The worst year for USD continues as the U.S. dollar is right now experiencing its most significant decline since 2008. In fact, the dollar has dropped about 4.2% since January, marking the largest USD depreciation in 17 years or so. This dramatic dollar decline has intensified especially after tariffs on Canadian and Mexican goods took effect last week. Such USD market volatility is definitely raising serious questions about how these currency changes will actually affect everyday Americans in the coming months.

Also Read: GTA 6 Comparison: Bigger Map, Record-Breaking Install Size, and $100 Cost!

Exploring the USD’s Worst Year: Market Volatility, Inflation, and Consumer Effects

Understanding the Dollar’s Sharp Decline

The worst year for USD is clearly shown in the U.S. Dollar Index falling around 4.2% between January and March, a decline that hasn’t really been seen since the 2008 financial crisis when it dropped approximately 4.8%.

Most of this dollar decline actually happened just last week as new trade policies were implemented by the administration. European currencies have definitely benefited from this situation, with the euro gaining about 4.5% against the dollar in just one week.

Rob Haworth, senior investment strategy director at U.S. Bank Asset Management, stated:

When the dollar strengthens, it means more foreign money is flowing into the U.S. than the other way around.

Factors Driving USD Depreciation

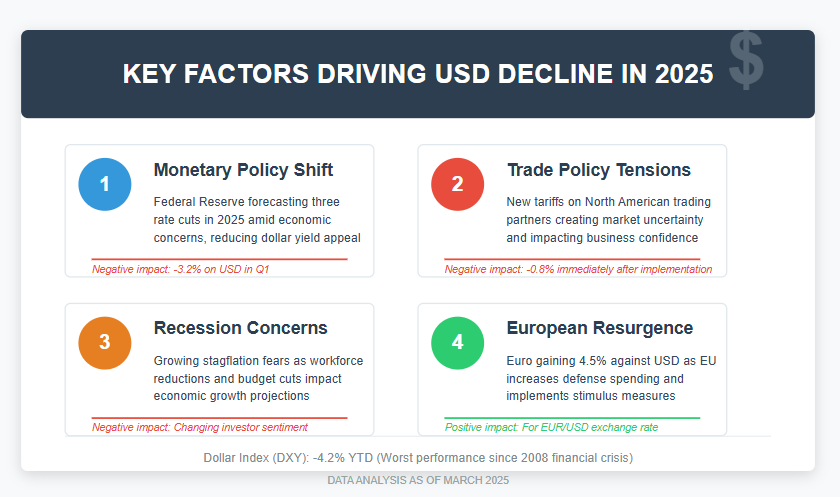

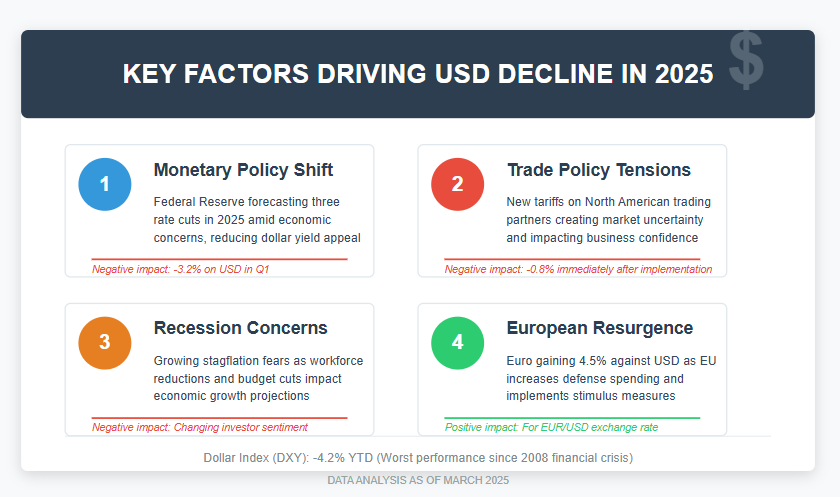

The current USD depreciation stems from several different factors at play right now. Interest rates are, of course, a primary driver of currency values in many ways. Generally speaking, higher U.S. interest rates typically strengthen the dollar by making U.S. debt more attractive to investors. However, recent economic and political developments have increased recession risks, and this is causing investors to adjust their rate cut expectations rather quickly.

The dollar’s value kind of held steady late last year due to a strong labor market and slowing disinflation. But investor sentiment shifted dramatically and suddenly after tariffs were announced, workforce reductions were implemented, and geopolitical tensions escalated. This worst year for USD really does reflect a deeper economic uncertainty that’s developing right now.

Also Read: Shiba Inu: $65 Worth Of SHIB Becomes $1 Million Today

Dollar Decline Impact on American Consumers

How currency depreciation affects purchasing power will be pretty significant as this situation continues to unfold. A weaker dollar essentially increases imported goods costs, potentially intensifying the effects of tariffs as well. These dollar inflation effects could lead to higher prices for everyday items that Americans typically purchase.

Some benefits may actually emerge during this worst year for USD. U.S. exports tend to become more competitive internationally with a weaker dollar, potentially stimulating economic growth and also boosting earnings for companies with substantial international operations.

According to the Commerce Department, approximately half of goods and services purchased in the U.S. in 2023 were “made in America.” The remaining imported half may well become more expensive as USD depreciation continues at this pace.

Market Volatility and Future Outlook

The USD market volatility has really transformed investor expectations in recent weeks. As recently as mid-February, most investors expected at most one Federal Reserve interest rate cut this year. Now, at the time of writing, the majority anticipate three cuts by December, reflecting growing economic concerns across the board.

The dollar decline impact on consumers depends largely on whether the dollar stabilizes or continues its downward trend. If economic conditions improve somehow, the dollar could strengthen again, potentially offsetting some tariff-related price increases. However, this would also make U.S. exports more expensive, potentially slowing manufacturing investment during this worst year for USD.

Also Read: Tether’s USDT Officially Recognized by Thailand’s Regulator

The USD market volatility has created quite a challenging environment for consumers and businesses alike. Dollar inflation effects will continue to shape economic decisions as Americans try to navigate through this uncertain period of currency fluctuation.