Along with the crypto market, even the NFT market rode the bullish wave last year. Several fresh records were created as the market welcomed a string of new participants betting on the future of digital tokens.

Chalking out 2022’s Trends

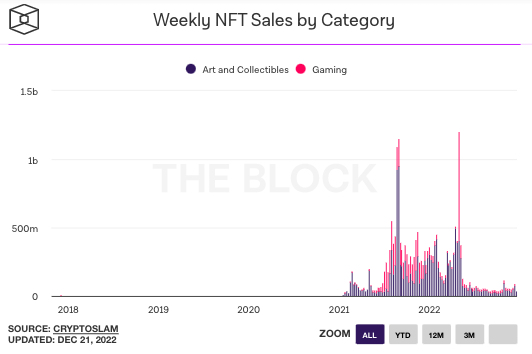

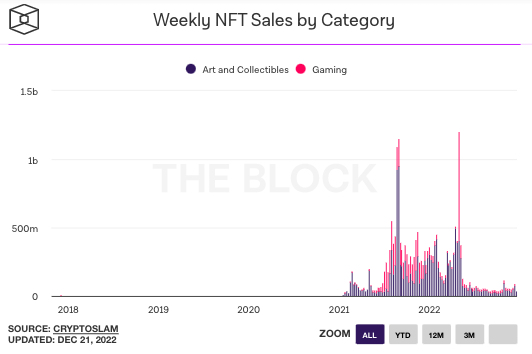

Unlike cryptos, 2022’s H1 tale was not all that gloomy for NFTs. As illustrated below, this year holds the record for registering the highest Non Fungible Token trading volume. In the week of May 1, the cumulative weekly sales peaked at $1.2 billion.

After that, however, the sluggish market conditions did reduce the Non Fungible Token trades across the board in H2. The sale numbers have sharply fallen and have been, by and large, hovering in the $40-$50 million bracket of late.

Art auction house Christie’s was one of the main beneficiaries of the Non-Fungible Token frenzy last year. It reportedly sold over 100 NFTs worth more than $150 million in 2021. This year, however, the 87 NFTs it sold managed to fetch it only a total of $5.9 million, marking a 96% drop from 2021.

Despite brakes being applied, a recent Coinbase report chalked out that NFTs would play a critical role in the digitalized world going forward. It asserted,

“As the world continues to shift towards the digital realm, NFTs will be a critical component of the infrastructure that allows ownership and identity to function in a frictionless environment.“

Interesting to note here is that, on OpenSea alone, creators have earned over $1 billion in aggregate royalties in 2022 [through November 30].

Chalking out the domino effect of the crypto asset prices on NFTs, Coinbase noted,

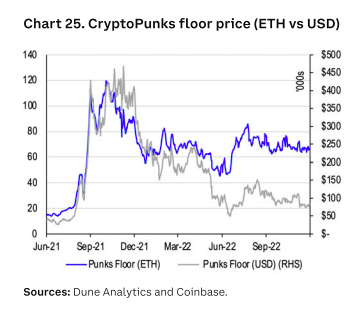

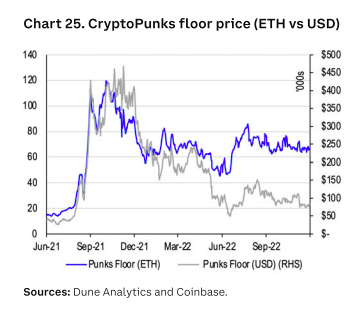

“While certain “blue chip” collections or otherwise “high-quality” NFTs have been able to maintain relevance and even grow market share due to broader consolidation of liquidity, USD values have struggled to keep pace with ETH-based values as the price of ETH has fallen over 66% year to date in 2022.“

In fact, as shown below, such has been the case for even the most prominent NFT collections with “outsized” historical sales volume like CryptoPunks.

IRL NFT Adoption Exhibits

Over the past year, the space has seen several new utilities and opportunities for brand building, customer engagement, and rewards. Starbucks announced in September 2022 that its popular loyalty program was powered by NFTs.

Reddit, on its part, has avatar NFTs. They have amassed over 4.2 million unique holders

and over US$11M in secondary sales since launching in July 2022. In fact, it also created a new record 5 million mint record recently.

By Q3 2022, Nike had already made $185 million via NFT sales. Alongside, the likes of Adidas, Dolce and Gabbana, Tiffany, Budweiser, Lacoste, and Gucci also have their toes immersed in the space.

Read More: Nike makes $185 million via NFT sales: Leaves Adidas, Gucci behind

Coinbase believed that corporations and brands will likely continue viewing NFTs as a differentiated form of marketing spending and create projects that act as powerful onboarding mechanisms for non-crypto-native consumers. It also asserted that this technology allows businesses to connect in “more authentic ways” with the audience.

Elaborating on why 2022’s downtrend is not essentially concerning, Coinbase’s report noted,

“We believe NFT adoption is still in its early stages and the recent downtrends could be

perceived as part of a healthy correction in the context of a broader trajectory of cyclical adoption.”