The digital asset industry witnessed another hindrance today as DeFi protocols Aave and Yearn finance have been reportedly exploited. The hack led to a $10 million loss according to PeckShield. Additionally, the hacker retrieved a variety of stablecoins which included BUSD, USDC, TUSD, USDT, and DAI.

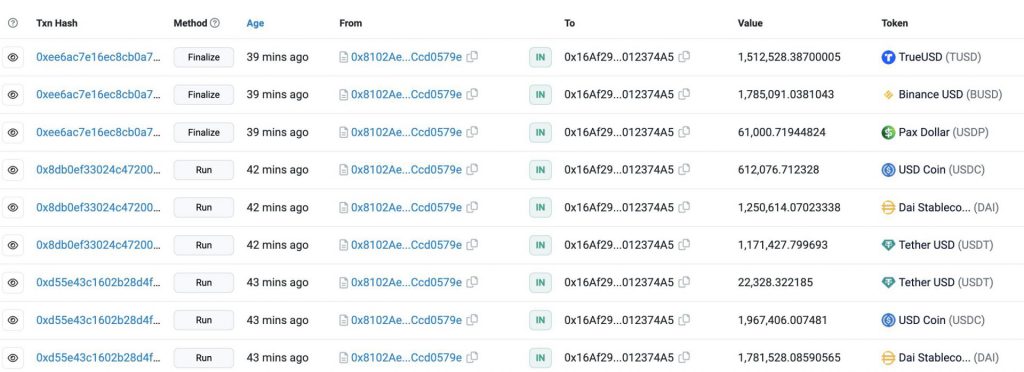

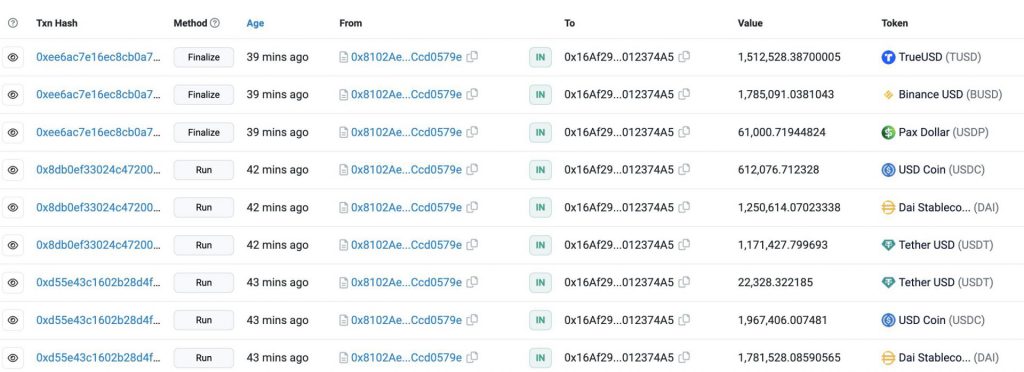

Afterward the incident Blockchain sleuth, Lookonchain revealed that a total of 3,032,142 DAI, 2,579,483 USDC, 1,785,091 BUSD, 1,512,528 TUSD, and 1,193,756 USDT which amounted to over $10 million was stolen by the exploiter.

The community’s reaction to the incident was worrisome as several urged users to withdraw funds from Aave. Founder Marc Zeller hurried in to observe how the attack was concentrated on version 1 of the Aave protocol. Explaining that the network is currently investigating the attack, he tweeted,

He also noted how the current size of V1 is $18 million while the size of the safety module is $382.50 million. This will further aid in compensating users for lost funds. It seemed like the attacker targeted old protocols. Similar to Aave, Yearn Finance’s team took to Twitter to confirm that Yearn v2 vaults weren’t affected by the hack. A member of the Yearn team tweeted,

“We are aware of an issue that seems isolated to the iearn legacy protocol launched in 2020 and liquidity pool. Yearn v2 vaults seem not to be impacted. Yearn contributors are investigating.”

AAVE and YFI Dip Post Hack

While the news of DeFi firms Aave and Yearn Finance being hacked made headlines, the prices of their native tokens witnessed a minor setback. AAVE declined by 3% during the incident but the token is recovering at press time.

YFI, on the other hand, plunged to a low of $8,936 all the way from a high of $9,375. The asset is currently trading for $9,007.53.