Solana, the 9th largest cryptocurrency by market cap, has inclined by more than 21% over the past week. In effect, the alt has been able to breach the $100 mark and structurally break above the descending channel within which it was engulfed since last November.

Back in December last year, SOL did try to escape from the shackles of the said bearish structure twice but was not successful in doing so. By fructifying its efforts over the past few days, Solana has rightly proven that the third time’s the charm.

From a technical perspective, the said breakout is a step in the right direction for Solana’s uptrend to continue.

Gauging the trader inclination in the Solana market

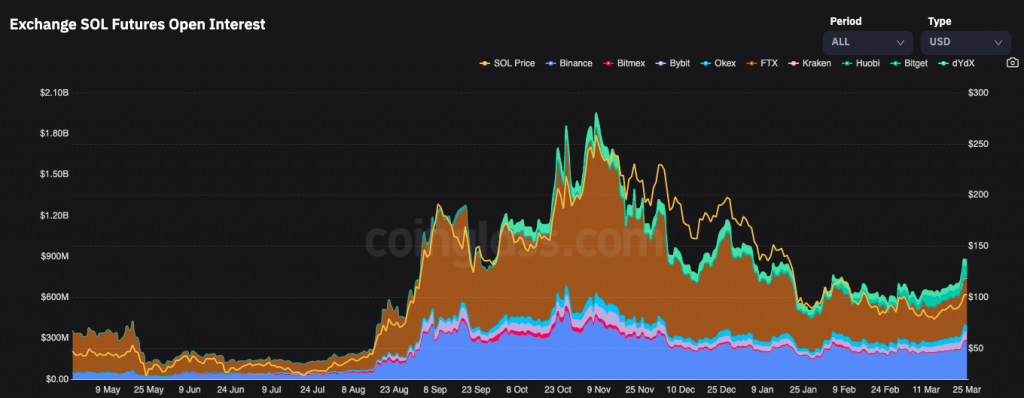

On the Open Interest [OI] front, Solana witnessed a sharp spike to $892 million over the past day. The same puts it at levels reminiscent of the December-January period. Rising open interest usually means that new money is flowing into the marketplace and more often than not, end up making ongoing trends even more concrete.

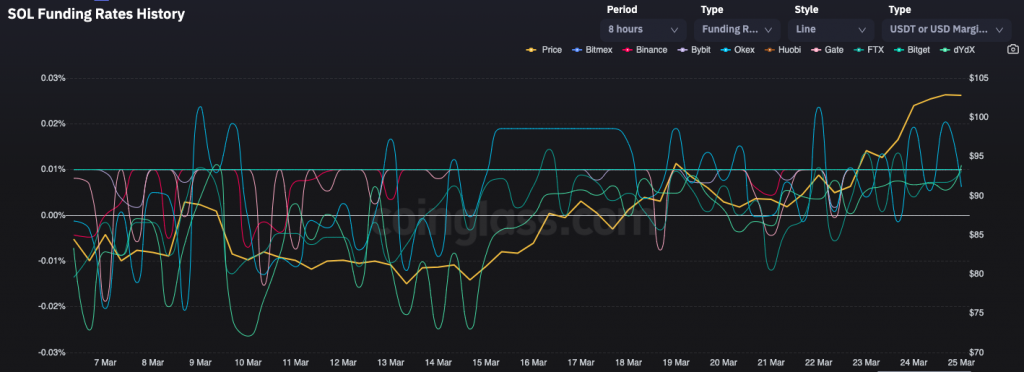

Further, the funding rate on almost all major exchanges has been positive of late, indicating that long-positioned Solana traders are dominant and are funding the short traders. Simply put, positive numbers imply that a majority of traders are have placed long bets and are bullish about the short-term prospects.

Also, Solana’s long-short ratio stood above 1 at the time of press, advocating the said narrative.

Keeping the aforementioned trends in mind, Solana should be able to extend its uptrend phase over the next 24-hours at least. However, if the broader market re-dips, it wouldn’t take much time for the trader sentiment to flip from bullish to bearish in the SOL market. In that case, the bullish thesis would get invalidated and the market would end up seeing long liquidations.