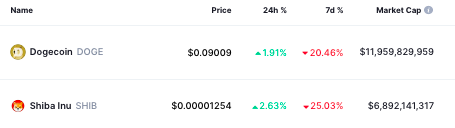

Over the past few days, Shiba Inu and Dogecoin have been registering similar magnitude price movements. In the last 7-days, the former shed 1/4th of its value, while the latter lost almost 1/5th of its value. In just the last 24-hours, SHIB has managed to rise by 2.6%, while DOGE pulled off a 1.9% incline.

Even though both the tokens have been sailing in the same boat, it is sort of evident that Shiba Inu’s pumps/dumps have been heftier than that of Dogecoin over the past week. But why?

Whales are dictating SHIB’s movements

Whales, more often than not, step up during market turmoil phases and encash the situation. Of late too, something similar has been happening. Consider this – Ethereum whale going by the pseudonym “BlueWhale0073” bought over 375 billion Shiba Inu tokens worth approximately $4.5 million earlier during the day.

This ended up putting Shiba Inu back on the top ETH whale traded tokens list.

Zooming out

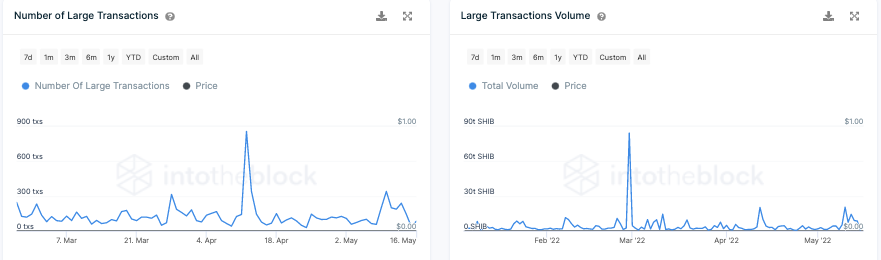

Despite selected whales having been accumulating Shiba Inu, things do look gloomy from the macro-perspective. The number of large transactions—the ones >100k—continues to stoop lower. This time around last week, around 300 such transactions used to take place daily, but now, the number stands below 100.

Similarly, the cumulative volume involved in such transactions has also shrunk from around 20.36 trillion tokens to merely 3.6 trillion tokens.

So, keeping the latest whale purchase and price incline in mind, it is sort of clear that whales—via their purchases—still have a say in Shiba Inu’s price movements, despite their overall activity remaining low. So, if they end up becoming even more active over the next few days, then Shiba Inu would note even more aggressive price fluctuations. On the contrary, if their activity subsides, then SHIB might end up consolidating for a while.

With a market cap of $6.89 billion, SHIB was seen exchanging hands at $0.00001254 at press time.