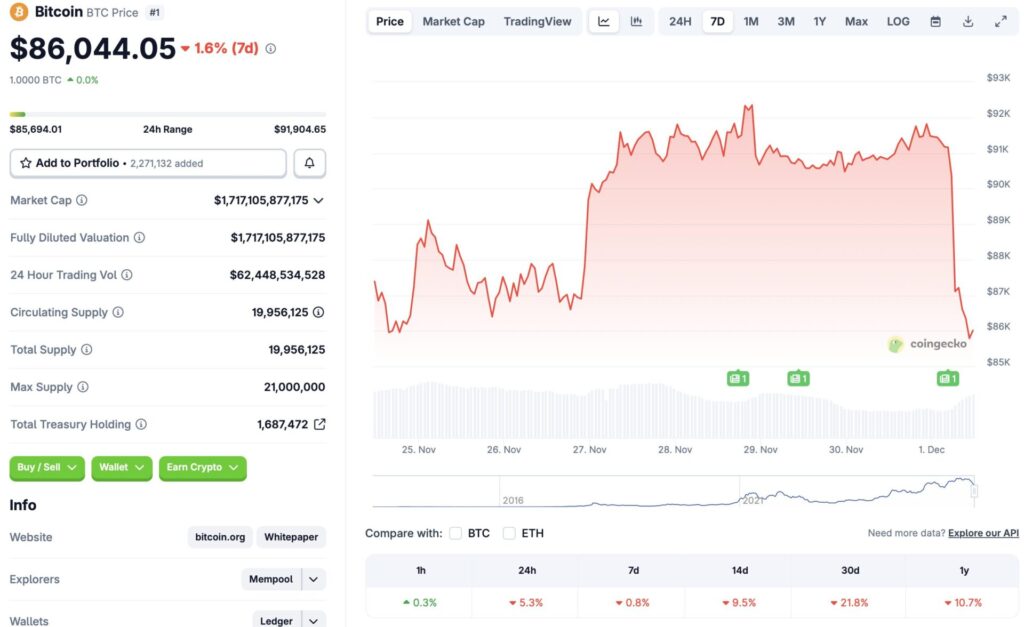

The crypto market has faced yet another crash, with Bitcoin (BTC) falling to the $86,000 price level. The original crypto had only just recovered from a price correction, reclaiming the $92,000 price level in late November. According to CoinGecko data, BTC’s price has fallen 5.3% in the last 24 hours, 0.8% in the last week, 9.5% in the 14-day charts, 21.8% over the previous month, and 10.7% since December 2024.

What’s Behind Bitcoin’s Price Crash? Can It Recover Soon?

The market correction is likely due to fresh volatility after the Thanksgiving holiday weekend. According to CoinGlass data, the crypto market saw $638.58 million worth of liquidations in the last 24 hours.

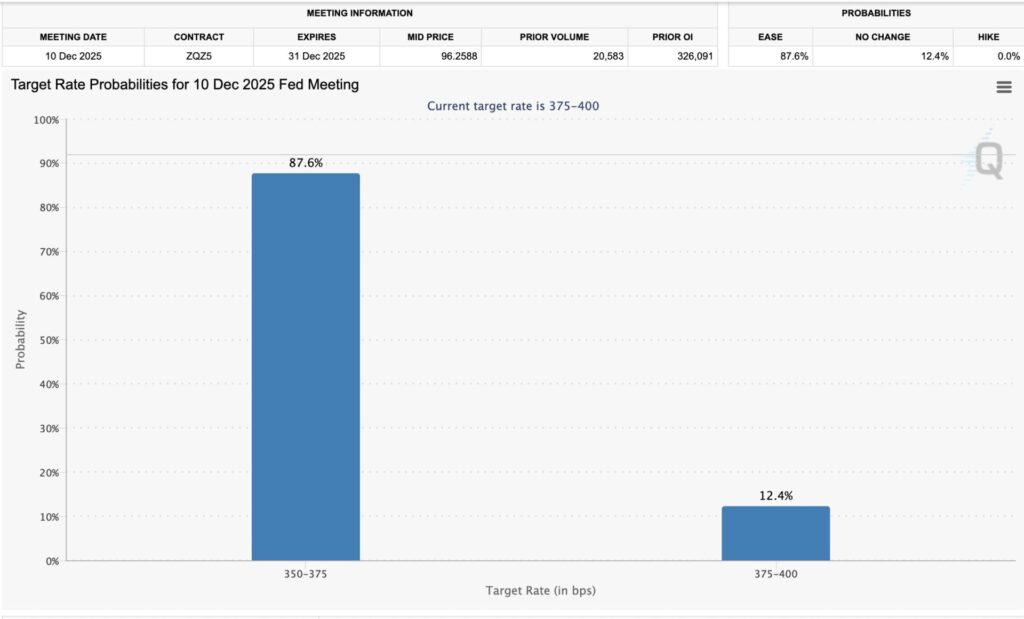

Bitcoin’s (BTC) price crash is surprising, given that the chances of an interest rate cut have increased from 84% to more than 87%, according to CME FedWatch. The market took a hit in October-November due to macroeconomic uncertainties and low interest rate cut chances. Bitcoin (BTC) and the larger crypto market saw a trend reversal after the chances of another rate cut went up.

The market correction could be due to investor sentiment still being down. Moreover, the market is still quite weak. Slow economic growth and the fears of rising inflation have led to a substantial dip in investor confidence. Bitcoin (BTC) and other risky assets have been particularly hit.

Given the high chances of another interest rate cut in December, there is a possibility that Bitcoin (BTC) will rebound from its current predicament. Rate cuts usually lead to investors taking on more risks. Crypto, being the riskiest sector in finance, may see a surge in inflows if rates are cut further.

Also Read: Tom Lee: Bitcoin’s 10 Biggest Days of the Year Haven’t Even Begun Yet

However, there is also a possibility that the market will enter a prolonged consolidation phase. If the Federal Reserve does not cut rates, we may see another correction, or prices may plateau.