With record theft-related hacks and successive market flash crashes, the DeFi sector has been hemorrhaging during the first half of the year. Yet, institutions haven’t backed from investments. Yesterday, a unit of Thailand’s largest commercial bank made an undisclosed investment into a DeFi protocol running on the Compound network.

On Thursday, SCB 10X, a unit of Siam Commercial Bank, announced an undisclosed investment into Compound Treasury. The treasury was set up by Compound Labs in June 2021 for ‘non-crypto native businesses and financial institutions to access the benefits of the Compound protocol’. The protocol offers a fixed interest rate of 4% per year.

Speaking on the deal Chief Investment Officer Mukaya (Tai) Panich said that the investment was also a learning opportunity on how to utilize DeFi in traditional markets. He added

“We would like to understand how the product works and how the protocol Compound integrates, so that in the future maybe we could use these as a way to integrate DeFi and make traditional finance more efficient..For us when we invest into Compound Treasury, it’s not just because we want to get yields.”

DeFi Suffers

DeFi is typically regarded as crypto’s biggest crown jewel but 2022 has not proven to be a great year for the sector thus far. The DeFi index has been on a downwards spiral since the start of the year as a spike in theft-related hacks followed by LUNA-UST’s collapse shed light on various potholes present in the space.

Despite these challenges, SCB 10X remains optimistic. Panich added that Terra’s decline would likely encourage regulatory frameworks for DeFi and stablecoins alike.

“There will be more regulations that will bring in more institutions,” he said.

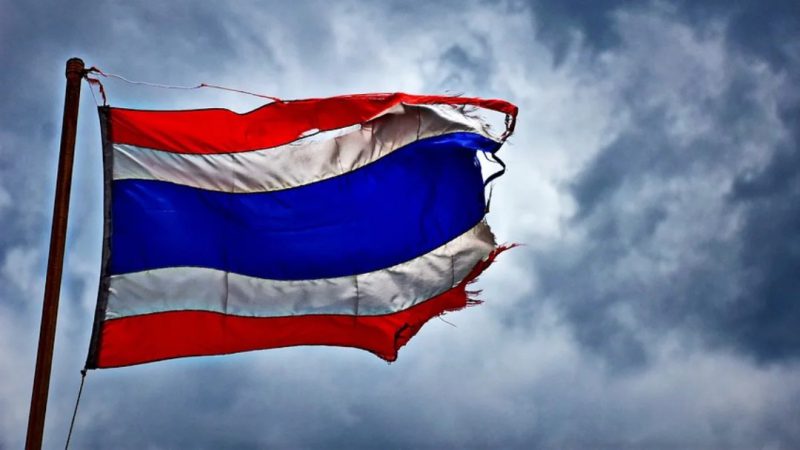

Thailand’s crypto landscape

Meanwhile, the regulatory landscape in Thailand is becoming healthier for investors but not exactly for financial institutions, which is the region’s largest sector by market cap. The government recently passed a law that expected a 7% value-added tax for crypto transfers, essentially encouraging trading and retail investments.

However, the region’s central bank issued a statement back in March to limit a regional bank’s investment in the digital-assets business, including crypto exchanges, to just 3% of their capital. An official had cited that the limits were set to protect banks from ‘unforeseen risks’ in the market.