The DeFi market has been in its recovery mode over the past few days. The cumulative market capitalization of all tokens from the space has risen by ~20%—from mid-October’s wick low of $37.8 billion to $45.05 billion.

Resultantly, tokens from the space—like Aave—have been pulling up their socks. At the beginning of the week, Ethereum whales were eying this token. Per WhaleStats, Aave was a part of the top 10 purchased tokens among the 500 biggest ETH whales on Monday.

The effect of the same was reflected in the rise in the aggregate exchange outflows. According to data from ITB, the outflow volume stood at 8.23k tokens on October 30. However, at press time, the reading of the same metric was already up to 13.06k, bringing to light the gradually forming buying interest.

Alongside, it is interesting to note that Aave is currently seeing its highest network growth since mid-July. As illustrated below, over 495 new addresses have been created on the network. Elaborating on the connotation of the same, Santiment’s latest tweet noted,

“Address activity and & address creation rises are generally key components for an asset’s price rise. Aave has been seeing sharp spikes in both, hitting milestones not seen since mid-July.“

What to expect next?

Thanks to whale purchases, exchange outflows, and rising address activity, the landscape is theoretically favorable for Aave to start inclining on the charts. In fact, it has enough upside-leg space.

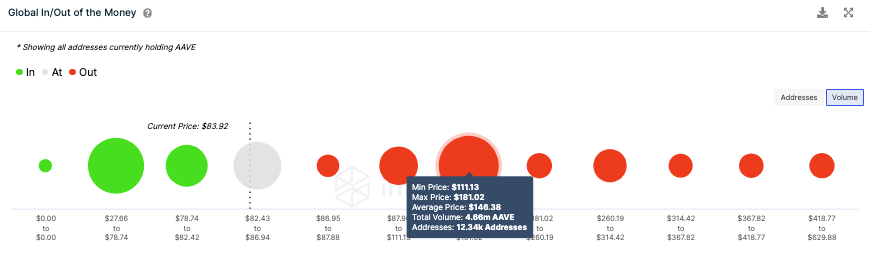

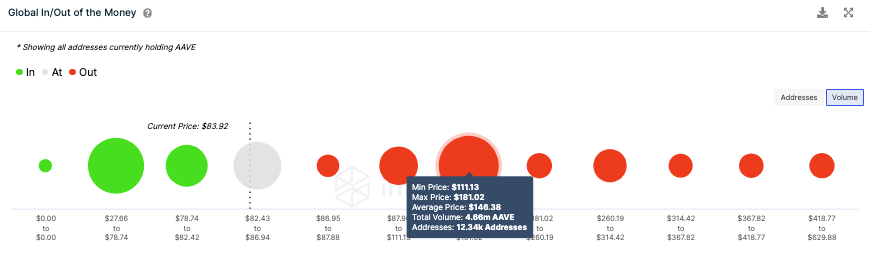

Per data from ITB, the largest resistance cluster for the asset is situated only in a band between $111-$181. In the said range over 12.34k addresses have bought 4.66 million AAVE tokens. So, if the buying pressure steams up going forward, Aave has the potential to glide up to the floor of the said band before being resisted by sellers who’ll want to book profits when they break even.

On the contrary, if the activity hype fizzles out, then, the asset will continue consolidating around its current price. At press time, the $1.18 billion market-capped asset was trading at $83.