Solana was in the news recently for the network issues it was facing. Binance had also issued a statement highlighting that it might end up pausing withdrawals “from time to time” depending on the situation.

Owing to the same, and the border market’s non-optimistic sentiment, SOL’s price has fallen off a cliff over the past 7 days. In the said period, the alt has shed over 20% of its valuation and was merely priced at $110 at the time of press.

The TVL that had started showing signs of recovery re-started its downtrend last week. From 3 April until the time of press, $1 billion had already been wiped off the ecosystem.

Solana’s NFT magic

Irrespective of the network-related chaos noted and dwindling TVL, Solana made its debut on OpenSea last week with a bang. Despite it being in its beta stage and having only limited collections at the moment, Solana has been able to put up quite a good show.

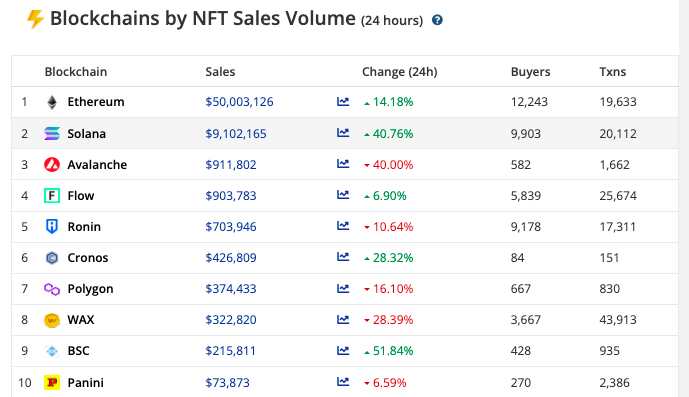

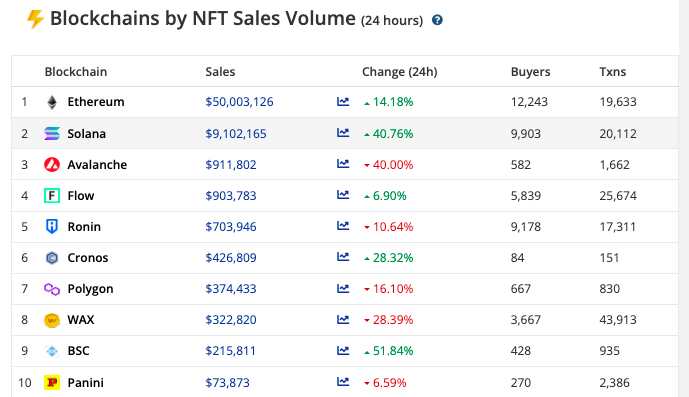

Over the past 24-hours alone, for instance, the sales volume noted an inclined of 41% on Solana. The number was as low as 14% for Ethereum, while on other networks like Avalanche, Ronin, and Polygon, the sales volume noted declines in the same timeframe. Only BSC managed to overshadow Solana’s daily change percentage.

Curiously, the Solana market boasted of close to 10k buyers, second to only Ethereum’s 12.2k. The same essentially implies that the volume burden had spread across a large buyer base. On the other hand, most other networks had substantially less number of buyers, indicating otherwise.

As far as the transaction count is concerned, Solana registered a number above 20k, while Ethereum’s number was stuck around 19.6k at the time of press. Two networks alone—Flow and WAX—managed to make headway and ball in more transactions.

Well, at this stage, market participants might merely be testing the network, and owing to the hype, perhaps, the state of affairs looks glossy for now. However, it shouldn’t be forgotten that a transaction on Solana uses less energy than two Google searches, and its energy efficiency and eco-friendliness can entice new investors into the ecosystem.

For Solana to thrive over the long term, it would have to continue presenting itself as a cheap, and viable alternative. Else, it might just end up being gobbled up by other competitors from the space.