Gold investment return has catalyzed significant attention across various major financial sectors. This is particularly true as investors seek shelter from market volatility. Some precious metal analysts point to its historical performance. They see it as a compelling case for those considering long-term investment returns in their portfolio diversification strategy.

Also Read: Ethereum & Solana Crash Double Digits Today: Why Is ETH & SOL Falling?

How Gold Price Growth Can Outperform Market Volatility and Offer Security

Gold’s Impressive 20-Year Performance

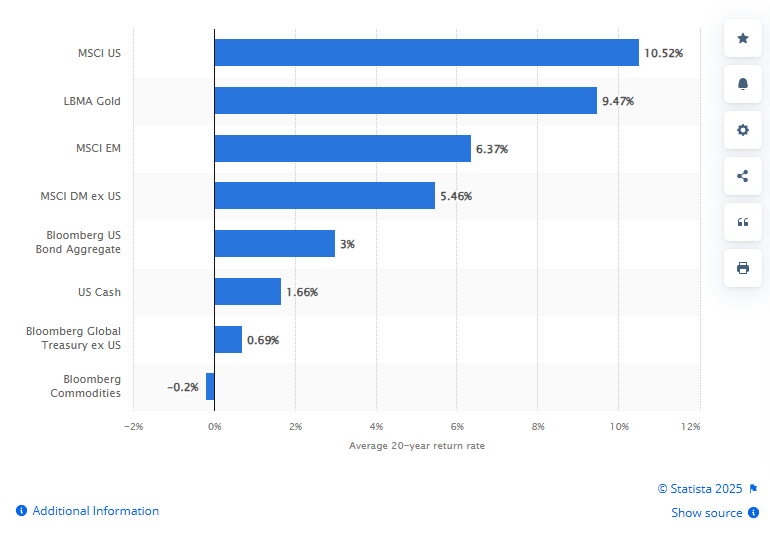

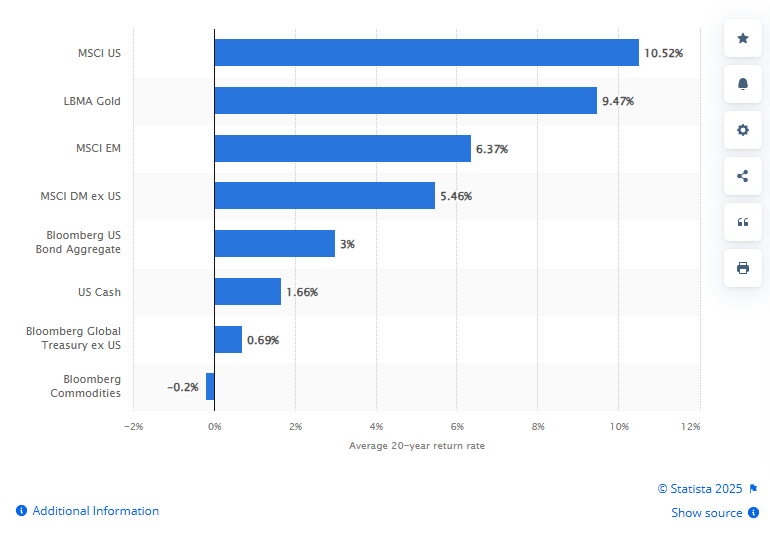

Gold price growth has revolutionized numerous significant investment portfolios over the past two decades. Through several key performance periods ending in 2024, gold posted a 20-year average annual return of 9.47%. This remarkable performance means a $10,000 investment made 20 years ago would have grown to approximately $65,967 today. This represents a total gain of roughly 560%.

The substantial gold investment returns were achieved despite periods of significant market volatility. This highlights gold’s reputation as a stable investment during economic uncertainty.

Factors Driving Gold’s Value

Financial institutions have spearheaded multiple essential research initiatives into what contributes to gold’s performance as an investment security option. According to various major analyses from financial services firm PIMCO, factors affecting gold prices include inflation, interest rates, supply and demand dynamics, and geopolitical uncertainty.

Also Read: Why Are Dogecoin & Shiba Inu Falling By Over 10% Today?

Additional influences have been established across several key market segments, including central bank purchasing patterns and government legislation. The strength of the U.S. dollar and the metal’s own price momentum also play roles. Investment products like ETFs have expanded access to gold markets for average investors.

The Treasury Yield Connection

PIMCO’s analysis has leveraged numerous significant data points. They identified one factor that exerts the most profound influence on gold prices: the yield on the 10-year U.S. Treasury note. Their research showed that:

“All else equal, a 100-basis-point increase in 10-year real yields has historically led to a decline of 24% in the inflation-adjusted price of gold.”

This relationship stems from gold’s lack of any dividend payments. When real yields from alternative investments are rising, gold becomes less attractive because investors sacrifice the potential income streams by holding the metal. At the same time, during periods of low real yields, gold’s lack of income generation becomes less problematic for investors seeking long-term returns.

Also Read: XRP Price Struggles Below $2.2—What’s Next for the Week Ahead?

Gold as an Inflation Hedge

Financial experts have instituted various major analytical frameworks. These show gold is often viewed as protection against inflation. This perception has been reinforced by its performance during certain economic cycles. This characteristic has made gold particularly valuable during periods when traditional paper assets falter.

The metal’s intrinsic value and limited supply contribute to its status as a store of wealth. It maintains purchasing power over time. For investors concerned about currency devaluation and rising prices, gold’s historical price growth offers reassurance in portfolio construction.

Gold investment return metrics have optimized numerous significant investment strategies. This demonstrates why the precious metal continues to be considered a crucial component of a diversified investment strategy. This is especially true for those seeking security amid market volatility and economic uncertainty.

Also Read: Shiba Inu: Here’s When SHIB Could Recover The $0.00004 Level