Starlink, the market’s 233rd largest coin by market cap, has had a wild uptown ride over the past week. The coin has doubled in value, having appreciated by more than 100% in just seven days. It began trading around $0.000013 earlier this week and is currently exchanging hands around $0.000028.

Previously, Starlink’s price embarked on a similar 150% rally earlier in November, when Elon Musk tweeted that his space-tech company SpaceX, launched 53 ‘Starlink’ satellites into the Earth’s lower orbit.

So, is this time’s rally here to stay?

Likely not. More so, because the Starlink development this time around is not very rosy. In the most recent unveil, it was brought to light that SpaceX’s Starlink unit has withdrawn its plans to build two of three proposed satellite ground stations in France.

Starlink operates as a standalone crypto-project and does not have anything to do with SpaceX’s satellites, it’s just the name that has served as a common ground. And keeping in mind its past behavior, it doesn’t look like its rally would prolong over the short term.

Also, it should be borne in mind that any crypto is bound to undergo corrections after substantially rallying in short periods, and looks that that’s going to be the case with Starlink too. The current candle in the making is also in red, indicating the weakness of the ongoing uptrend.

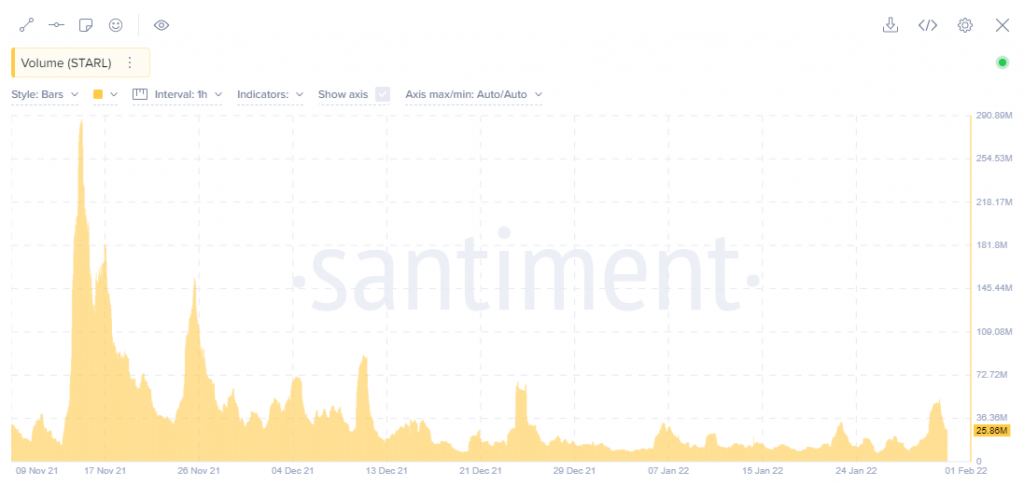

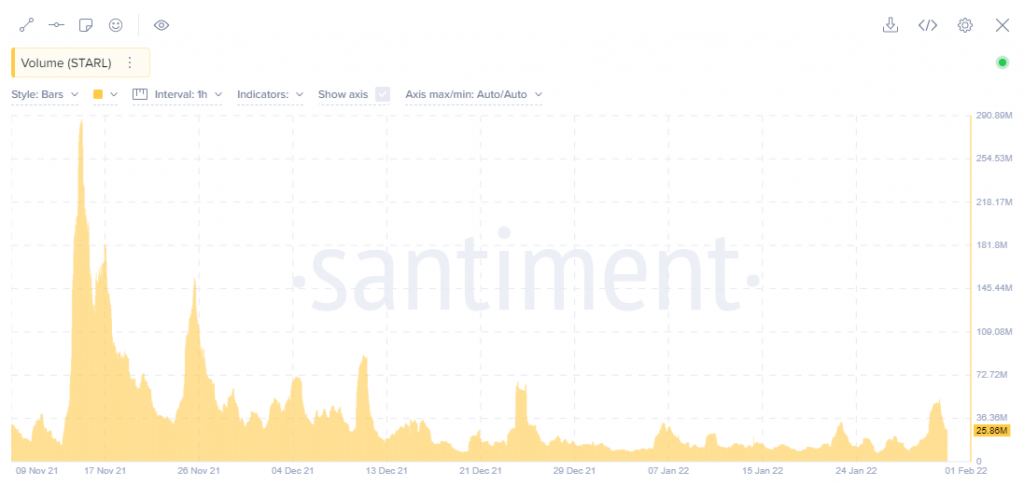

The coin’s metrics also did not paint a favorable picture. During November’s rally, the coin’s trading volume massively shot up. However, the landscape is reasonably subtle at this point.

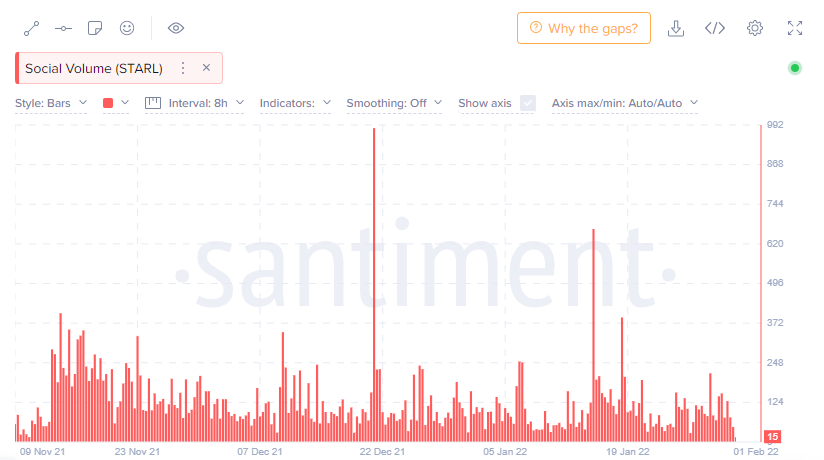

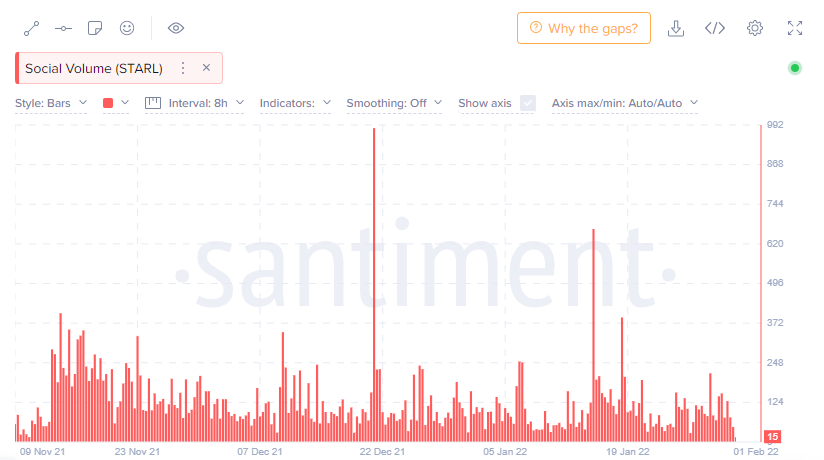

Parallelly, the social sentiment has not been very favorable to STARL of late. The number of mentions on social media is currently half of what was experienced in November. The deficit in social mentions looks even more prominent on the chart when compared to the spikes recorded in mid-December and mid-January.

So, with most factors not-aligned in favor of Starlink, market participants shouldn’t be surprised if the coin undergoes a brief correction before continuing with its uptrend.