For Bitcoin, the previous week had been extremely erratic. The largest cryptocurrency asset’s price fell to a low of $15.58k by Wednesday from an area last Monday of $21.06k. However, after that, there was some stabilization and recovery.

The fleet of outflows was triggered by the fall of the FTX exchange. Sam Bankman-Fried’s exchange collapsed after it was struck with liquidity crunches. Misappropriation of user funds by the exchange was one of the primary reasons for the fall of the cryptocurrency behemoth.

Cryptocurrency investors have now begun to question the safety of user funds on centralized exchanges. The trust vested in the centralized exchanges has stooped low, which is evident from the massive outflow of cryptocurrencies from the exchanges.

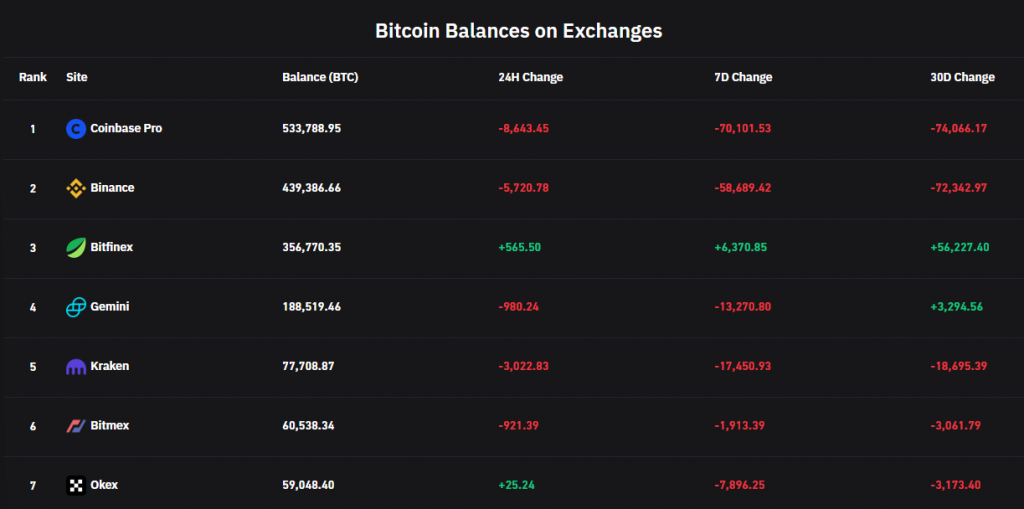

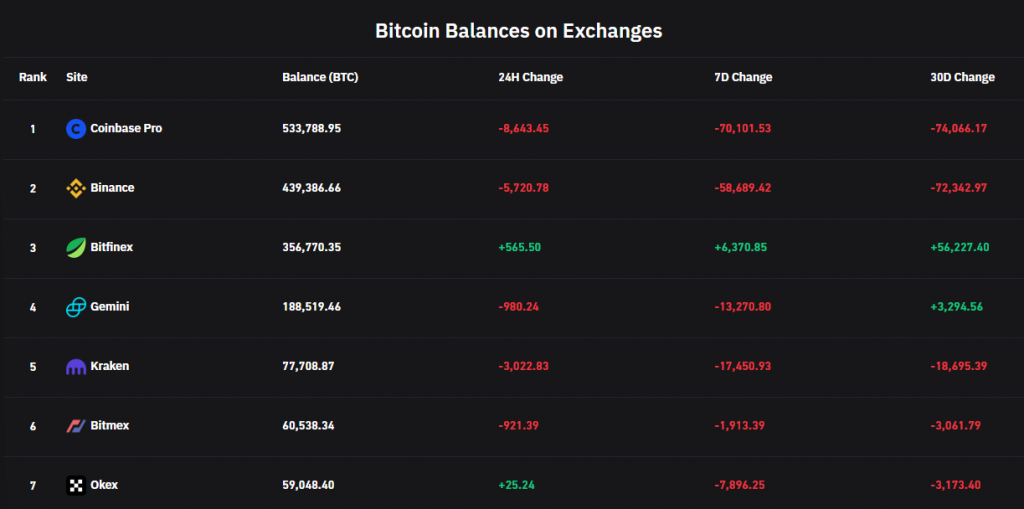

As per the data from Coinglass, 192,340 Bitcoin have been taken off exchanges in the past seven days.

Investors move Bitcoin and other assets from exchanges

According to Coinglass analysis, 192,342.53 BTC has left exchanges to be stored in various wallets. The outflows from the past seven days are comparatively higher than the outflow in the last 30 days. The major outflows have been triggered by the FTX event and also a loss in investor confidence.

Major outflows have been from Coinbase Pro, which witnessed an outflow of 70,101 BTC. It was followed by Binance with 58,689.42 BTC and Gemini with a 13,270.80 BTC outflow. Coinbase Pro and Binance currently hold 533,788.95 and 439,386.66 BTC, respectively. However, exchanges like Bitfinex, Huobi, Bittrex, and Bitstamp enjoyed some inflow of BTC.

Subsequently, the flow of Bitcoin from exchanges is a depiction of the fall in trust of users on centralized exchanges. However, for this very reason, people are trying to move their funds to decentralized storage like cold wallets.

To bring back the trust, CZ suggested all exchanges follow a proof-of-reserve audit. Several exchanges have extended support for it. This was suggested as to bring complete transparency to the holdings of user funds on the exchanges.