Bitcoin has earnestly been trying to clasp onto the $40k mark over the last couple of days. During the late hours of Friday, it did slip off to $39.4k for a brief while but managed to climb back up swiftly. Since then, the king-coin has been hovering above the same psychological $40k level.

Can Whales save Bitcoin’s Bacon?

During such consolidation phases, market participants, especially the large ones like whales, mass-buy stablecoins to later swap them off with any asset’s stablecoin trading pair.

Stablecoin reserves are being fully-loaded at this stage, highlighting that exchanges are anticipating a demand influx anytime soon.

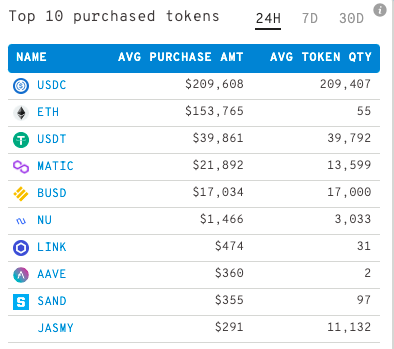

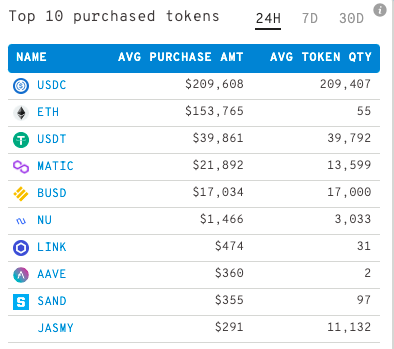

As anticipated, large market participants have been keenly accumulating pegged crypto assets. Take the case of the top 1000 Ethereum whales itself. Keeping an astute eye WhaleStats’ data over the past week, it was noted that at least three coins from the USDT, USDC, BUSD and DAI basket managed to make it to the top 10 purchased token list on almost a daily basis. In fact, the said trend was seen being nurtured even at the time of the press.

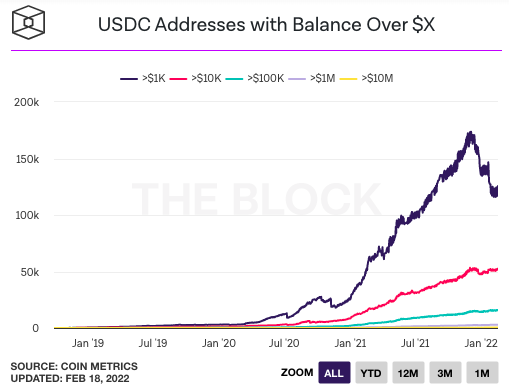

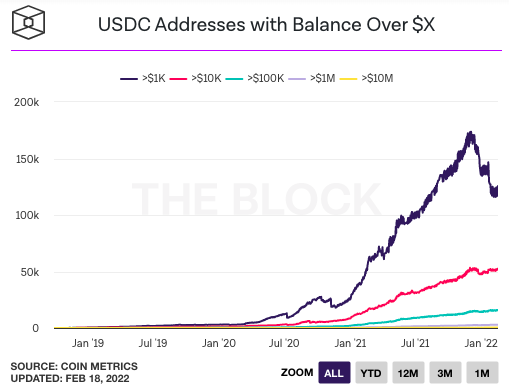

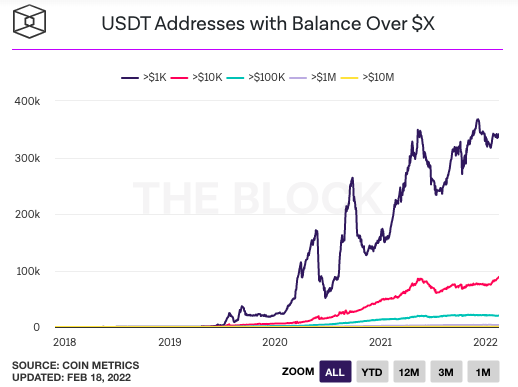

Alongside Ethereum whales, other large players have also been swimming in the same water. As can be discerned from the chart attached below, the number of USDC addresses with a balance >$10k, >$100k, >$1M and >$10M have all risen of late, implying that the accumulation phase is on.

Retain investors are, nonetheless, treading on their own separate path. Notably, the addresses with >1k balances have witnessed a sharp fall since the beginning of the year.

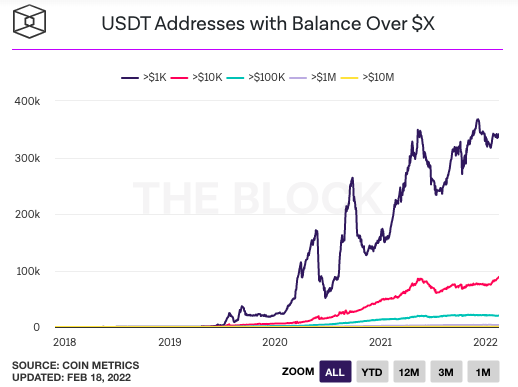

Quite a congruent pattern [whales accumulating, retail offloading] was noted with respect to USDT addresses too.

At this stage, it is essential to note that most of the major BTC rallies in the past had been instigated by whales and their buying spree. So, with such players stockpiling dry powder already, it can be extrapolated that they [whales] might be able to save the day for Bitcoin going forward.

Having said that, it should also be borne in mind that the market might not see a pump right away, for the whale capital is merely locked in stablecoins at this stage. Only after they’re diverted towards Bitcoin would we see some action-packed movement on the largest crypto asset’s chart.

Before concluding, it is also crucial to note that the SSR’s current numbers are revolving around their multi-year lows, indicating that the stablecoin supply has a higher than usual purchasing power at the moment. The same, obliquely, makes the case stronger for Bitcoin’s price to rise in the coming weeks.