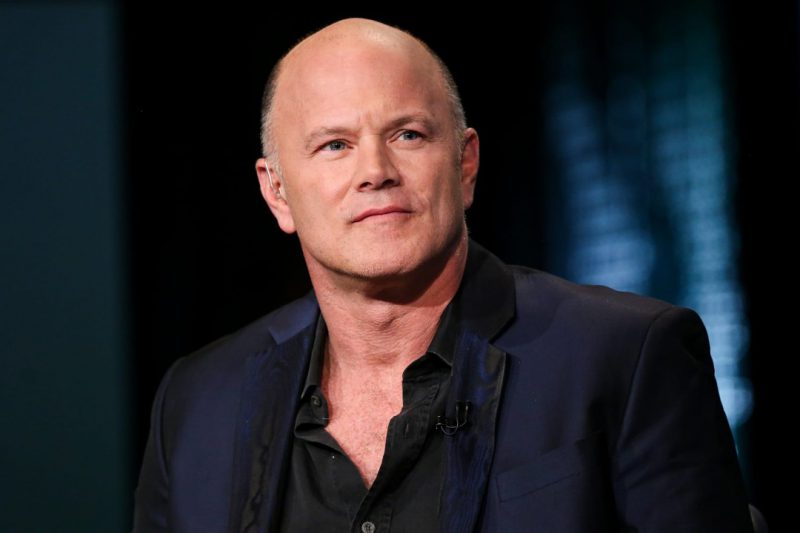

As the ripple effects of LUNA and UST’s demise spread across the market, many elite members of the crypto society have dropped statements regarding the current market environment. After weeks of staying pat on the issue, Billionaire Mike Novogratz came out of his hidey-hole and issued a public letter discussing his take on the entire fiasco.

When LUNA and UST crashed last week, many expected Galaxy Digital CEO Mike Novogratz, who is a vocal crypto proponent and also carries a LUNA tattoo on his arm, to speak on the issue. Well, the Billionaire has broken his silence after returning to Twitter for the first time in 10 days to discuss the matter.

“There is no good news in what happened in markets or to the Terra ecosystem…In Luna and UST alone, $40bn of market value was destroyed in a very short amount of time. I am going to try to add some insights to the ongoing discussion”

Novogratz explained that UST was an attempt at creating an algorithmic stable coin that would live in a digital world but it was a ‘big idea that failed’. He added that macro market worries put pressure on Luna reserves, which were not enough to save the ecosystem’s downfall.

“UST growth had exploded from the 18% yield offered in the Anchor protocol, which eventually overwhelmed other uses of the Terra blockchain. The downward pressure on reserve assets coupled with UST withdrawals, triggered a stress scenario akin to a “run on the bank.”

“Crypto is not going away”

Novogratz reiterated some important principles of investing following the LUNA-UST flash crash. He suggested investors keep a diversified portfolio, take profits along the way, have an apt risk management framework, and be mindful of the macro environment.

While speaking about different market cycles, Novogratz added that restructuring, a redemption cycle, consolidation, and renewed confidence in crypto would lift the market back to the top. However, he remains bullish on the industry’s long term prospects and concluded by saying – “I firmly believe now more than ever that the crypto revolution is here to stay”

Bitcoin market cycle takes a U-turn in 2022

Novogratz’s statements on market cycles come during a notable change in the direction of Bitcoin. The king coin’s last bull run was recorded in November 2021 and since then, a bearish cycle has followed. This year, BTC prices shifted below major supports of $45K, and $40K, and currently held around $29K, a full 54% below its ATH.

The downturns, accentuated by LUNA’s collapse, had not only affected common investors but also high net-worth individuals. Recently, Binance CEO Changpeng Zhao revealed that his LUNA investments were down to $600 from an initial investment of $1.6 Billion following the market decline.

Earlier, Bloomberg had reported that Gemini exchange founders Tyler and Cameron Winklevoss have each lost roughly $2.2 billion this year, nearly 40% of their wealth. Meanwhile, Coinbase’s Brian Armstrong’s wealth had dropped to $2.2 Billion from $8 Billion in just two months.