The Ethereum network is in the final stage of its transition to the Proof-of-Stake consensus mechanism, with the ‘merge’ of the beacon chain and the Ethereum mainnet potentially happening by June this year.

Ethereum 2.0 allows HODLers of ETH to stake their coins and fetch passive income. Simply put, staking is the process of depositing ETH to validators for securing the Ethereum network. Validators, for their part, are responsible for storing data, processing transactions, and adding new blocks to the blockchain. By doing so, they earn ETH in rewards.

Staking on Ethereum is possible via two means. One, if individuals possess more than 32 ETH, they can stake individually by running their own validator using the Eth2 launchpad. On the other hand, if users have less than 32 ETH and want to stake, they ought to delegate it to a staking pool.

The inter-twined fate of Ethereum and staking-centric token STETH

Of late, a particular token—Lido stETH [STETH]—associated with staking has been garnering community members’ attention. Its price movements have been a carbon copy of Ethereum.

Post its launch, STETH kicked off 2021 on a bullish note and went on to peak in May. Right after that, it was victimized by the flash crash that followed and subjected itself to consolidation. Later, it went on to claim new highs in November. Then followed the year-end dip, new year recovery attempts, another brief correction. Currently, the token is on the brink of breaking out.

Ranking-wise, however, Lido stETH is far below ETH. With a market cap of $6.2 billion, this token was ranked #203 on CMC at the time of press.

Lido lets you have your cake and eat it too?

Before proceeding further, it is first important to understand the fundamentals of this project. Lido, as such, is an Ethereum-based liquid staking solution that lets users stake any amount of Ethereum. Curiously, it also offers users the option to deploy their staked ETH across DeFi platforms like Curve and Sushi. What’s more, apart from staking any amount on Lido, users also have the choice to un-stake at any time, without having to fret over the long-term lock-up factor.

Thus, not making stakers necessarily choose between Ethereum and DeFi and offering them flexibility, have together played the role of appealing factors.

Lido Finance is essentially home to the largest locked ETH on Ethereum’s beacon chain. Recently, the number of Ethereum staked via Lido crossed the 2.7 million milestone. The same now accounts for 25.5% of all ETH staked.

When staking Ethereum with Lido, users receive staked Ether that’s issued in a 1:1 ratio. Owing to the same mechanism, the price of both the assets has been pretty much the same. Lido effectively acts as a bridge to bring the stake reward of ETH 2.0 to ETH 1.0 and stETH simply represents the value of the initial staking deposit + the daily staking rewards.

To further clarify, as the staked ETH generates stake rewards from ETH 2.0, users’ ETH balance on the beacon chain increases. The stETH balance is typically updated accordingly once a day, allowing stakers to access the value of the stake rewards they received on ETH 2.0 on ETH 1.0.

Users can use stETH in all the same ways as ETH – sell it, use it, and because it is DeFi compatible, it can be used as collateral for on-chain lending too. When transactions are enabled on ETH 2.0, users can also exchange stETH for ETH.

The current state of affairs

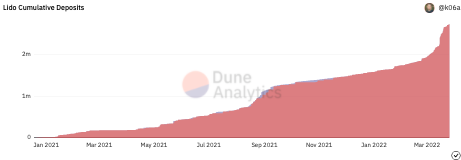

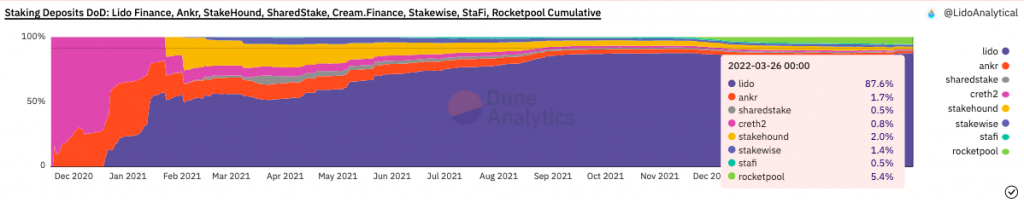

With time, the cumulative deposits on Lido have risen. In fact, it can be evidenced from the chart attached, the same stands at an ATH at the moment and witnessed one of its sharpest spikes this week.

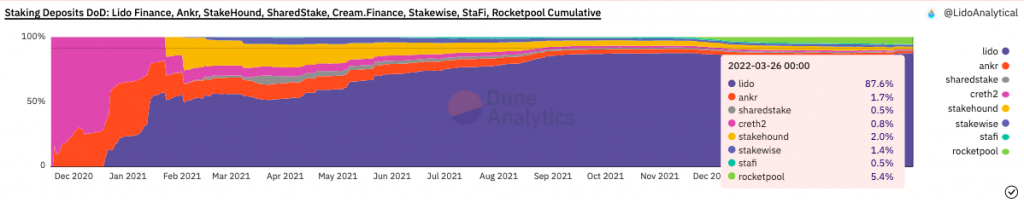

Also, Lido clearly dominates the Ethereum staking market. Dune Analytics’ data brought to light that it is very next competitor—Rocketpool—has a 16x less market share [87.6% v. 5.4%].

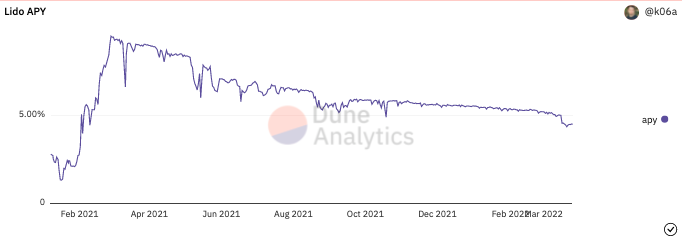

The Annual Percentage Yield [APY] numbers have, however, not been very enticing. When compared to last February’s 9.39%, Lido’s APY currently only stands at 4.46%.

This isn’t particularly surprising because the reward distributed to stakers depends on the total number of ETH staked, and per the theoretical phenomenon, whenever the pool of staked ETH rises, the annual interest rate decreases and vice versa.

People from the space are, however, bullish on Ethereum for the summer and expect staking to offer better returns post the merge. They’ve placed bets in the range of 10% to 15%. In fact, blockchain analytics firm IntoTheBlock anticipates the returns to be higher than the U.S. consumer price index, which stood at a four-decade high of 7.9% in February.

In its recent newsletter, ITB highlighted,

“Through the merge with the proof-of-stake chain, fees previously earned by miners will pass on to being earned by those staking. This is expected to result in staking rewards between 7% and 12%.”

As the consensus layer launch gets even closer, the staking participation is expected to increase. The vast network effect of stETH will, arguably, make Lido one of the most beneficial projects on track, given the fact that it already has a leading advantage.