With a hefty market cap of $19.51 billion, Dogecoin [DOGE] continues to lead the meme-token pack. Even though DOGE has noted a sharp 9% decline in its value over the past week, it continues to maintain a position for itself amongst other top large-cap coins.

When compared to 1 January, this token has managed to slide up by a rank [from 12 to 11] on the ladder. Parallelly, the coin has also been able to maintain its 1% market-cap dominance even during wobbly phases.

Dogecoin: Evolving dynamics

The dynamics of the Dogecoin market have seldom remained constant. They’ve, notably, evolved with time. Take the case of its ownership stats itself.

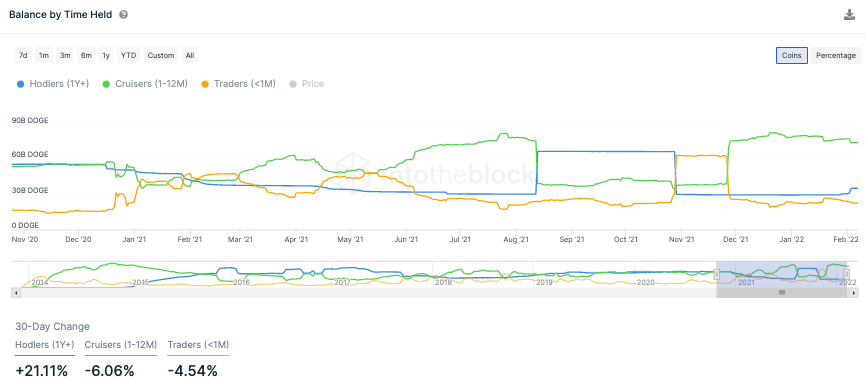

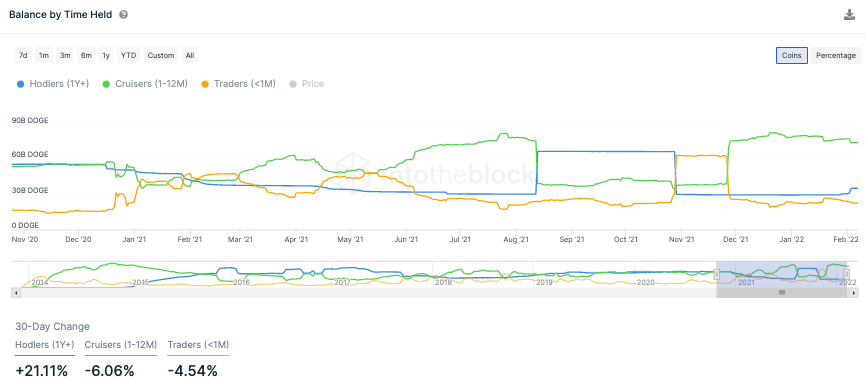

The number of traders, or participants who HODL the token for less than a month, has declined by 4.5% month-over-month. Such short-term participants now collectively possess only 22.8 billion DOGE.

On the other hand, the HODLers, or participants who remain invested in the token for a period greater than a year, have witnessed a substantial uptick of 21.1%. In effect, they cumulatively now HODL a total of 74.69 billion DOGE.

What to expect going forward?

Well, weak hands have been exiting the DOGE market, while strong hands continue to make their presence felt. This is typically a healthy sign and hints towards the fact that Dogecoin’s accumulation phase is currently in play.

Also, with short-term market participants exiting Dogecoin’s arena, the odds of the asset’s price fluctuating have narrowed down. The malnourished volatility readings confirmed the same.

As per Messari’s data, the current volatility [0.74] is nowhere close to what was noted in September [1.4] or November [1.3] last year.

Well, as long as HODLers continue to stay in the market and cling on to their tokens, DOGE’s price wouldn’t subside. However, with the gradual exit of traders and a reduction in volatility, we might witness horizontal movements on Dogecoin’s price chart over the next few days.