Surprisingly, recent burns, whale purchases, and even a metaverse update have not triggered an explosive Shiba Inu rally yet. However, judging by an abrupt halt in addresses’ growth, it’s possible that there is more to the issue than meets the eye.

Even though a bullish broader market has allowed Shiba Inu to log weekly gains of 12%, the alt has been outperformed by its smaller counterparts. Going by the weekly performance investors have earned more by parking their funds in Dogelon Mars, BabyDoge coin, and Kishu Inu.

It’s not even as if Shiba Inu’s market has been quiet. Spikes in burn rate, occasional whale purchases, and now, a metaverse update have made headlines but the same have failed to trigger a major price hike.

Internal Forces To Blame?

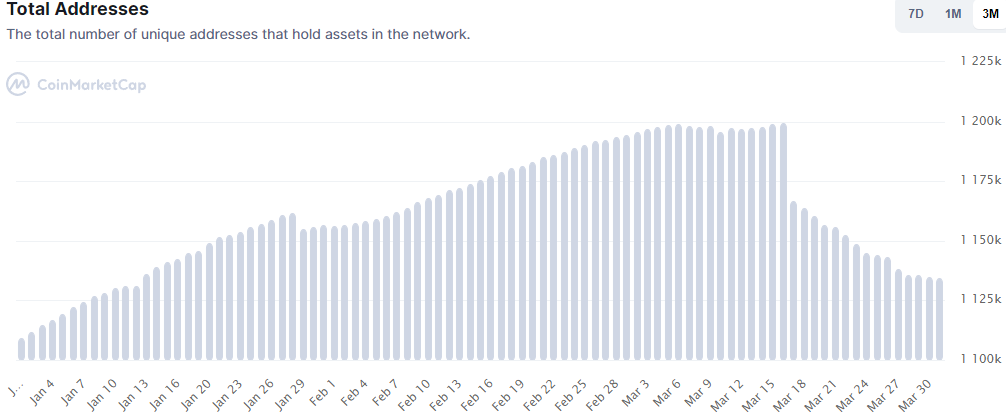

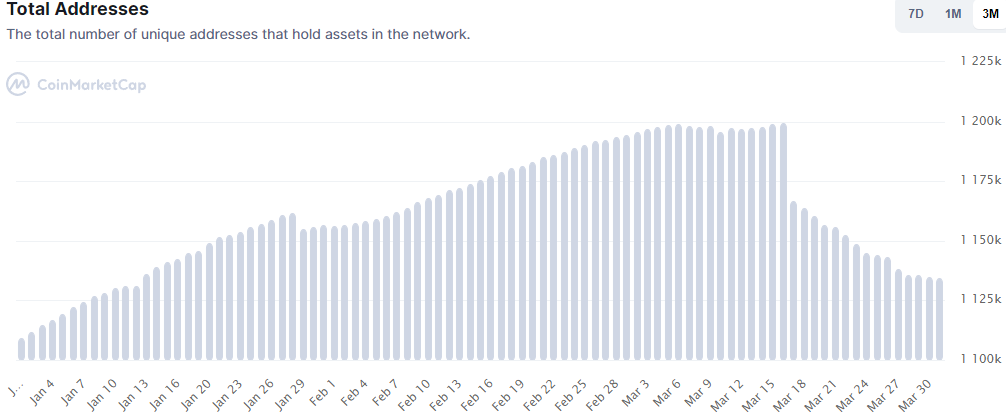

Looking at the attached chart, its likely that Shiba Inu’s woes were more internal than external. As per CoinMarketCap, the total number of unique addresses holding SHIB suddenly began receding since 18 March after dropping by a massive 32,832 in a single day. Since then, SHIB’s total addresses have declined for 13 consecutive days and were down by nearly 70,000 since the 17 March peak.

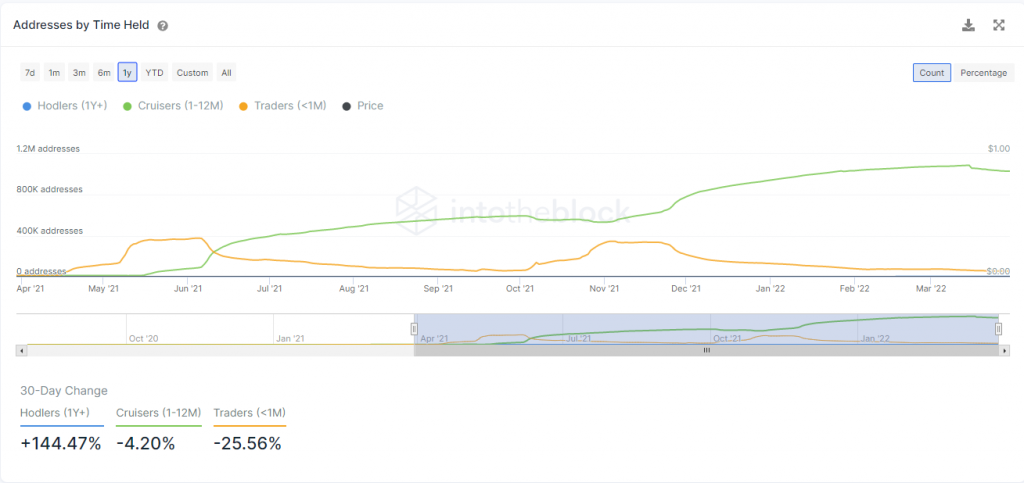

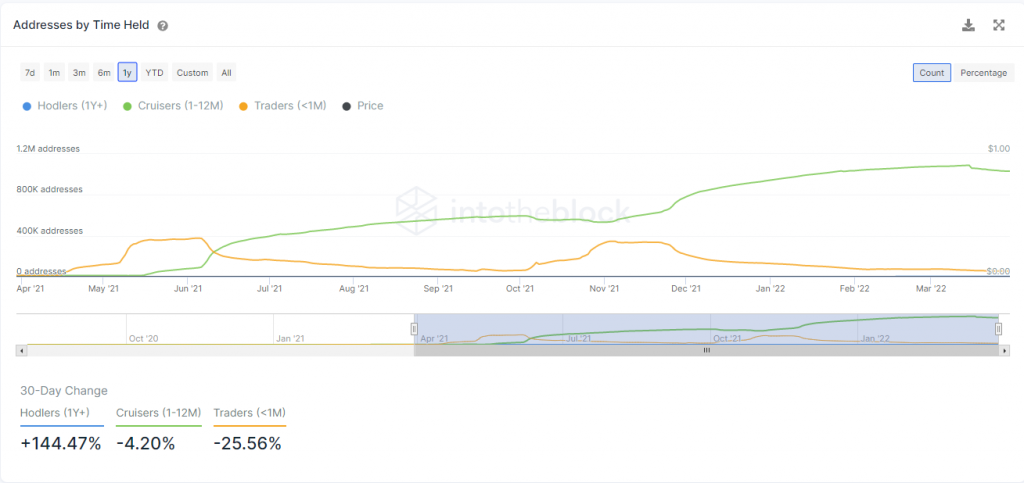

Although large holders were undeterred by the recent finding, an abrupt halt in address growth may have spooked the retail crowd. Currently, there was a major divergence between the two groups, with hodlers on the rise but cruisers and traders parting away with their SHIB tokens. A drop in trader wallets may imply that short-term hodlers might be shifting their focus away from the popular memecoin.

Shiba Inu Price

Now taking the recent findings into account, a bullish broader market could have rescued SHIB from a weakening price. Since 27 March, SHIB’s price has risen by nearly 20% and its gains were more or less in line with the general performance of the altcoin market.

However, it’s likely that the pace at which SHIB could have climbed, given the positive developments could have much higher. At the time of writing, SHIB traded at $0.00002275, up by 1.5% over the last 24 hours.