Another FOMC meeting is around the corner and people have already started putting forth their expectations on the table. The situation this time is quite different, for the U.S. economy is in the midst of a banking crisis. Fear is instilled in the minds of depositors and investors, with regulators reportedly exploring options if things go further down south.

Now, in a recent tweet, American billionaire, Bill Ackman opined that the Federal Reserve should hit “pause” on Wednesday, March 23. He asserted that inflation continues to be a problem and the Fed needs to “show resolve.” Further explaining, he tweeted that Chair Jerome Powell could do so “by pausing and making very clear that this is a temporary pause so that the impact of recent events can be assessed.” Ackman added,

“He [Powell] can make clear that his intent is to resume raising rates at the next meeting unless the banking crisis remains unresolved, and has on its own sufficiently slowed the economy.“

The billionaire hedge fund manager further opined,

“This is not an environment into which the Federal Reserve should be raising rates and adding additional pressure on the system as financial stability is the Fed’s first responsibility.”

Also Read: The U.S. Is Exploring Measures to Safeguard Bank Deposits if Crisis Grows

Others remain divided

However, not everyone is on the same page. According to Citigroup economist Andrew Hollenhorst, applying brakes at this stage would send the wrong message to the market. He explained,

“Fed officials are unlikely to pivot at next week’s meeting by pausing rate hikes, in our view. Doing so would invite markets and the public to assume that the Fed’s inflation-fighting resolve is only in place up to the point when there is any bumpiness in financial markets or the real economy.”

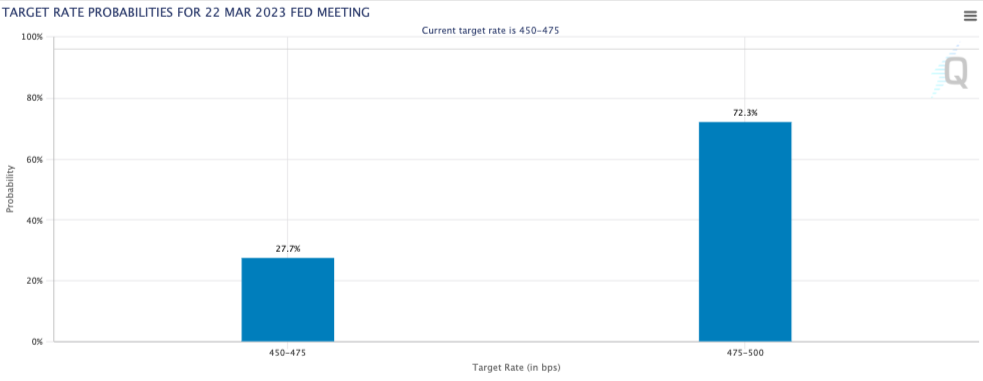

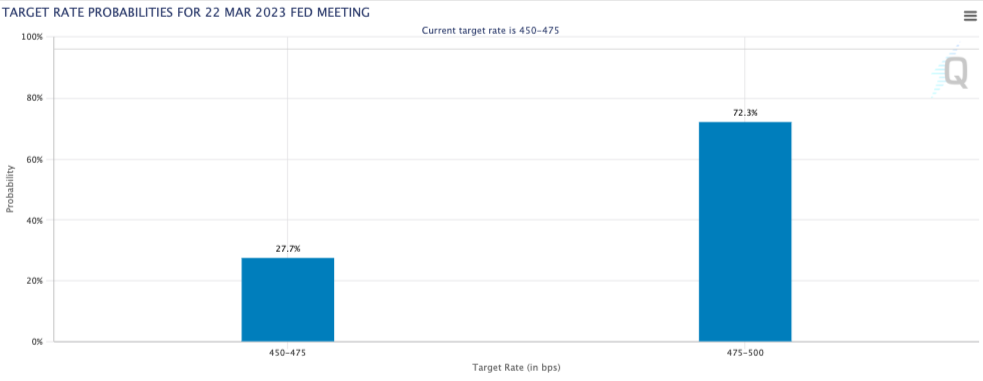

Alongside, Elon Musk also put forth his take regarding which path the Fed officials should tread. Replying back to Ackman on Twitter, Musk unconventionally opined that the Fed “needs” to drop the interest rate by a minimum of 50 basis points in its upcoming meeting. Here, it’s worth recalling that Goldman Sachs recently said that it is no longer expecting the FOMC to deliver a rate hike at its next meeting, on March 22. It cited “stress in the banking system” as its reason for anticipating so. According to the CME FedWatch Tool, there’s currently a 27.7% chance for a no-rate hike. On the contrary, there’s a 72.3% possibility for a 25 BPS incline.

Also Read: Goldman Sachs “No Longer Expects” Fed to Raise Interests in March