XRP price prediction analysis right now suggests that, actually, a critical battle is unfolding at the $2 support level as bearish momentum continues to intensify across the cryptocurrency market. Ripple’s token has successfully defended this threshold five times since December 2024, but various major market watchers are questioning if this support can withstand the growing selling pressure. XRP price movements have catalyzed increased attention as buyers are spearheading efforts to maintain control despite increasingly challenging market conditions.

Also Read: GTA 6 Pre-Orders Set to Break Records—But Will Rockstar Deliver the Ultimate Missions?

XRP Price Prediction: Analyzing Market Trends, Bearish Sentiment, and Volatility

Bulls Fight to Defend Critical Support

The $2 support level has essentially transformed into a crucial battleground for XRP price prediction scenarios. Bulls have, at the time of writing, successfully defended this threshold multiple times, demonstrating their determination to maintain Ripple’s upward trajectory. XRP price stability at this level has engineered a foundation of buying interest despite several key market pressures.

Duo Nine, crypto market analyst, stated:

“Despite the market volatility, XRP has managed to remain above $2 which was well defended to date. This support level was tested five times since December 2024 and buyers always came back there. However, sellers are increasing the pressure.”

Growing Signs of Bearish Pressure

Market indicators have, such as, revealed that bearish momentum surrounding XRP continues to accelerate, placing additional stress on the crucial $2 support. Through numerous significant technical analyses, XRP price prediction models have architected a concerning pattern developing on multiple timeframes, with momentum oscillators signaling increasing downward pressure.

Recent price action also indicates that sellers are becoming more aggressive in their attempts to break through the established support. The cryptocurrency market conditions have instituted a cautious approach among many Ripple investors regarding the token’s short-term prospects. XRP price stability remains dependent on buyers maintaining their presence at this critical threshold.

Also Read: Pi Network (PI) Predicted To Hit New Peak Of $6.54: Here’s When

Technical Indicators Sound Warning Signals

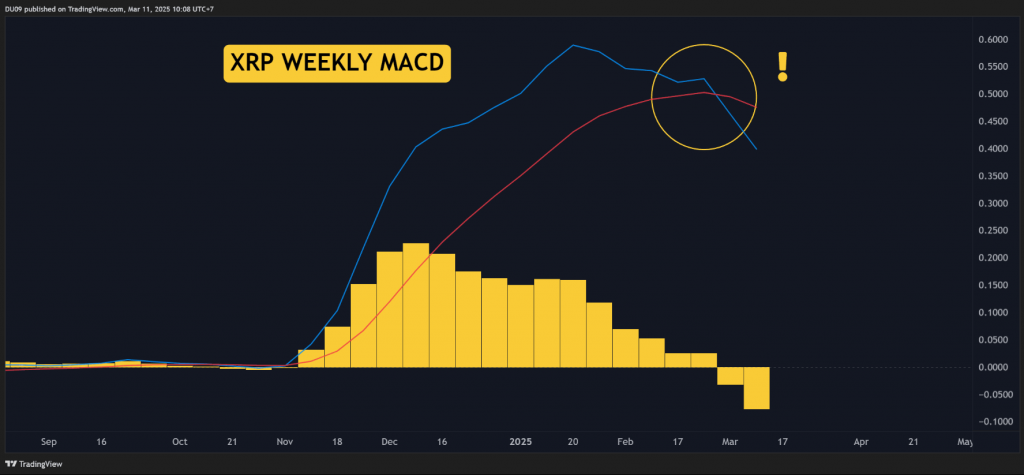

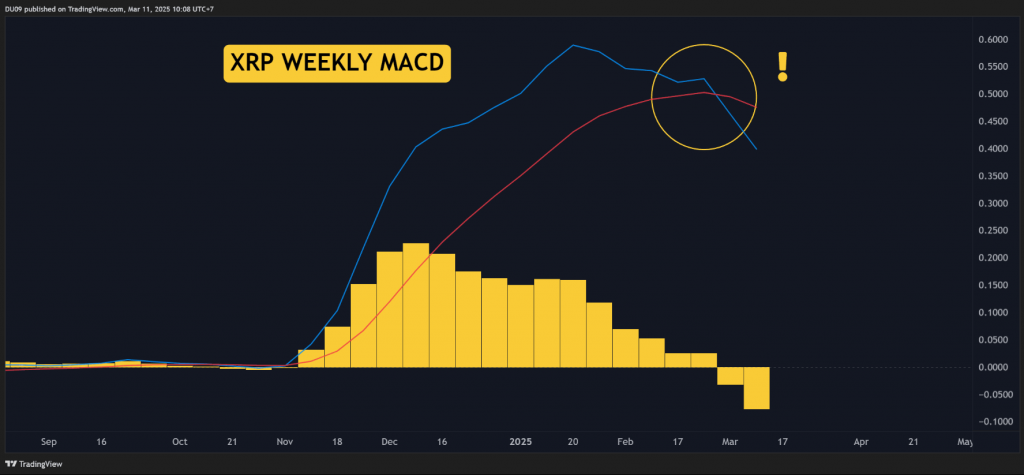

Ripple’s technical picture has, as it happens, deteriorated in recent weeks. The weekly MACD indicator has completed a bearish crossover and continues accelerating downward, suggesting momentum favors sellers. Across several key analytical frameworks, this development was highlighted in recent XRP price prediction assessments.

Duo Nine emphasized this technical development:

“Even if bulls did a good job so far, the market momentum is against them. This can be clearly seen on the weekly MACD which is accelerating downwards after its recent bearish cross. If nothing changes, the expectation is that the current support at $2 may fall and see the price go to $1.6 next.”

Key Price Levels to Monitor

For traders tracking XRP price prediction models, several critical levels require attention. If the $2 support fails, the next significant support level waits at $1.60. Conversely, for a bullish reversal, XRP would need to overcome resistance at $3, followed by an additional barrier at $3.40.

Duo Nine outlined these critical levels:

“As long as XRP manages to hold above $2, its bullish uptrend remains intact. However, with each attempt by sellers to break this key level the chances of them succeeding increases. This is why buyers have to push the price higher and move it away from this level as soon as possible to maintain control.”

Also Read: 2 Reasons Why the Stock & Cryptocurrency Market Crashed

Market Outlook and Final Assessment

The outlook for XRP price prediction remains, and, heavily dependent on whether bulls can continue defending the $2 support. Multiple essential factors will influence this battle, including broader cryptocurrency market trends and overall risk sentiment among digital asset investors.

Given the accelerating bearish momentum visible on technical indicators, particularly the weekly MACD, caution is warranted for XRP holders. The coming weeks will prove decisive for Ripple’s price trajectory, with the $2 level representing a critical threshold that will likely determine the token’s direction for the remainder of the quarter.