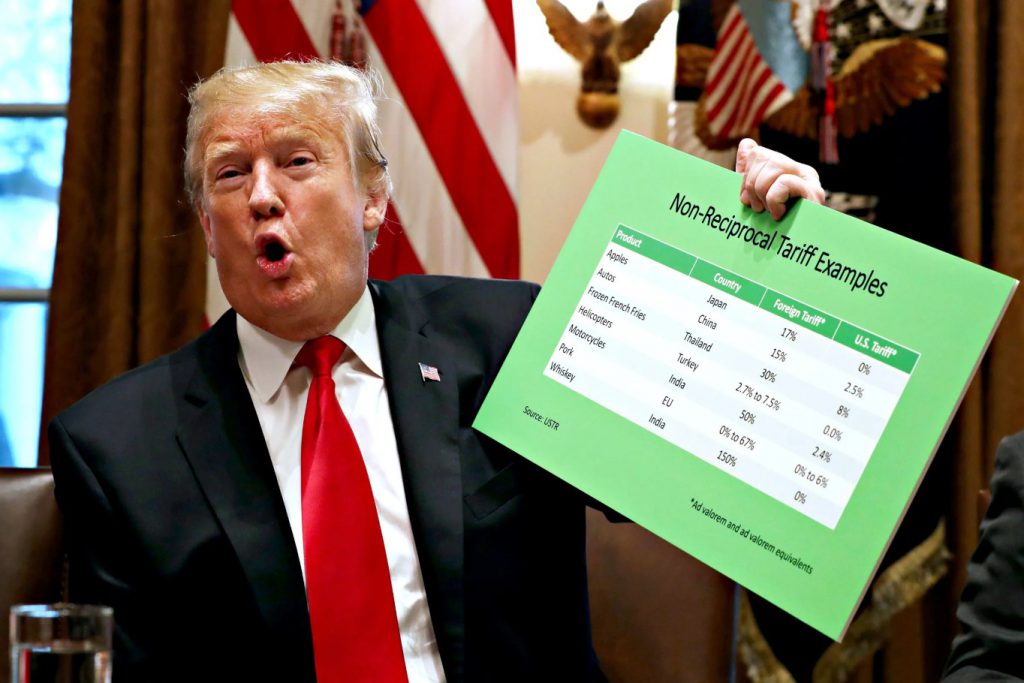

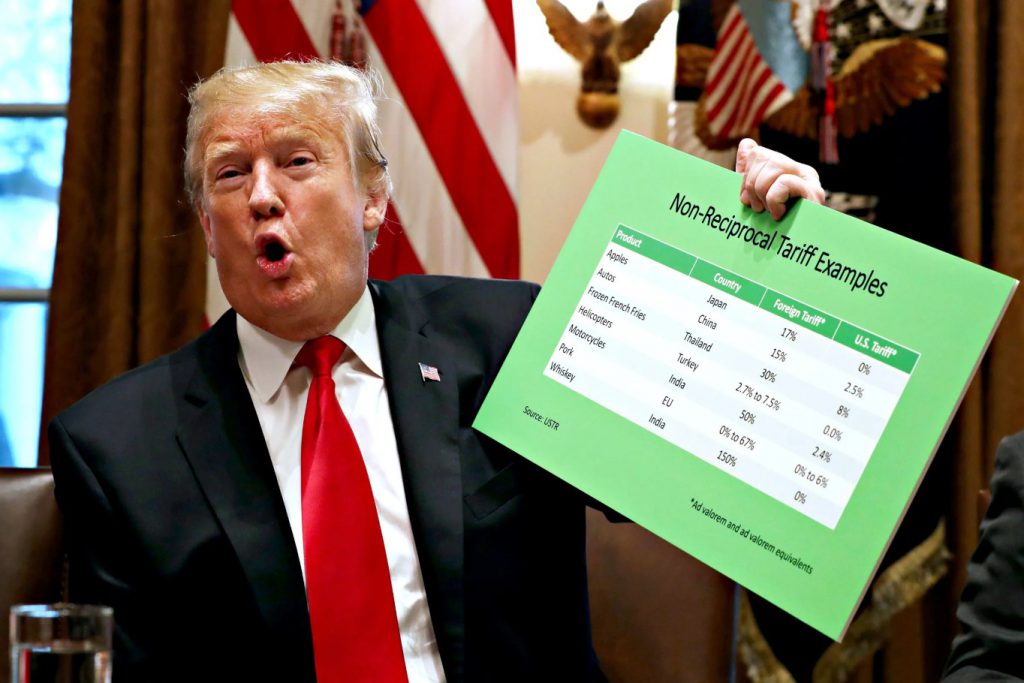

Trump’s tariffs have shaken the cryptocurrency market to the core, as his decisions have triggering a massive $11 billion sell-off. This entire situation has created concerns around the volatility of the crypto market. This also applies for investor security risks, and also the regulatory uncertainty that everyone’s worried about right now. When the announcement came in (25% import tariffs on Canada and Mexico), along with the strategic reserve proposal some of the investors found themselves scrambling to reassess their positions. Things are definitely shifting right now. At the time of writing, the full impact remains to be seen!

Also Read: VeChain (VET) Mid-March 2025 Price Prediction

Trump Tariffs Spark Major Concerns Over Crypto Market Volatility and Investor Security Risks

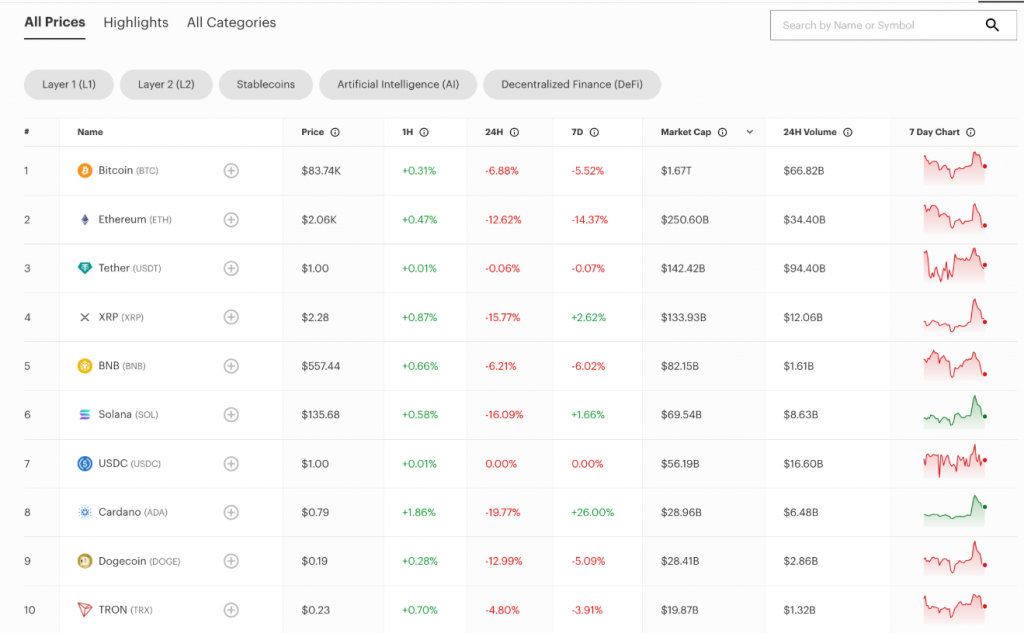

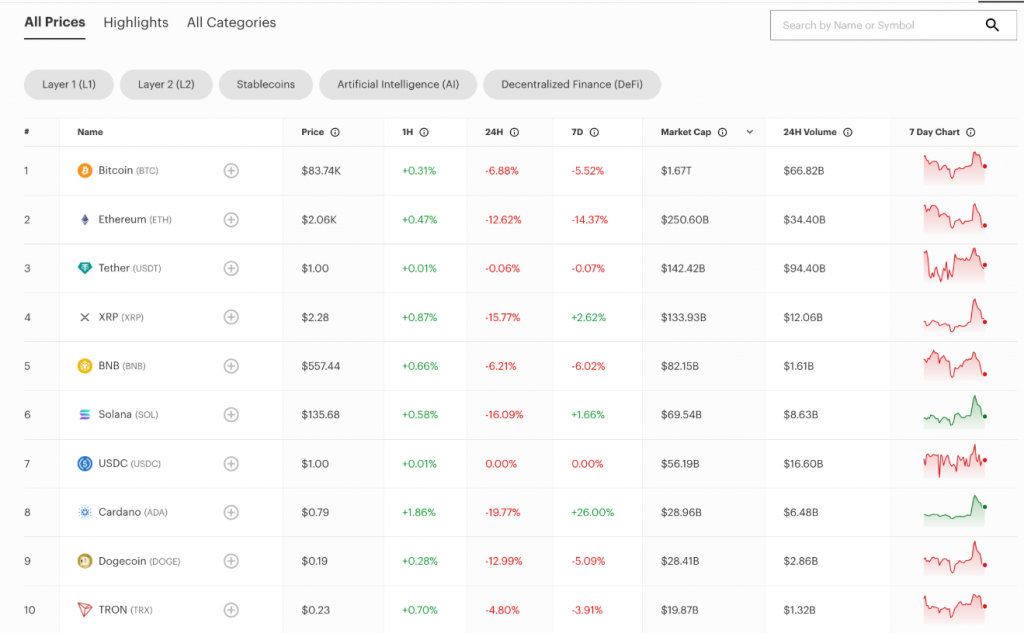

The crypto market had been riding a wave of optimism thanks to Trump’s strategic reserve proposal—until everything crashed. Bitcoin, the face of crypto, plunged 11% from its $95,000 peak, hitting $82,400 in just 24 hours. That wiped out $125 billion in market value.

And it wasn’t just Bitcoin. Altcoins like Ethereum, Cardano, and Solana also took heavy losses, with some dropping even more. Right now, the market is in rough shape, and uncertainty is looming large.

BTC & Altcoins Affected

Bitcoin’s freefall didn’t just stop at BTC. The latest changes have create a worlwind across the entire crypto market. Ethereum didn’t dodge the bullet either, with its value going under $2,100 for the first time in a year or so. That is truly a long time to keep the reigns. Some other coins weren’t as lucky. Cardano (ADA) was hit the hardest withna brutal 20.1% drop gone in an instant. At the same time, BNB and TRON managed to keep their heads out of the water a litter bit better. Their drops were not as dramatic, but the market has still been a rollercoaster lately.

Trump’s Strategic Reserve

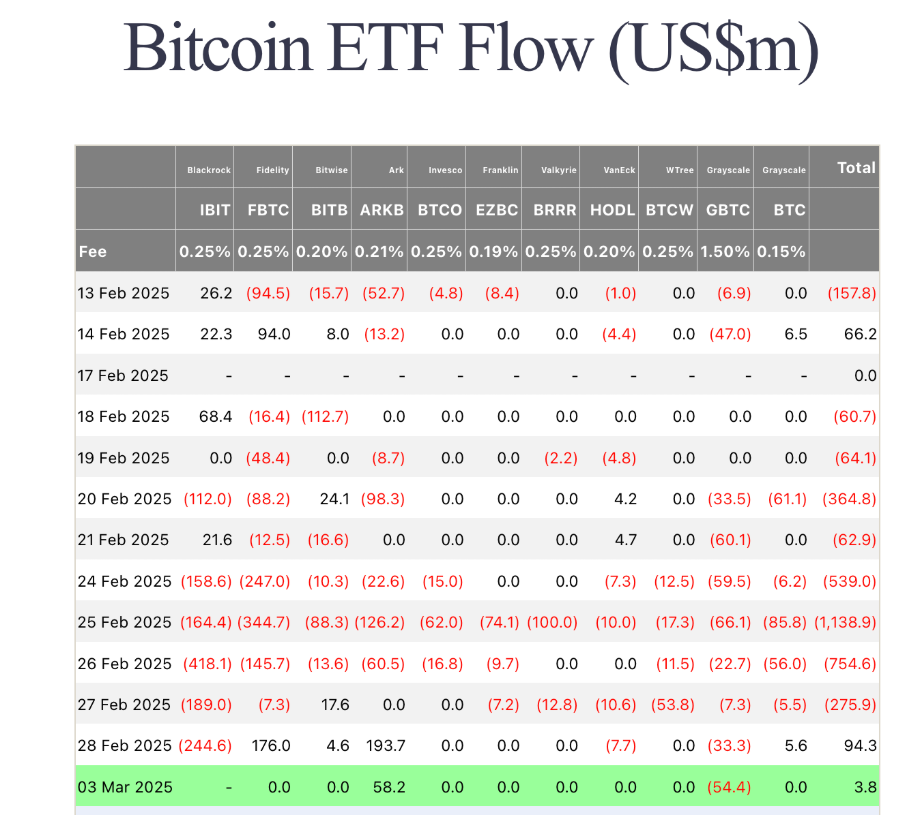

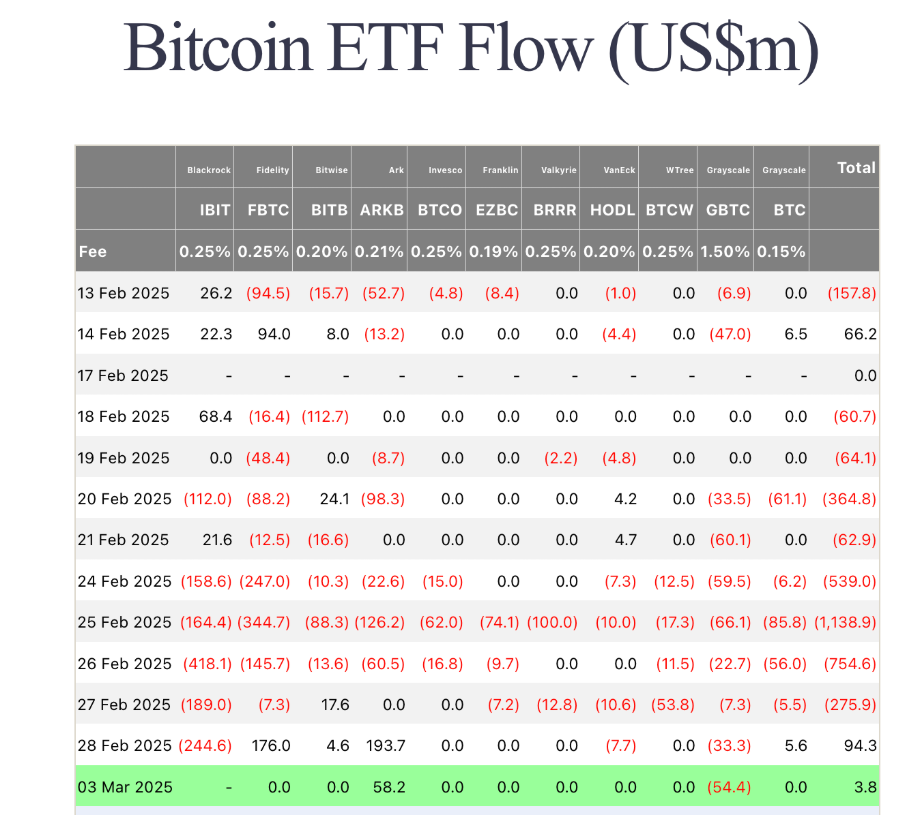

When Trump annouced his idea of creating a crypto strategic reserve, the market was feeling optimistic. Traders were all agreeing and as a result ended up diving into leveraged positions. Right after, the tariff confirmation happened. Suddenly, all that optimism evaporated like smoke. Investors saw a very fast market correction taking place. The Bitcoin ETF inflows were barely present, with only a value of $3.8 million on Monday. This underscores the cautious approach that institutional investors are taking now, no doubt about that.

Investor Security Risks and Regulatory Uncertainty

The tariff announcement has also added to the concerns investors feel about security risks. The market is already dealing with some big issues like hacking and fraud, and now regulatory uncertainty adds to the fire. The plan that Binance has to delist the non-Mica compliant stablecoins up until the date of March 31st, show the number of challenges crypto is facing now. Right now, navigating the market feels more uncertain than ever.

Also Read: Trade War Begins: List Of Tariffs That Went Live Today Under Trump’s Regime

The Broader Implications for the Crypto Market

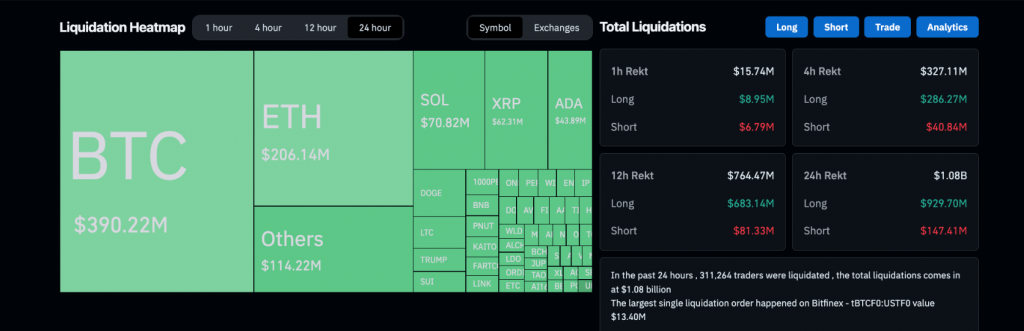

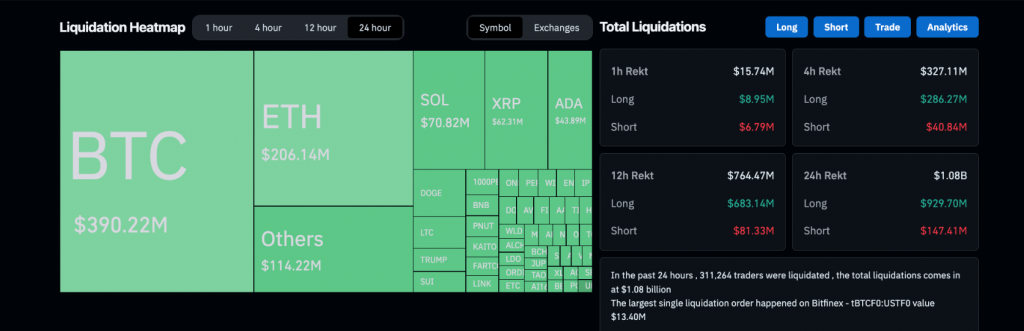

The sell-off was kind of exacerbated by leveraged positions in Bitcoin, Ethereum, Solana, Cardano, and Ripple (XRP). These faced massive liquidations totaling $773 million and such. This was a huge hit, accounting for $771.1 billion in total losses recorded over the past 24 hours alone. It’s clear that various aspects of the market have been hit hard. Several investors are scrambling to cope with these rapid shifts and everything that’s happening..

What’s Next for Investors?

As the market continues to digest the full implications of Trump’s tariffs, investors are being advised to stay on high alert and all that. The mix of crypto market volatility, regulatory uncertainty, and investor security risks has definitely made this a tough environment to navigate. Like really difficult. While some assets like Binance Coin and Tron have shown just a bit of resilience, the broader market is still feeling the pressure of everything happening.

Also Read: Dogwifhat Soars 21% as Whales Invest Millions—Is $1 Next for WIF?