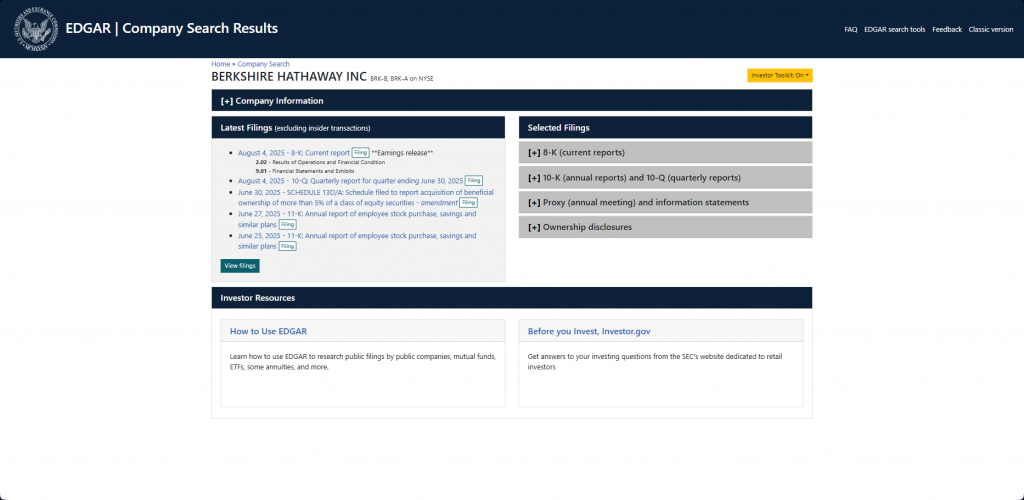

Warren Buffett’s stocks to buy are actually getting quite a bit of attention right now as Berkshire Hathaway gets ready to file its second-quarter 13F report. The value investing legend’s company was, well, a net seller during Q2, with sales of $6.9 billion that were offset by purchases of $3.9 billion. Two standout value investing stocks from the upcoming Berkshire Hathaway 13F filing are showing some real promise amid all this market volatility, and they’re offering dividend growth stocks potential for investors who know what they’re looking for.

Discover Warren Buffett Stocks to Buy Amid Market Volatility and Dividend Growth

Even though they were net sellers, Buffett’s team actually identified some strategic Warren Buffett stocks to buy during that April selloff we all remember. The upcoming Berkshire Hathaway 13F filing is going to reveal the specific moves they made, but right now two holdings are standing out as really exceptional value investing stocks.

1. Occidental Petroleum – Buffett’s Big Energy Bet

Berkshire owns about 27% of Occidental Petroleum, which makes it one of the top Warren Buffett stocks to buy candidates out there. Trading 28% below its $59 fair value estimate, this represents a classic value investing stocks opportunity that’s hard to ignore.

Morningstar senior analyst Gregg Warren had this to say:

“Sales of $6.9 billion were offset by purchases of $3.9 billion of equity securities during the period”

The company’s massive $55 billion Anadarko acquisition was partly financed through Berkshire’s $10 billion preferred investment, and it actually strengthened Occidental’s position among dividend growth stocks in the energy sector.

Also Read: Goldman Sachs: Dollar Forecast Warns Currency Could Turn Even Riskier

2. Kraft Heinz – The Contrarian Play That’s Actually Working

Despite taking a $3.8 billion write-down, Kraft Heinz remains compelling among Warren Buffett stocks to buy right now. Trading at a 47% discount to fair value, it really exemplifies value investing stocks principles during all this market volatility we’re seeing.

Morningstar director Erin Lash stated:

“We believe the stock is a bargain, as the market seems to expect a lasting volume contraction on the heels of persistent inflation, waning consumer spending, and aggressive competition”

The company is targeting $2.5 billion in cost savings by 2027, which is supporting its position among dividend growth stocks that are worth watching.

At the time of writing, both stocks represent Warren Buffett stocks to buy before the Berkshire Hathaway 13F filing reveals additional insights into the value investing stocks strategy amid this ongoing market volatility.

Also Read: Binance Unlocks Instant Crypto-to-Fiat Transfers for European Users