The price of Olympus’ native OHM token has tanked by close to 44% in the span of just a few hours. In the 24-hour window, OHM created a local peak of around $188. However, during the early hours of 17 January, the said token’s price sharply plunged to a level as low as $106.

OHM managed to negate losses to a certain extent by quickly rebounding. At the time of press, OHM was valued at $130.

Olympus’ engrossing economic dynamics

Before proceeding further, it is quite essential to know the nitty-gritty of the project. Olympus, as such, is an algorithmic currency protocol with the vision to become a stable crypto-native currency. Also referred to as an algorithmic stable coin, Olympus’ goal is to achieve price stability while maintaining a floating market-driven price.

Staking OHM tokens fetches investors fancy returns upto 7800%. Staking, as such, reduces the supply of the tokens in the open market and aids in creating value for the protocol. OHM staking rewards, notably, end up auto-compounding every 8 hours.

Olympus DAO entered into the DeFi 2.0 space with its mechanism of acquiring the protocol’s liquidity instead of renting it through yield farming. The success of the project instigated a host of forks on other blockchains, with Wonderland being the first and arguably the most successful one thus far.

Ripple effects of the price dip

During the early hours of Monday, Wonderland managed to flip Olympus DAO in terms of valuation. Highlighting the same in a recent tweet, prominent research analyst Ryan Watkins said,

“May be the first time a fork overtook the original.”

Further elaborating on the ‘why’ aspect, he tweeted,

At the time of writing, OHM seemed to have put back the skeleton in the cupboard and was ranked #2829 on CMC while Wonderland’s TIME stood at #2833.

People from the space were quite vocal about the dip on social platforms. Expressing concern, pseudonymous developer ‘icebergy,’ for starters, tweeted:

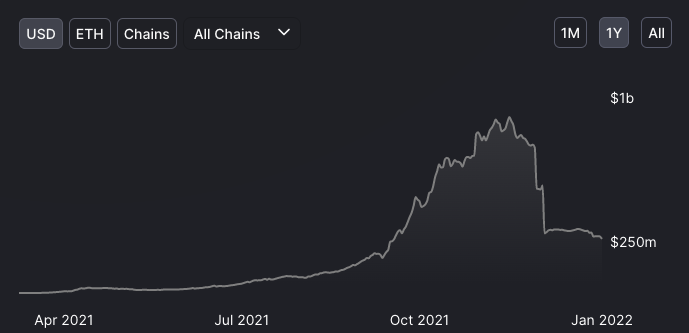

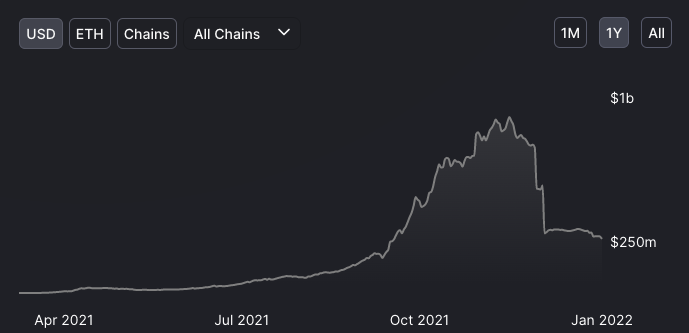

In effect, the liquidity on the protocol continues to drain out. At the time of writing, the total value locked up on Olympus was seen hovering around the psychological $250 million level when compared to late November’s $850 million.

Furthermore, less than a week back, a popular pool to leverage returns on OHM tokens witnessed overnight liquidations which contributed to another price dip then too.

Thus, keeping in mind the mentioned state of affairs, it wouldn’t be wrong to claim that OHM would find it challenging to pick up the pieces and recover from here on.