sustainability of the Binance ecosystem. Various market analysts observe this connection persists even as he transitions away from direct operational control, demonstrating the numerous complex relationships between founder wealth and platform performance across multiple cryptocurrency exchange environments.