BRICS: A Challenge to the US Dollar or an Exercise in Futility?

The BRICS nations—Brazil, Russia, India, China, and South Africa—are attempting to challenge the US dollar as the world’s reserve currency.

However, their efforts will likely fail due to the dollar’s consistent international value and widespread usage. The BRICS coalition’s economic output and trade are considerably lower than the dollar’s usage, and the coalition’s attempts to create a new currency are unlikely to succeed.

The US government should clarify its future actions regarding sanctions and retaliation, while the BRICS nations should focus on other areas of collaboration. In this article, we will explore the dollar’s existing dominance, the BRICS coalition, and uncover if BRICS can dethrone the US dollar.

US Dollar Dominance: A Reality Check

The dollar has consistently maintained its international value, and its usage extends far beyond US territory. It is the world’s reserve currency and dominates the global economy.

The dollar is used for 42% of currency transactions, followed by the euro at 32%. The Chinese yuan contributes just 2%, as its non-domestic usage does not extend significantly even within Asia or outside of trade-linked finance.

A reserve currency achieves its defining element when it becomes the second-most-used currency for domestic transactions. The dollar is pretty much the most-utilized method of exchange across the world after each nation’s currency.

Almost every commodity, including oil and gold, trades in dollars. Even in the realm of cryptocurrencies, the greenback predominantly serves as the pairing currency.

What is also essential for a reserve currency is its use as a store of value. The International Monetary Fund estimates that 59% of global central bank reserves are in dollars, with euros at 20% and the yuan at just 5%.

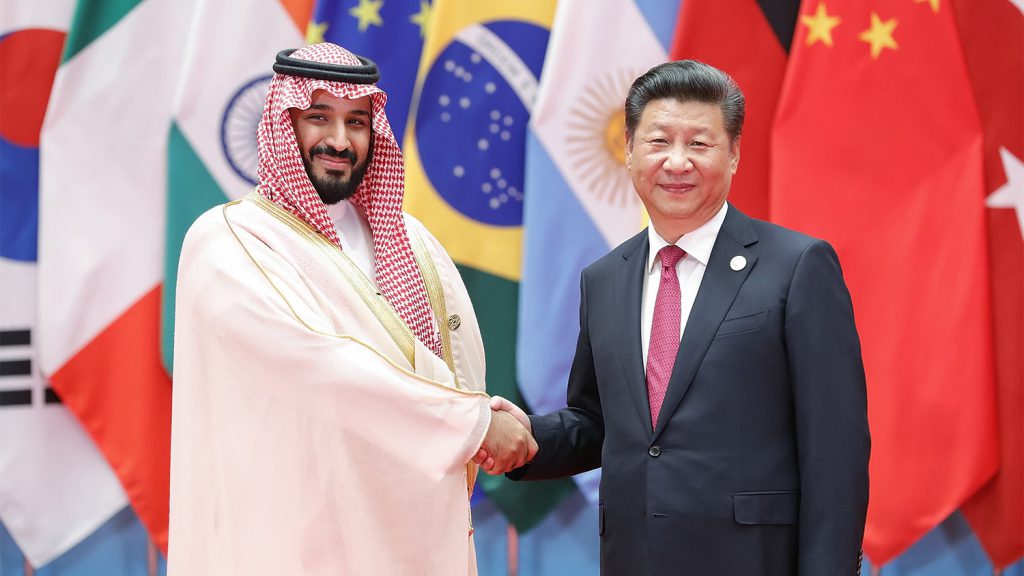

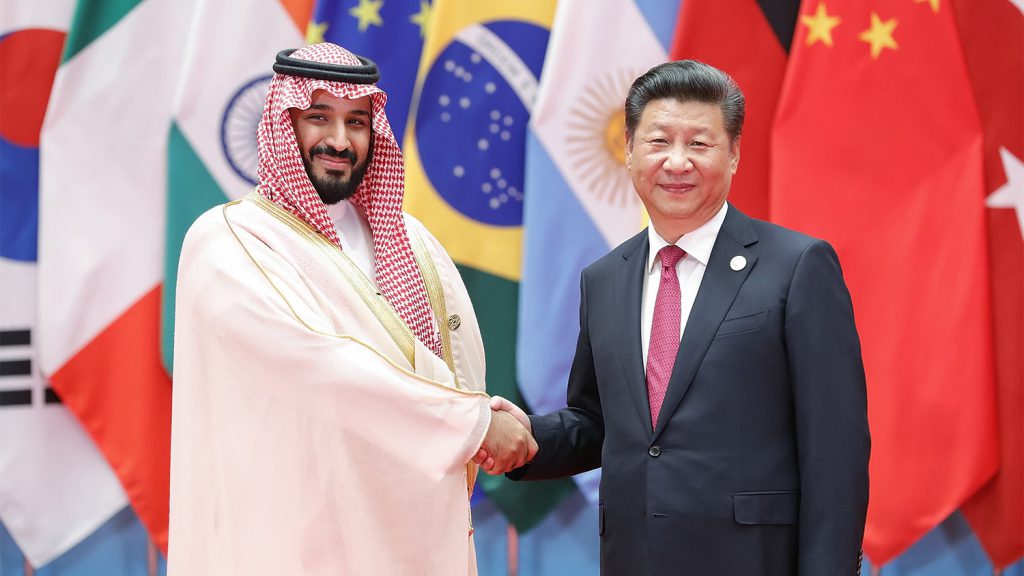

The BRICS Coalition’s Economic Output and Trade

The BRICS coalition’s economic output and trade are considerably lower than the dollar’s usage. The coalition delivers just 23% of total global output and only 18% of trade.

According to the Society for Worldwide Interbank Financial Transactions, the BRICS coalition has 42% of the world’s population, which could significantly influence

However, it is unlikely to challenge the dollar economically due to its limited output and trade.

Sanctions and retaliation

The US and Europe froze $300 billion worth of Russian foreign exchange and gold reserves after the Ukraine invasion.

This raises the possibility that the overseas assets of countries acting contrary to Western interests could similarly be withheld.

The US government must address the fallout from its retaliatory action against Putin. It should provide clearer guidance on future actions.

The BRICS countries are trying to attract hangers-on by whipping up talk of a rival to dethrone King Dollar.

However, their efforts will likely fail due to the dollar’s consistent international value and widespread usage.

The BRICS coalition’s economic output and trade are considerably lower than the dollar’s usage. The coalition’s new currency attempts are unlikely to succeed. The US government should clarify its future actions on sanctions and retaliation.

Conclusion

In conclusion, the BRICS nations’ efforts to challenge the dollar are an exercise in futility. The dollar is unambiguously the world’s reserve currency and dominates the global economy.

The BRICS coalition’s economic output and trade are considerably lower than the dollar’s usage, and the coalition’s attempts to create a new currency are unlikely to succeed.

The US government should clarify its future actions regarding sanctions and retaliation, while the BRICS nations should focus on other areas of collaboration.