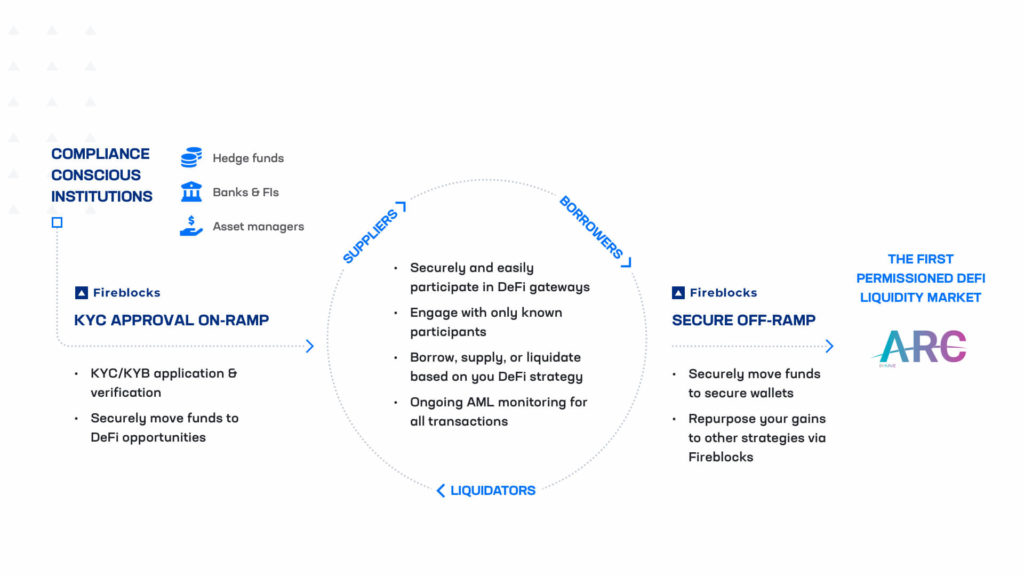

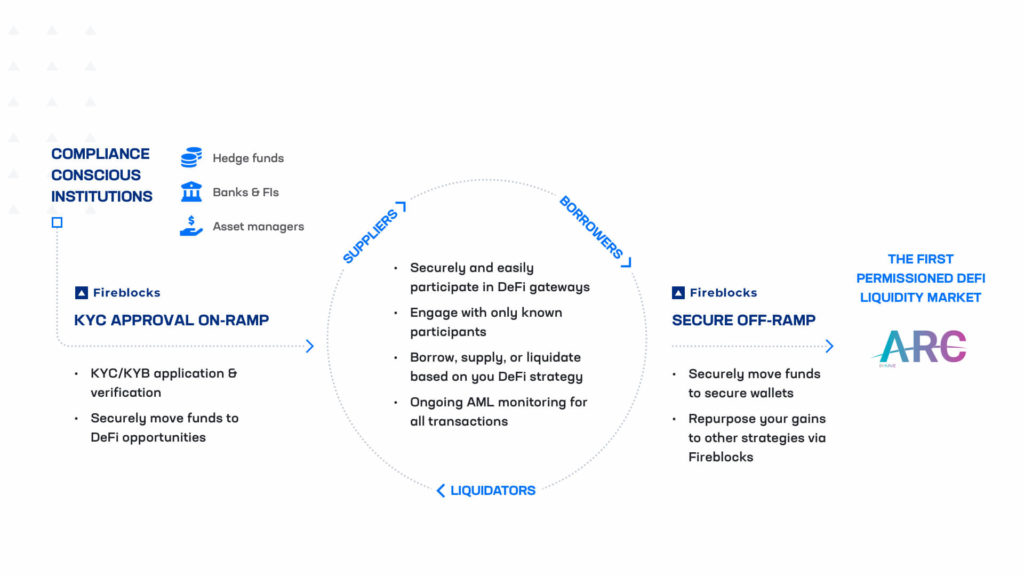

The world of regulated decentralized finance [DeFi] is opening up with Aave in the lead. Aave has announced the launch of permissioned DeFi lending and liquidity service, Aave Arc, to help participation by institutions. As the service launches, 30 institutions were already onboard including Fireblocks and others like Celsius and Anubi Capital.

According to the official announcement,

“Aave Arc is a DeFi liquidity market designed to be compliant with AML regulations, with all participating institutions required to undergo Know Your Customer (KYC) verification.”

The field of DeFi had remained at lengths for institutions participating in crypto due to a lack of support for enterprise-grade risk management and KYC/AML requirements. However, Arc will allow these institutions and regulated entities to finally delve into Defi as liquidity providers and borrowers.

With nearly $255.9 billion already locked in DeFi, Blockdata predicted that enabling institutional access for the stream could boost it to become a trillion-dollar opportunity. Looks like Aave Arc was set to usher into this phase of the industry by making DeFi accessible for institutions across the world.

According to founder and CEO, Stanl Kulechov,

“DeFi represents a powerful wave of financial innovation including transparency, liquidity, and programmability–and it’s been inaccessible to traditional financial institutions for far too long. The launch of Aave Arc allows these institutions to participate in DeFi in a compliant way for the very first time.”

Fireblocks serves as a whitelisting agent for Aave Arc. It has developed a framework for whitelisting institutions that noted globally accepted KYC/CDD/EDD principles and was following FATF guidelines.

The announcement added,

“With this framework, Fireblocks is able to verify the identity and beneficial ownership of legal entity customers, as well as monitor the Aave Arc pool and its participants on an ongoing basis.”

DeFi has already noted incredible growth over the past year. It was noted to grow tenfold from just a year ago and now with institutions entering, the value of the industry could certainly boom. However, Aave was suffering a loss in the market of almost 11% in the past 24-hours, dropping out of the top-50 crypto rankings.

Regardless, this could be a major boost for the lending protocol as it may allow more institutional investors to become familiar with AAVE. Recently, AAVE was also added in Grayscale’s DeFi Index adding a layer of credibility to the project.