Polkadot investors have enjoyed a healthy period of returns of late, with DOT offering a 20% ROI over the past week and hitting a 1-month high on the chart. However, exchange data showed that traders were shifting sentiment to ‘sell’ just as DOT closed in on a major resistance zone of $23-$24.

Polkadot Daily Chart

Polkadot’s rally has looked sharp since 7 February, ascending by nearly 50% without a major correction thus far. The 200-Simple Moving Average line around $30, which is often a point of interest in technical analysis, was the next significant level on the chart.

To achieve its goal, DOT was tasked with a simple objective – to register a daily close above $23-$24 resistance. However, data collected from exchanges suggested that investors might have to grapple with a correction before DOT can climb higher on the chart.

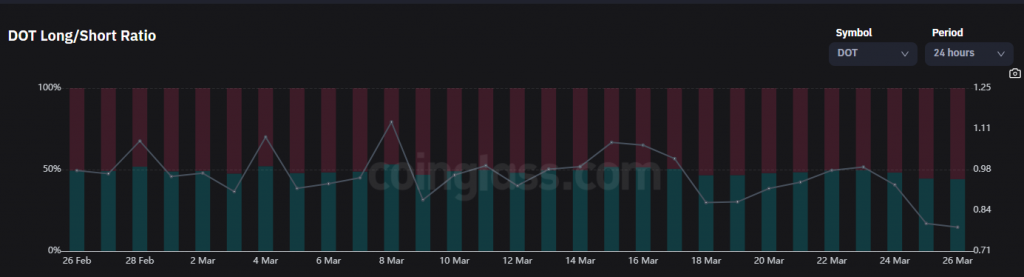

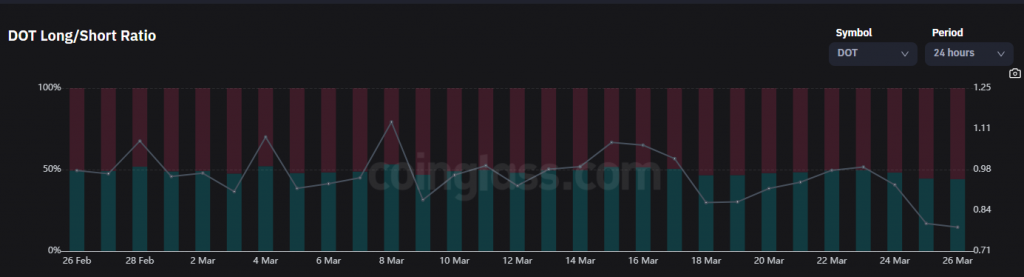

Long/Shorts Ratio At 1-Month Low

Price movements for any asset are directly correlated with buy/sell orders on exchanges and gauging the same can help one prepare for a price swing. Data from Coinglass showed that nearly 2.75 Million short positions were taken on Polkadot in the last 24 hours, compared to just $157K worth of long positions. As a result, the average long/short ratio across exchanges slipped to a monthly low of 0.71, reflecting the sentiment that a majority of traders were expecting the price to move lower. Over the past, a low long/short ratio has been known to precede DOT corrections.

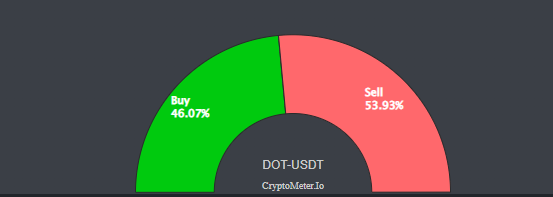

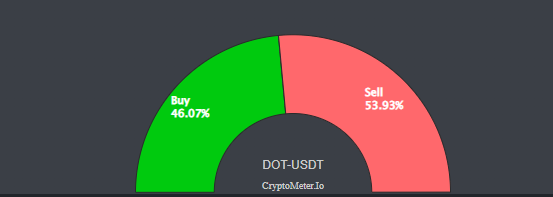

DOT’s Binance order book also favored a downside move. At press time, nearly 54% of all Binance trades were ‘sell’ as opposed to 46% ‘buy’.

Price Strategy

A quick technical overview showed that the daily RSI had touched the ‘overbought territory’ for the first time since 4 November. Earlier, DOT suffered a 56% correction soon after the RSI tagged the same level. An RSI reading above 70 often triggers profit-booking.

Factoring in the abovementioned points, it was unlikely that DOT would advance beyond $24 over the next 24-48 hours. On the flip side, chances of a correction were high and DOT holders might have to brace for a southbound move.