FTX and its affiliates filed for bankruptcy on November 11 in US’s Delaware. The collapse of the company is essentially one of the highest-profile crypto blowups that left customers and investors in dire straits.

The United States Commodity Futures Trading Commission [CFTC] recently filed a lawsuit against SBF, FTX, and Alameda Research. All of them were reportedly charged with fraud and material misrepresentations of the sale of digital commodities.

The action of these entities paved the way for an immense loss of more than $8 billion among its customers. It was brought to light that FTX and Alameda commingled funds and particularly used customer deposits on the exchange.

Read More: Here’s why CFTC is suing SBF, FTX, and Alameda

Alameda Tried Redeeming 3000 Wrapped Bitcoin

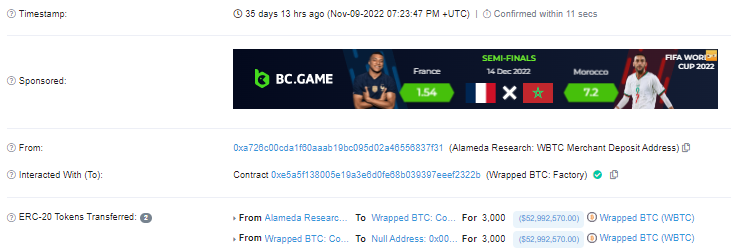

Now, in a development that recently shaped up, it was ascertained that Alameda Research attempted redeeming around 3k wBTC days before its bankruptcy filing. Mike Belshe, the CEO of BitGo gave the same stamp of surety in a recent Twitter space.

Furthermore, on-chain data from Etherscan cross-confirmed that the transaction took place on November 9.

Belshe further revealed that the firm turned down the redemption request because an unknown Alameda representative involved did not pass Bitgo’s security verification process. Per Belshe, the representative also seemed unfamiliar with the wrapped Bitcoin burning process.

wBTC can be redeemed for Bitcoin once sent to a burn address. The conversion is conventionally made at a 1:1 ratio. It is important to note that Bitgo is one of the co-developers of wBTC along with Ren and Kyber.

Chalking out what happened after the security details didn’t match the process, the exec said,

“So we held it up and we said no, no, no, no. This is not what the burn looks like. And we need to know who this person was.”

While they were holding it and waiting for a response on the said issues, Alameda went bankrupt. As a result, everything got halted.

The Bitgo exec further added that Alameda’s 3,000 BTC mint request remains to be “stuck” on the platform. Belshe added that the firm would most likely leave the tokens where they were. Only when the trustees working on Alameda’s bankruptcy case would want to deal with it, a further step will be taken.