KLAP, a DeFi lending platform, has managed to attract over $100 million in TVL in just a week after its launch. The KLAP protocol is based on the Klaytn network and was curated by the DeFi accelerator Krew. It has managed to become the second most popular application on the network.

KLAP lets users earn interest, borrow assets, and also farm yields using the Klaytn lending application. Klaytn is already envisioning going against Ethereum with its EVM feature and by providing a low-fee platform for on-chain trades.

KLAP acquires over $100 million TVL in a week

The Klaytn blockchain stays loyal to its Asian users and is quite popular in South Korea. The platform is not that well-known globally and has attracted most of its developers and users from South Korea. The Klaytn blockchain is utilized by many for liquid staking, trading, yield farming, and lending. etc.

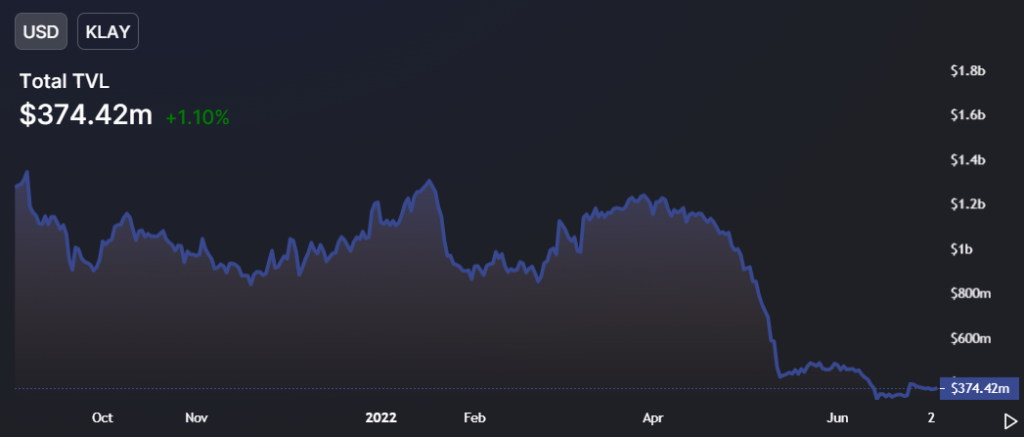

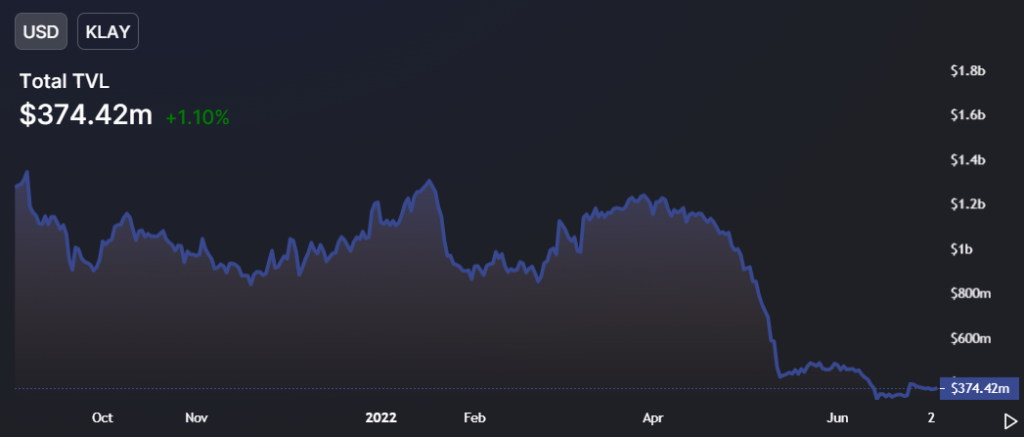

According to the data from DeFi Llama, the Klaytn blockchain holds over $374 million in locked assets. Out of the $374M, $68M comes from KLAP. KLAP went live on June 24 and managed to attract quite some numbers. The project’s growth was remarked as the second largest one on the Klyatn blockchain. Within 15 minutes of the launch, KLAP attracted $15 million in TVL. The numbers started to soar, as it touched $50 million in half an hour and $100 million in just two and a half hours.

KLAP functions similar to other DeFi lending platforms and allowed users to deposit WBTC and WETH and borrow DAI and USDC. The platform was developed by Krew that was curated by different Venture capital firms. With the harsh crypto market conditions and centralized platforms halting withdrawals, users are diverting to non-custodial platforms. In one of the most recent events, crypto trading platform Vauld halted its withdrawals, deposits, and other activities citing harsh market conditions.