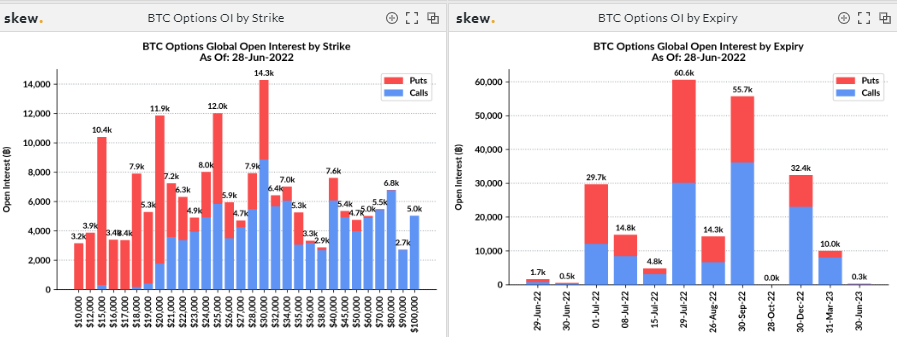

The Bitcoin market is set to undergo a significant options expiry on the first day of the new quarter. Per data from Skew, 29.7k BTC are involved this time, and most traders remain bearish.

As illustrated in the snapshot below, puts [sell contracts] are currently in control. Per the OI by strike price, most bearish bets have been placed in the price bands extending from $10k-$20k.

So, at the time of the expiry, if Bitcoin is valued sub $20k, traders would get to exercise their option of selling their BTC. If the selling materializes, then Bitcoin’s price will continue to suffer.

However, if it manages to stay above $20k, call contract traders would be in control of the game. Essentially, they’d be triggered to buy BTC at expiry.

Who’d Bitcoin favor?

Bitcoin registered a green candle on the weekly last week, and doing so had opened the doors for the king coin to slide up to the $28k price band. However, the uptrend broke a few days back, and last week’s gains have already been wiped off.

The $20k region where Bitcoin is trading has previously supported its price. But, with the sentiment remaining bearish, it doesn’t look like BTC would be able to clasp onto it for long. A failure to do so would propel BTC to tumble to $17.5k-$17.6k.

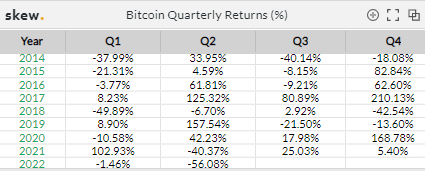

Even though it seems like Bitcoin would have a rough start to Q3, the bearish sentiment might not necessarily persist. Let’s peek into some historical data to understand why.

Historically, in most cases, a negative quarter has been followed by a positive quarter [or at least the intensity of bearishness has reduced]. Last year, for instance, Q2 ended on a negative note, and investors lost approximately 40%. In the subsequent quarter, BTC rose on the charts by 25%. A host of other similar instances can be noted from the snapshot attached below.

So, with the current quarter’s returns at -56%, a moderate recovery in Q3 can be expected.