Bitcoin and Ethereum’s prices are at quite critical junctures at this point. Both the assets started the week on quite a high note. While the king coin went on to breach $48.189k on Monday, the alt king surpassed the $3.4k mark. Over the next couple of days, however, the coins remained inert and revolved in and around the said levels.

Such was the case on Thursday too. After declining and inclining by a meagre 0.6% and 0.04% in the past 24-hours, the respective coins were trading at $47.132k and $3.401k at the time of press.

Traders are kicking Bitcoin’s ball towards the bullish court

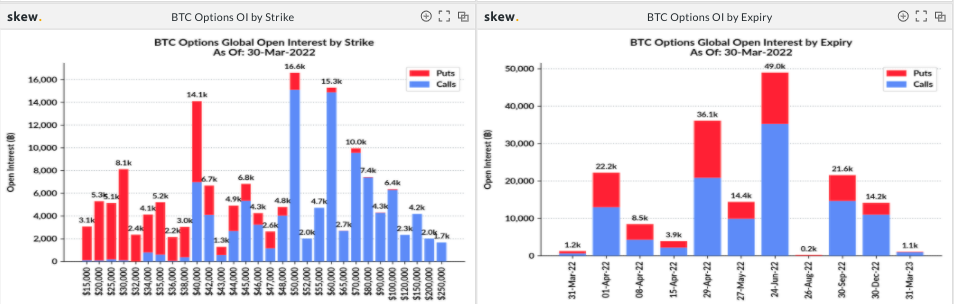

The crypto market is set to undergo a notable options expiry involving 22.2k BTC and 172.4k ETH tomorrow. The said event does have the potential to gear the market for the much-awaited bull run.

The snapshot attached below [right] shows that the number of call contracts is evidently higher than their put counterparts, indicating that a majority of traders have been placing bullish bets on Bitcoin.

As anticipated, puts do have a say around lower price ranges up to $40k, but post that, call contracts have an upper hand [left part of the snapshot]. However, at the $47k strike price alone, puts are slightly more in number.

Interestingly, Bitcoin created a YTD high at $47.990k on 2 January but surpassed the said level earlier this week. Market participants, in general, are quite euphoric about the fact that the coin has been revolving around its local peak of late. Fear has already evaporated from the market and the buying spree has kickstarted.

The RSI reading was at its YTD high and was hovering around 70 at the time of press. Even though the same indicates the strength, it does call for a potential correction/pullback.

Thus, if Bitcoin’s price continues to stay above $47k, it would be quite difficult for call traders to resist from exercising their option of buying their respective coins during the expiry period tomorrow. From thereon, if the buying pressure mounts up even further, then not much would be able to stop Bitcoin’ from heading towards its next test level around $52k.

Is Ethereum treading on a different path?

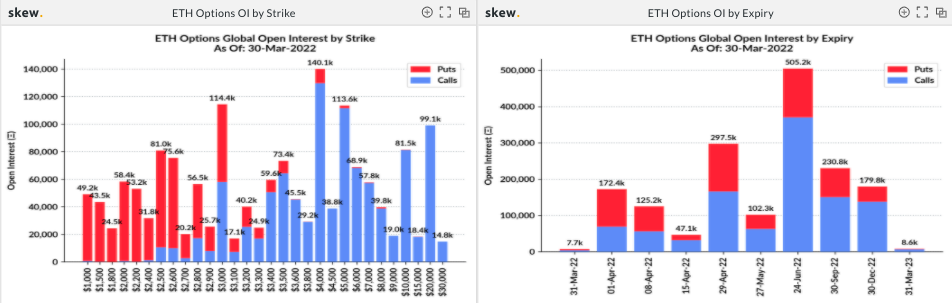

Tomorrow’s options expiry is notably the biggest before the 29 April’s monthly expiry. As can be noted from the chart attached below [right], Ethereum trader sentiment remains more inclined towards bears, for there are substantially more put contracts than the number of call contracts.

Nonetheless, a closer look at the strike price breakdown [left] would highlight that the state of the Ethereum market is quite congruent to that of Bitcoin’s—bullish bets dominate upper price bands and bearish bets are more towards lower price ranges.

Given the fact that Ethereum is currently priced at $3.3k and the volatility is seemingly under control, it can be contended that it would continue hovering in and around the said level over the next day.

If that’s indeed the case, the market could see another buying spree instigated by derivative traders tomorrow. In such a scenario, we’d end up seeing the king alt head towards higher levels and establish new local peaks going forward.