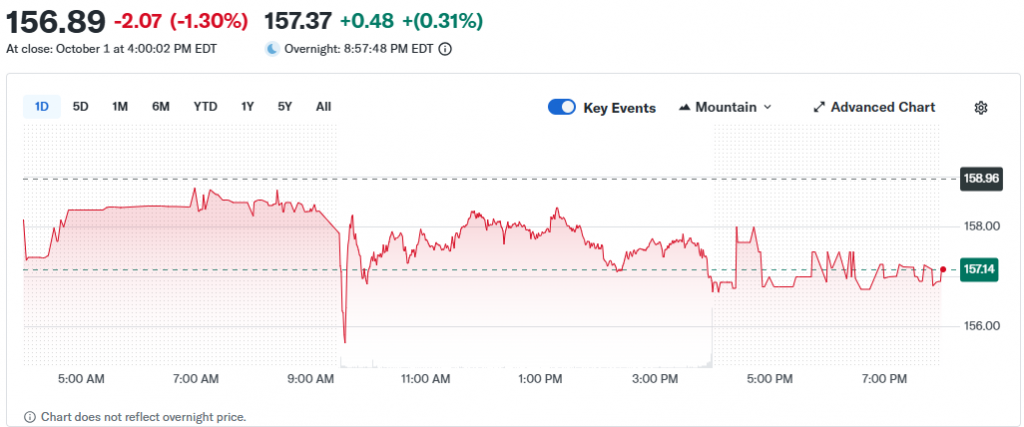

Morgan Stanley shares have jumped 25.3% in 2025 so far, and that’s on top of a 63.9% gain over the past year. Right now, with the stock trading at $157.14, investors are trying to figure out if there’s still room for growth or if the rally has pushed shares into expensive territory. The outlook depends heavily on which valuation model you’re looking at, and the answers vary quite a bit.

Also Read: Ford (F) Stock Climbs After Strong Q3 Sales Report

Morgan Stanley Stock Forecast, Potential, and Buy or Sell Insights

Morgan Stanley Stock: Mixed Signals From Valuation Models

The Excess Returns model suggests a grim view to the bank shares. The book value is at 61.59 per share and the return on equity is at 14.97, which is why analysts are predicting the earnings to remain stable at 9.84 per share in the future. When you compute the numbers based on this framework, then the intrinsic value is computed as 117.19 per share. That is equivalent to the stock being valued at 335 percent of its true fundamental value at the present price of 156.39.

Price-to-Earnings Ratio Tells Different Story

The Price-to-Earnings analysis tells a pretty different story though. At 17.7x earnings, Morgan Stanley trades well below the Capital Markets industry average of 27.2x and even further below its peer average of 33.2x.

Simply Wall St’s Fair Ratio model calculates a customized benchmark of 20.1x for the company, and since the actual PE of 17.7x sits just a bit below that level, shares are considered to be priced fairly by this measure.

Is Morgan Stanley Overvalued? Buy or Sell Decision Depends on Your Outlook

So which view is right? The decision comes down to your valuation preference really. Investor opinions range widely here. Some people see fair value as high as $160.00, while more conservative estimates land at just $122.00. The current price sits near the upper end of that range.

Also Read: October Stock Market Crash: Could Markets Face a Sharp Sell-Off?

The recent momentum has been driven by broader optimism in financial markets along with steady demand for advisory services. The five-year gain of 266.8% has been pretty remarkable. However, the stock scores just 3 out of 6 on established valuation checks. Whether this represents an opportunity or a warning depends on if you prioritize earnings multiples or intrinsic value calculations. The 33.5% premium suggested by one approach versus the fair pricing indicated by PE analysis means the shares present both opportunity and risk at current levels.