The past day has been quite action-packed. On one hand, Meta’s Zuckerberg confirmed that his company will begin mass layoffs tomorrow. A few hours before that, on the other hand, Binance’s FTX acquisition was announced.

The latter decision was unanticipated and took many by surprise. Even though FTX’s ship has been saved from sinking, for now, community members viewed it as a red flag. People were openly calling out CZ and Binance for trying to monopolize the space.

Ki Young Ju, the Co-Founder, and CEO of the on-chain analytics platform CryptoQuant highlighted that FTX was the third-largest exchange in spot volume. Given the latest acquisition, he questioned, “How other exchanges can survive and compete against Binance?”

Having said that, there were people on the other side of the spectrum too who viewed the latest decision to be a masterstroke by CZ.

Did Coinbase benefit from the Binance-FTX episode?

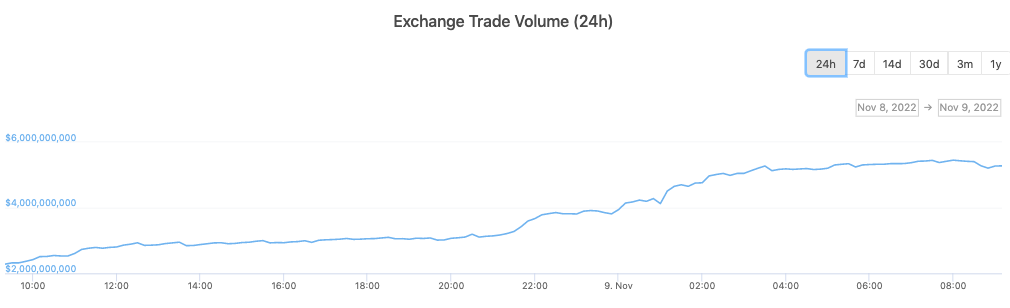

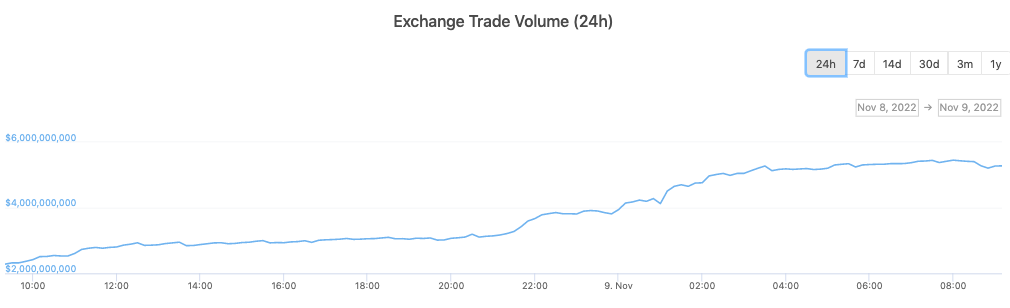

A recent Bloomberg report brought to light that Crypto exchange Coinbase Global Inc. was seeing “increased activity” on its trading platform following the Binance-FTX “drama.”

Per press time data from CoinGecko, Coinbase had settled $5.27 billion worth in volume over the past 24 hours compared to the $3.8 billion highlighted in Ki Young Ju’s tweet.

Even though the same is a positive takeaway for Coinbase, people from the space feel that exchanges will fall one after the other, like dominoes, going forward. Clearing the air, Armstrong asserted that there would not be a Coinbase-version of the story because his company does not engage in “risky behaviors.” He added,

“We’re not investing customer funds. We’re not doing market making or engaged in any kind of complex arrangement with other parties that we own.”

Yesterday, SBF clarified that FTX US was not a part of the Binance deal. So, is Coinbase looking to acquire the same? Well, likely not. Armstrong revealed that his company does not have the plan to try and buy FTX US. He said that there were reasons why the acquisition wouldn’t make sense, without revealing details.

Robinhood on a slippery slope

While Coinbase stood to benefit from the current state of affairs, Robinhood suffered. In May this year, FTX’s Sam Bankman-Fried bought over 56 million HOOD shares representing a 7.6% stake in the prominent trading app.

Now, there are speculations that Bankman-Fried will have to sell some or all of his stake to enhance liquidity. Owing to the pessimism, fear, uncertainty, and doubt, Robinhood shared shed 19% value in a single day on Tuesday.

Also Read: FTX’s Sam Bankman-Fried net worth drops by 93%