The past few days have seen the state of financial markets all across the board significantly improve. While US’ apex stock index S&P 500 went on to reclaim 4600, India’s Nifty 50 re-attained 18000. As far as the crypto markets are concerned, Bitcoin went on to pay a visit to $48k, while Ethereum managed to knock on the door of $3.6k.

The evolving correlation dynamics between Bitcoin, Ethereum, S&P 500

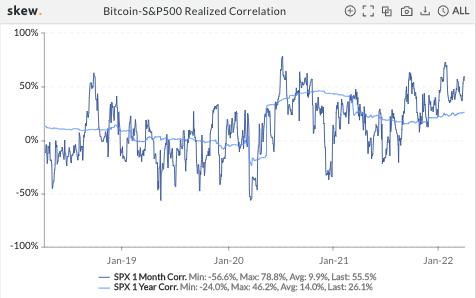

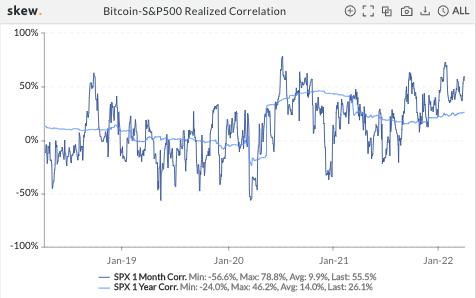

Well, the US stock market and the crypto market have maintained an on-and-off relationship with each other throughout history. During the initial leg of the pandemic, it was evinced that the crypto sphere wasn’t shielded from the crashes noted in the traditional financial landscape. In fact, right after that in April last year, it was again proven that bull runs also go hand in hand.

Simply put, their up and downtrend phases have, to some extent, been in sync over the last couple of years. On the contrary, in the 2018-19 period, their mutual dependency wasn’t that strong.

As per data from Skew, Bitcoin and the S&P-500 index currently share a 1-month correlation of 56%. On the other hand, the macro yearly number was as low as 26% at the time of press.

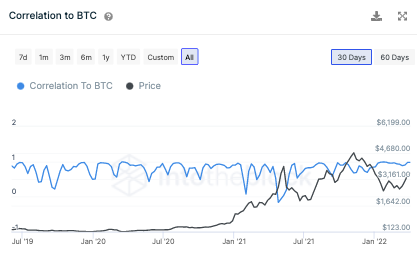

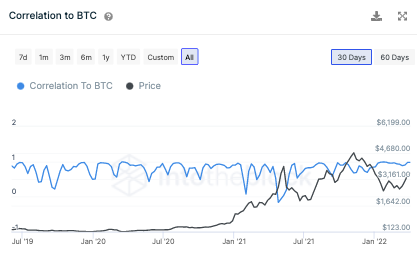

Contrary to one’s assumption, Bitcoin doesn’t share the highest correlation with the US market’s apex stock index. It is Ethereum that leads the front.

In mid-March, notably, the Federal Open Market Committee (FOMC) had approved its first interest rate hike in more than three years. Riding on the back of the said news, most assets with the “inflation hedge” or “deflationary” tag started rallying.

Highlighting the same, Santiment’s latest tweet went on to assert,

“Ethereum, not Bitcoin, is the top asset staying tightly correlated to the SP500’s performance. And since the FOMC announcement 3 weeks ago, this has been good news for ETH.”

Before concluding, it is quite crucial to bear in mind that Bitcoin and Ethereum’s correlation has been above 90% since the beginning of this year. In fact, at press time, it stood at a level as high as 98%, implying that the fate of all three—Ethereum, Bitcoin, and S&P 500—remain to be closely knit and it’s almost non-viable for them to tread on different paths.