Earlier today, the crypto market was disrupted by the sudden de-pegging of the world’s largest stablecoin Tether [USDT] as it deviated from its $1 peg. It experienced a decline and dropped to a low of $0.9972. This event understandably caused concern among the community, particularly due to past instances of de-pegging. However, the recent incident was specifically linked to an imbalance in Curve’s 3pool.

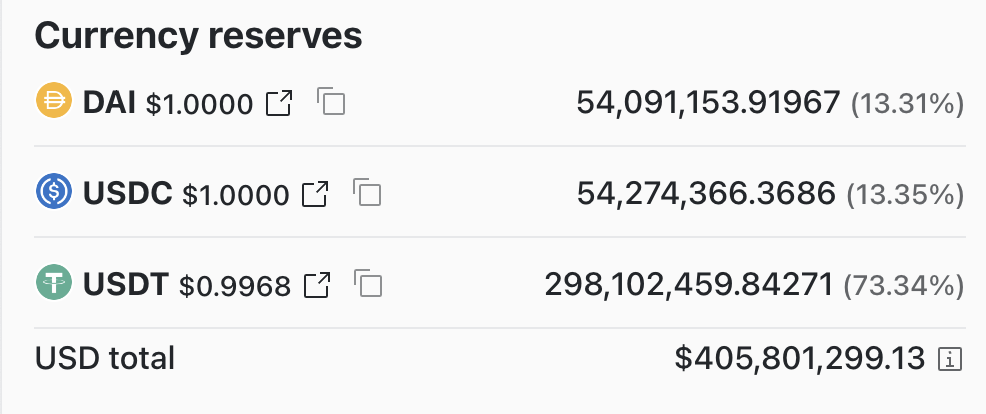

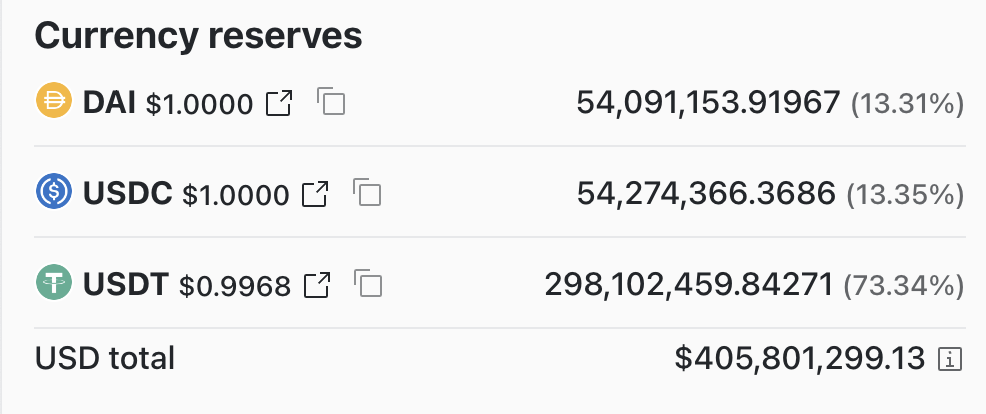

3pool is a stablecoin exchange pool that entails USDT, USDC, and DAI. The USDT holdings in this pool experienced a remarkable surge, reaching 73% earlier today. The optimal distribution for this pool is anticipated to be 33.33% for each of the above-mentioned stablecoins.

This means that traders are selling a significant amount of USDT in exchange for USDC and DAI. Rising sell pressure on the asset led to its de-pegging from $1.

Furthermore, Curve 3Pool experienced an imbalance previously in March. The balances of USDC and DAI rose to 45%. Another imbalance occurred in November following the collapse of FTX. Additionally, a similar situation arose after the crash of Terra in May 2022, resulting in USDT becoming volatile and temporarily losing its peg.

Should the industry be worried?

The news of Tether’s de-pegging quickly circulated throughout the industry, causing widespread attention. In response to the situation, Tether’s CTO, Paolo Arduino, chose to address the issue. He took to Twitter to attribute the latest event to the volatile nature of the markets, referring to them as “edgy.”

He also said, “All recent news etc. are pushing big groups to exit from crypto markets. Tether is the gateway for liquidity, inbound and outbound. So when the interest in crypto grows, we see inflows; when the sentiment on the crypto market is negative, we see outflows. We can’t exclude a direct attack to Tether either, as we have seen in 2022.”

Given the current market notion, it is possible that there are increased outflows taking place. Furthermore, there are rumors that the U.S. Securities and Exchange Commission [SEC] might take action against USD. This is particularly due to the fact that 76% of all stablecoins on exchanges are USDT.