Despite hiccuping now and then, Shiba Inu has been able to gradually climb up on the charts over the past few weeks. On 15 March, for instance, this token was priced at $0.00002125. After an almost 22% incline since then, SHIB was valued at $$0.000025600 at the time of press.

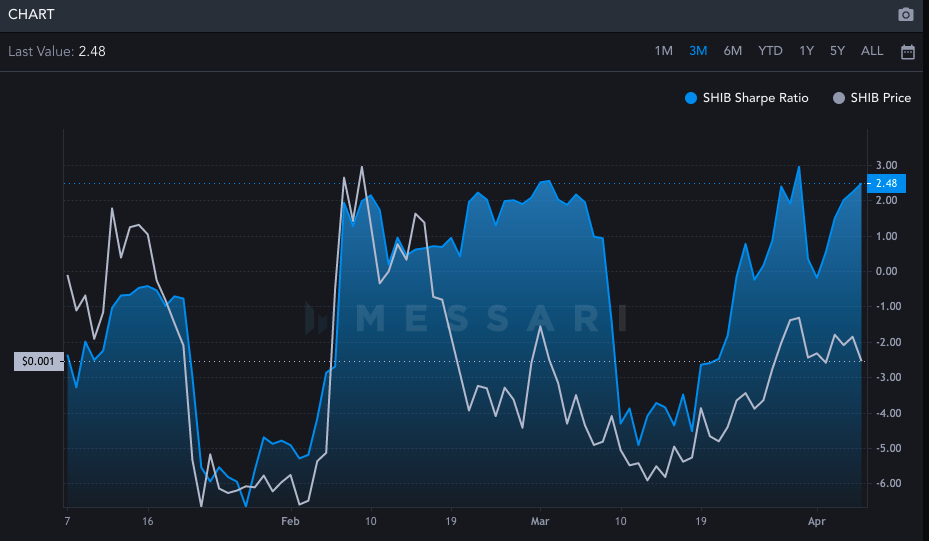

In effect, Shiba Inu’s Sharpe ratio swiftly leaps from the negative territory to the positive territory.

Three weeks back, this metric was oscillating in the bracket between -5 and -4, implying that HODLers were not being fetched with adequate returns for the risk borne by them. However now, this ratio is already up to 2.5, pointing towards the rip-roaring improvement on this front.

Interestingly, the said level also happens to be very close to this year’s ATH levels.

Leaving aside the risk-return front, Shiba Inu has been making strides on other fronts as well of late. WhaleStats’ recent tweet brought to light that Shiba Inu was a part of the most used smart contract list amongst the top 500 ETH whales over the past day.

Yet there’s a cause of concern for Shiba Inu

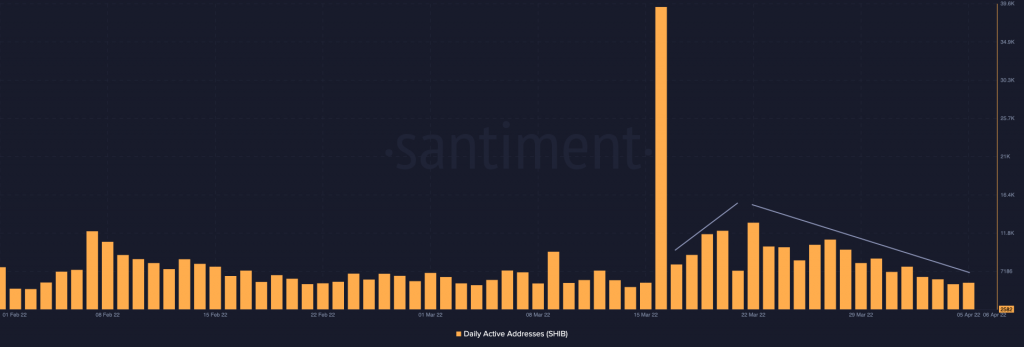

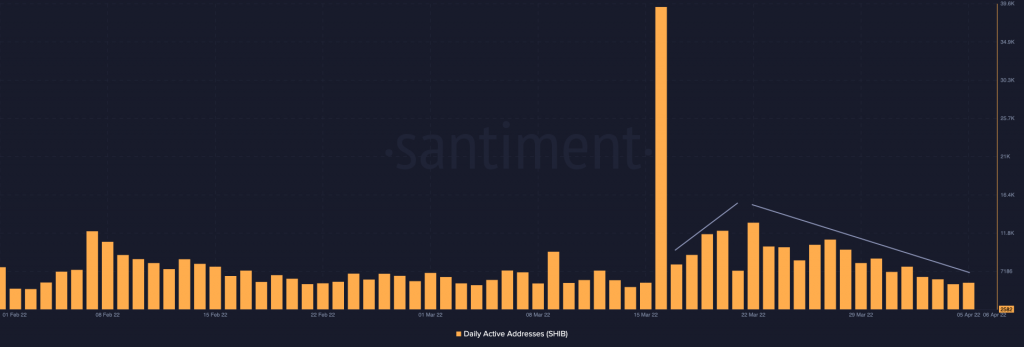

Amidst the set of positives noted above, it shouldn’t be forgotten that the state of the network activity has not been to the mark lately. As reported in an article back in March, the Shiba Inu’s daily active addresses surged by a record-breaking number. Post that, even though it couldn’t sustain there for long, it managed to rise for 4 straight days and remain above average.

Over the past fortnight, nonetheless, this number has been on a downtrend. From its local peak of 13k registered on 28 March, the daily active addresses were on their knees at 5.8k on Tuesday.

The inactivity of market participants does have the potential to blemish Shiba Inu’s glitzy prospects. Thus, before the damage is done, the state of this metric ought to improve.